Westpac’s latest Housing Pulse warns that Australia’s housing crisis will worsen as surging net overseas migration collides with falling housing construction.

This will place upward pressure on house prices as well as further tighten the nation’s rental market.

Uncanny Rally

The consistent picture of improved conditions and positive price expectations that has emerged since the start of the year has prompted a significant revision to our housing outlook.

Prices are now expected to remain flat this year, rather than post a further decline, with a sustained, broad-based recovery forecast to gain traction in 2024.

Three factors look to be driving the shift in early 2023: 1) a resurgence in net migration inflows; 2) a sharp rise in construction costs; and 3) low levels of ‘on market’ supply.

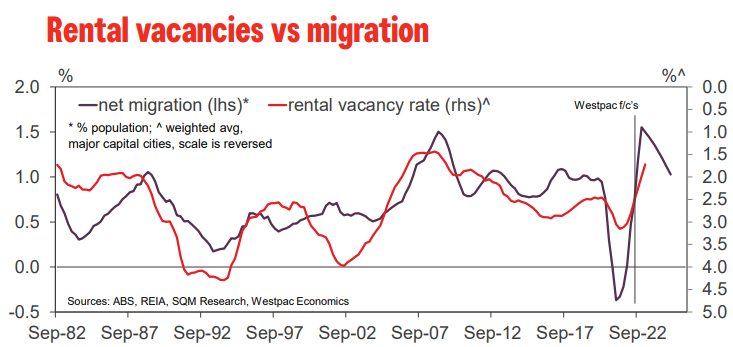

Border reopening has seen a much bigger than expected lift in immigration with net inflows set to hit 400k for 2022 and remain elevated in 2023.

There are clear links between population growth and demand for housing, both directly (through new buyers) and indirectly (through the impact on available rental property and the wider physical supply-demand balance).

The latest surge has contributed to a significant tightening in rental vacancy rates.

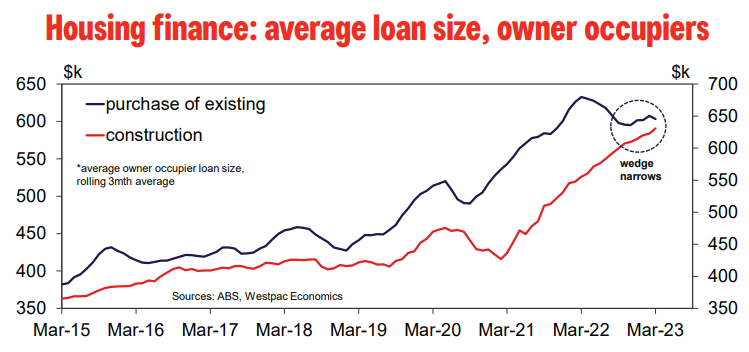

A sustained surge in construction costs has also shifted price relativities in some sub-markets. Nationally, the purchase cost of a newly built dwellings rose 18% in 2022.

With prices for existing dwellings declining, this has tilted the balance between existing and newly built houses (broadly captured in trends in average loan sizes).

The more granular price detail suggests this effect is driving gains in some suburban fringes of major cities.

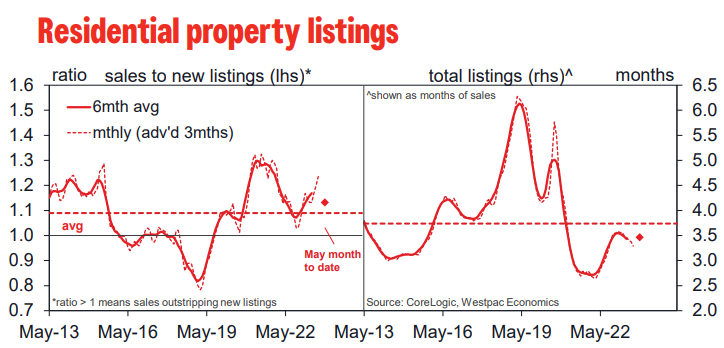

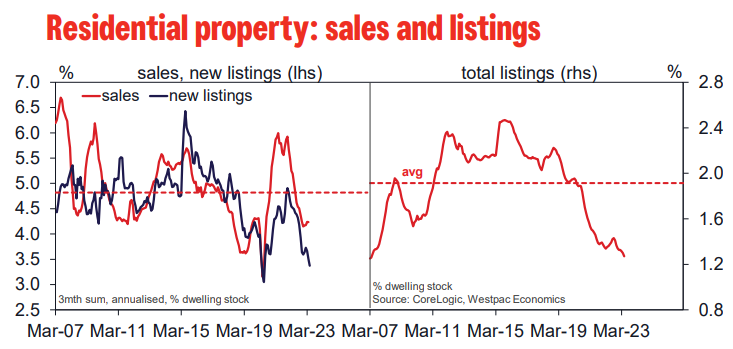

Low ‘on-market’ supply looks to be accentuating some of these drivers.

