CBA senior economist, Belinda Allen, believes the Reserve Bank of Australia (RBA) will keep the official cash rate (OCR) on hold at next week’s monetary policy meeting.

However, CBA still forecast that the RBA will hike one more time in August, taking the OCR to a terminal peak of 4.35%.

Key Points:

- In what is likely to be another finely balanced decision, we expect the RBA to leave the cash rate on hold at 4.10% in July, pausing before one final rate hike in August.

- The RBA has stated that the June meeting was finely balanced, with the rate hike driven by upside inflation risks.

- The lower than expected monthly CPI print for May has, in our view, tilted the balance of risks to an on hold decision in July.

- But the July RBA Board meeting remains‘live’given the RBA’s tightening bias and heightened concerns over inflation risks.

- We attach a 60% probability of on hold decision at the July RBA Board meeting,with a 40% chance of a 25bp hike.

The July Board meeting is live, but we favour no change

The coming week will see the RBA Board meet on Tuesday 4 July. The risks of a rate hike in July have ebbed and flowed with the local economic data over recent weeks.

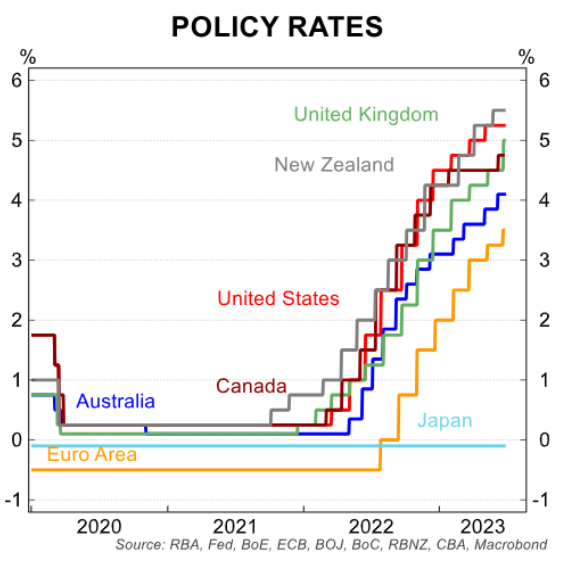

Global central banks have also made news. Over the past month the Bank of Canada and the Bank of England have delivered a surprise hike and a surprise 50bp hike, respectively, with both central banks reacting to inflation data.

However, it is important to remember the RBA, for now, meets more frequently than other central banks. The RBA will discuss these global developments at the July Board meeting, but front of mind will be the local economic data flow over the past month.

The monthly May CPI print and the labour force data for May will be top of the agenda. The Q1 23 National Accounts that were released the day after the June Board meeting and other data flow including housing related data, retail trade for May and sentiment data will also be up for discussion.

The June decision was more finely balanced than initially expected

Before we discuss the data flow of the past month, the release of the June Board Meeting minutes on 20 June highlighted that the deliberations were more finely balanced than perhaps conveyed in the post-meeting Statement and in the Governor’s speech.

The Minutes noted “Members recognised the strength of both sets of arguments, concluding that the arguments were finely balanced. They judged, though, that the case to raise the cash rate at this meeting was the stronger one.”

Ultimately the decision to lift the cash rate in June was firmly centred on inflation risks moving to the upside: “members observed that the monthly indicator of headline inflation had surprised on the upside in April and that the decline in goods price inflation had been less than observed in other countries. In addition, services price inflation had not yet shown signs of moderating and the evidence from abroad suggested that it may prove to be persistent”.

In contrast the arguments for an‘on hold’ decision focused on an economy that is already slowing and the risks the already significant increases in interest rates to date would lead to the economy slowing more sharply than expected.

The outcome of the data flow since the June Board meeting must be seen in the context of the deliberations that occurred that month.

As we note below, since the June Board meeting the monthly CPI came in below expected, the labour market report was strong and the Q1 23 National Accounts data showed the consumer is weakening – despite the bounce in retail trade in May.

The argument for a hike in July will come down to the same arguments put forward in June. That is, a perceived threat of upside risks to inflation and imbedding high inflation into price and wages settings regardless of the lower-than-expected monthly CPI.

We believe the decision between a hike and on hold swing in favour of no change in July.

The recent data flow has been mixed and we think this affords the RBA some time to slow its hiking cycle, pausing in July, and wait for the usual August forecast refresh and quarterly CPI print ahead of the August meeting. We continue to discuss below in the context of the recent key economic data flow.

