We reported last week on data from the Australian Securities and Investments Commision (ASIC) showing that 2,117 enterprises in the building and construction sector went into external administration in the financial year ending 18 June.

This was a 75.4% rise over the previous year’s corresponding period.

The number of construction enterprises in administration was more than double that of the second largest sector, accommodation and food services, which reported 1058 external administrations in the financial year ending 18 June 18.

High borrowing rates, increased input costs, and difficulties in obtaining workers and funding are forcing developers to delay projects and putting others at risk of failure.

Russ Stephens, co-founder of the Association of Professional Builders, believes the outlook for the home building sector is bleak, with builders caught between rising prices and diminishing consumer demand.

“This slowdown is going to catch them out, and that’s the reason why we will see a lot more liquidations over the next six months – it’s going to get worse before it gets better”, Stephens said.

The one silver lining is that materials cost inflation has moderated, as evidenced by the CoreLogic Cordell Construction Cost Index (CCCI), which tracks the cost to build a typical new home.

It returned a growth rate of 0.7% for the June quarter, the lowest rate since September 2020 and well below the 1.2% decade average.

On the other hand, building insurance costs have rocketed, rising by around 40% year-on-year.

Thus, the sector continues to face acute cost pressures.

This week we learned of three more significant building company collapses.

NSW-based luxury builder Millbrook Homes collapsed into liquidation owing more than $4 million to roughly 80 creditors.

Fortunately, however, there are only six unfinished projects.

Victorian residential construction firm Bentley Homes also appointed liquidators as its debts piled up to $1.8 million.

Its collapse has left 50 homeowners with partially incomplete projects, while another 26 homes had not yet begun construction.

Finally, Perth builder City Residence Pty LTD went into liquidation, leaving 13 unfinished homes in limbo.

The forward-looking indicators for the construction industry remain dire, with dwelling approvals, construction finance commitments and new home sales all plummeting.

Construction activity, therefore, is forecast to continue falling.

In late May, Treasury Secretary Steven Kennedy told the Senate Estimates Economics Committee hearing that the dwelling construction downturn will run until 2025, with investment in new dwellings expected to fall by 2.5% this year, 3.5% in 2023-24, and 1.5% in 2024-25.

Oxford Economics Australia similarly forecast that total housing construction work would fall by a cumulative 21% over the three years to financial year 2025.

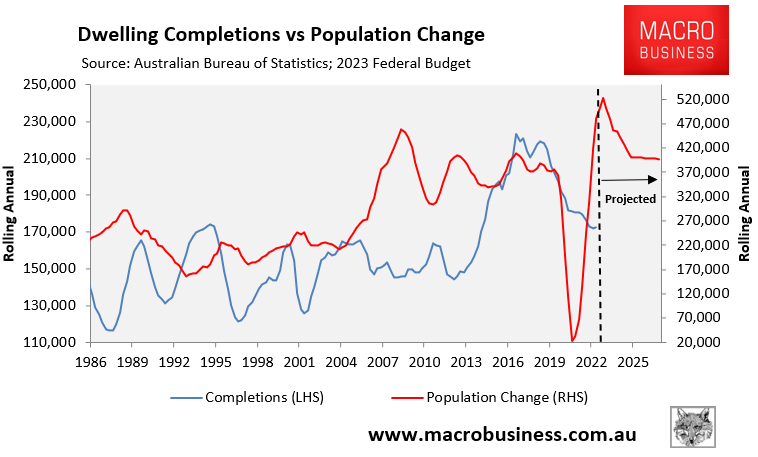

This means that the rate of new housing supply will continue to fall at the same time as Australia’s population grows at record levels:

Australia needs to add 329 dwellings to its housing stock each day (net of demolitions) just to house the 1.5 million net overseas migrants officially projected to arrive in Australia by 2026-27.

Meeting this supply target will obviously be an impossible task.

In turn, Australia’s housing shortages will continue to worsen, which will drive up rents and force thousands more Australians into homelessness.