The weak market has clearly discouraged many sellers with both new listings and total stock on market below average across the major capitals and extremely low when viewed as a share of the total dwelling stock.

These ‘thin’ market conditions mean small shifts in demand can have a bigger than usual impact on prices.

Notably, the stabilisation has come despite further official rate rises in February and March, and continued hawkish expectations for mortgage rates amongst consumers.

Housing recoveries typically only emerge once the RBA is actively cutting rates or is very clearly poised to do so. Price gains also tend to follow a sustained lift in turnover, not vice-versa.

The positives in play – migration, construction costs and limited supply – tend to be marginal and gradual drivers of price gains.

With interest rate negatives still in the mix, this suggests the market is stabilising rather than setting up for sustained gains near term.

Supply projections

A resurgence in migration-driven physical demand for housing has brought supply shortages back into sharp focus since the start of 2022.

Rental vacancy rates tell the story, dropping to historic lows nationally with all major capital city markets now seeing vacancy rates at or materially below 2%, a sign of widespread shortages.

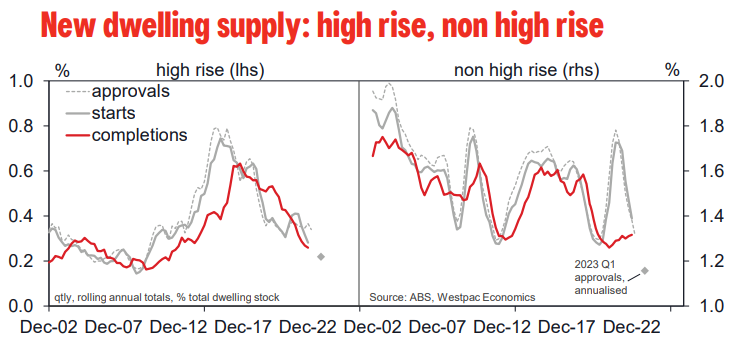

Unfortunately, this tightening is coinciding with a significant downturn in new dwelling construction that shows few signs of slowing any time soon.

Overlaid with the difficulties of getting large-scale higher density projects off the ground and the lags involved in these projects, new supply looks set to lag a long way behind growth in physical demand over the next two years.

Assumption-wise, approvals are projected to lift off their most recent (extreme) lows and hold steady at around 170k a year.

That is coming off 190k approvals in 2022, 226k in 2021 and a peak of just under 240k in 2015.

While this is similar to the average annual approvals over 2001-15 approvals are much lower relative to the size of the existing dwelling stock (1.5% vs 2%).

For reference, approvals have been running at an annualised pace of 150k over Q1 of 2023.

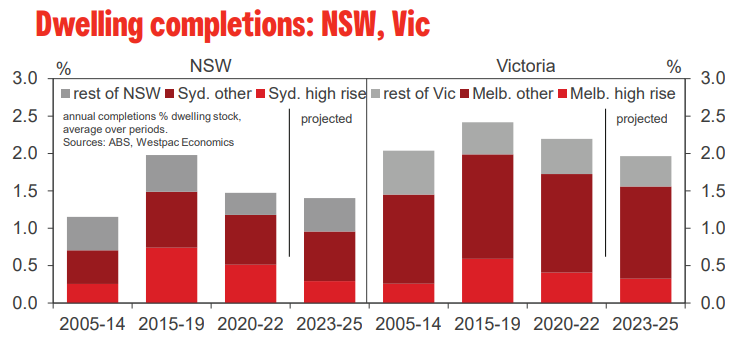

Not surprisingly, the 2023-25 projections highlight a challenging outlook for the major states, particularly for capital cities that rely more heavily on high rise building.

Sydney’s completions for example are set to run 20% below their 2020-22 average and 35% below their 2015-19 average – a period when high rise contributed about half of new supply.

Melbourne is also facing into a slowdown but is coming off a higher starting point with less exposure to the slow completion times of high rise builds.

The chart highlights Vic’s relative success in providing new dwelling supply in recent decades – a factor that allowed it to absorb considerably faster population growth that other states in the years leading into COVID.

That task may prove more challenging in the next few years.