Monthly CPI–May 2023

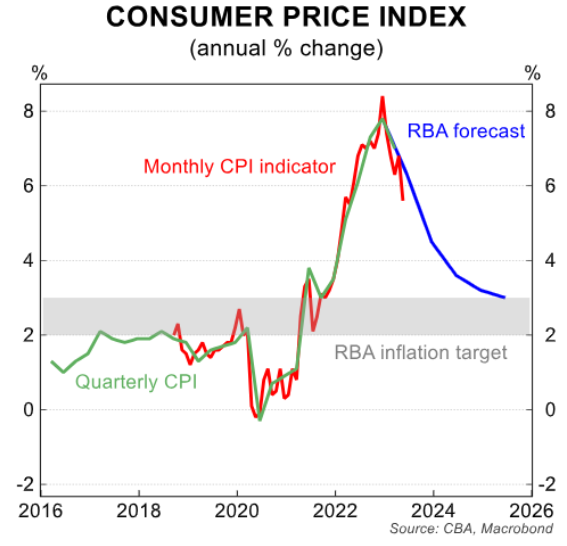

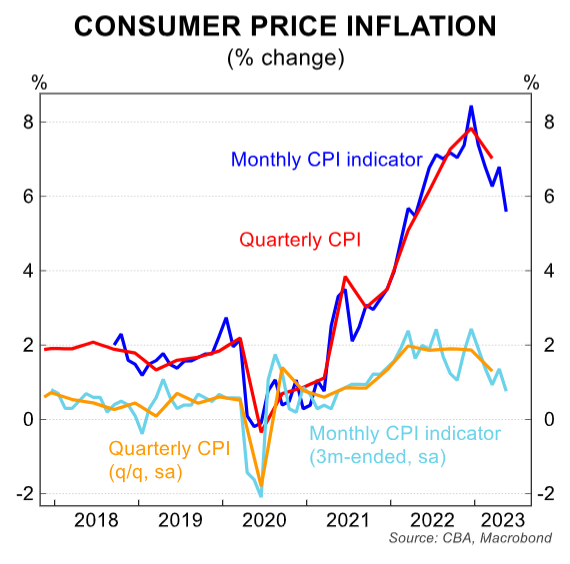

The May monthly CPI decelerated to 5.6%/yr, below market expectations, falling from 6.8%/yr in April.

The deceleration should please the RBA. Although it does highlight the volatility in the monthly CPI measure.

Recall that the April CPI report surprised the RBA on the upside, prompting a reassessment of the balance of risks to inflation. This volatility adds weight to the RBA preferring to see the full quarterly CPI measure released on 26 July before lifting the cash rate again.

The RBA will also refresh their economic forecasts as part of the August Statement on Monetary Policy. At this stage there is a chance the Q2 23 CPI headline number prints lower than the RBA’s implied inflation profile of 1.1%/qtr.

We will firm up our estimates of headline CPI ahead of the quarterly CPI report. The medium term inflation forecasts will be also important to watch given recent comments around upside risks to inflation staying high for longer than desired.

Parts of the CPI that focused on rents and market services did continue to show some signs of inflation accelerating or remaining elevated.

The monthly CPI did show sticky underlying inflation measures, remaining above 6%, as well as acceleration in some services items; including hairdressing, insurance and recreation services. Sticky services inflation and the RBA’s concerns around upside risks to inflation keep the chance of a hike in July in place, albeit it is not our base case.

Labour force –May 2023

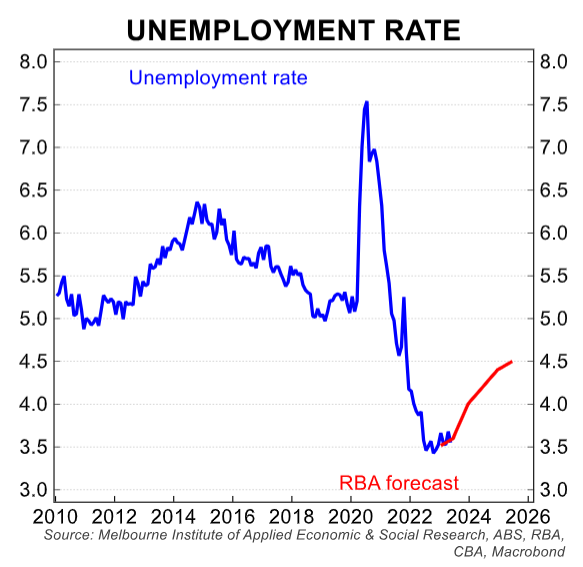

Employment rose by a strong 75.9k in May and the unemployment rate edged lower to 3.6%. Initially this led us to lift the risk of a July rate hike to 50/50.

While the labour market remains tight, there are signs forward indicators of labour demand are softening, Job vacancies continued to fall in the three months to May and are now down 10% from the peak.

The RBA expects the unemployment rate to average 3.6% in the June quarter. The data prints for April and May suggest this forecast will be met.

In short the unemployment rate is performing as the RBA expects at this stage of the cycle. The upside surprise comes from stronger employment growth.

Other economic data

The RBA will also assess the other economic data flow out since the last meeting. Q1 23 GDP rose by just 0.2%/qtr and 2.3%/yr, weaker than the market median and even weaker on a per capita basis given 2% population growth.

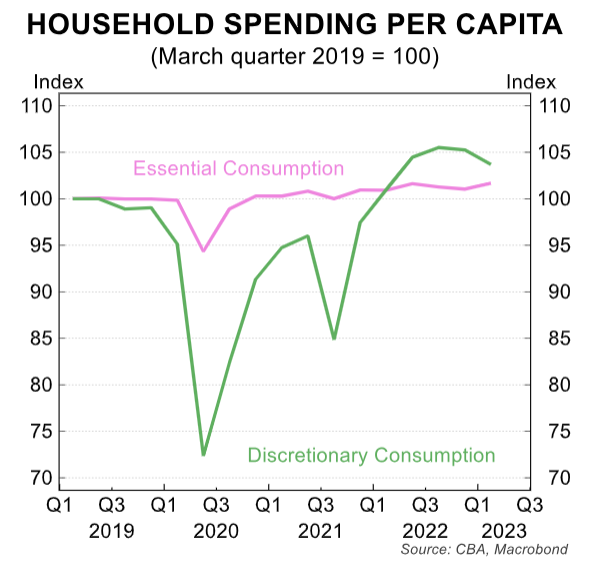

The data showed the household sector is already feeling the pinch of higher interest rates, particularly on a per capita basis.

Discretionary spending contracted in the quarter. The RBA is watching household spending closely. The weak household spending outcome in Q1 23 reinforced that point.

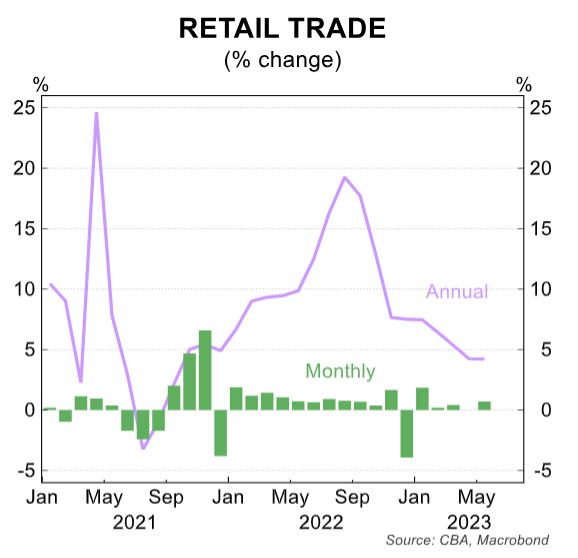

Since then the retail trade data has been mixed. After a flat result in April, retail trade rose by 0.7% in May driven by promotional activity in response to cost of living pressures and resilience in spending on eating out.

Both business and consumer sentiment data were weak since the last Board meeting.

Consumer sentiment was largely flat at deeply pessimistic levels. Consumers surveyed after the June rate hike recorded even weaker outcomes.

Business conditions and conditions both fell. Conditions had been holding up, but now appear to be capitulating.

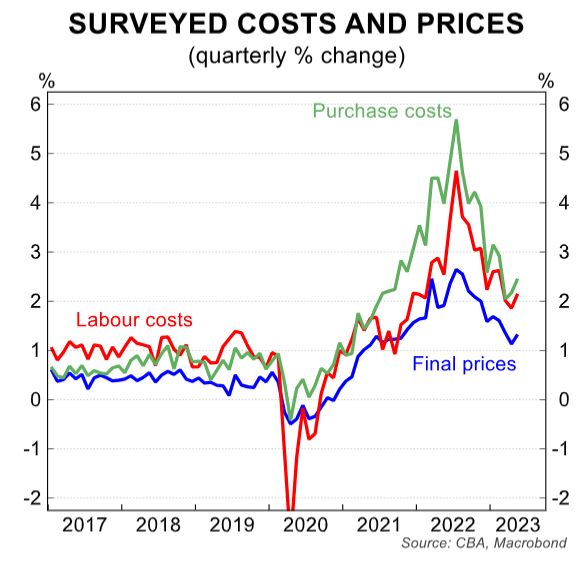

Of some concern though was a pick-up in surveyed prices in the month. But the monthly CPI fell in May despite these surveyed prices edging higher.

We note home prices, lending and building approvals are released the day before the July Board meeting on Monday 3 July.

The June Board Minutes noted the recent uptick in home prices and flat lending were factored into the June rate hike and could again this month.

Overall we expect the RBA to pause its hiking cycle in July, leaving the cash rate on hold at 4.1%. But we expect the RBA to retain their forward guidance that, “further increases in interest rates may still be required, but that this would depend on how the economy and inflation evolve”.

We expect the RBA to raise the cash rate by 25bp in August, to 4.35%, to ensure inflation returns to the 2%-3% target in a timely manner.