DXY was turned away at former support turned resistance:

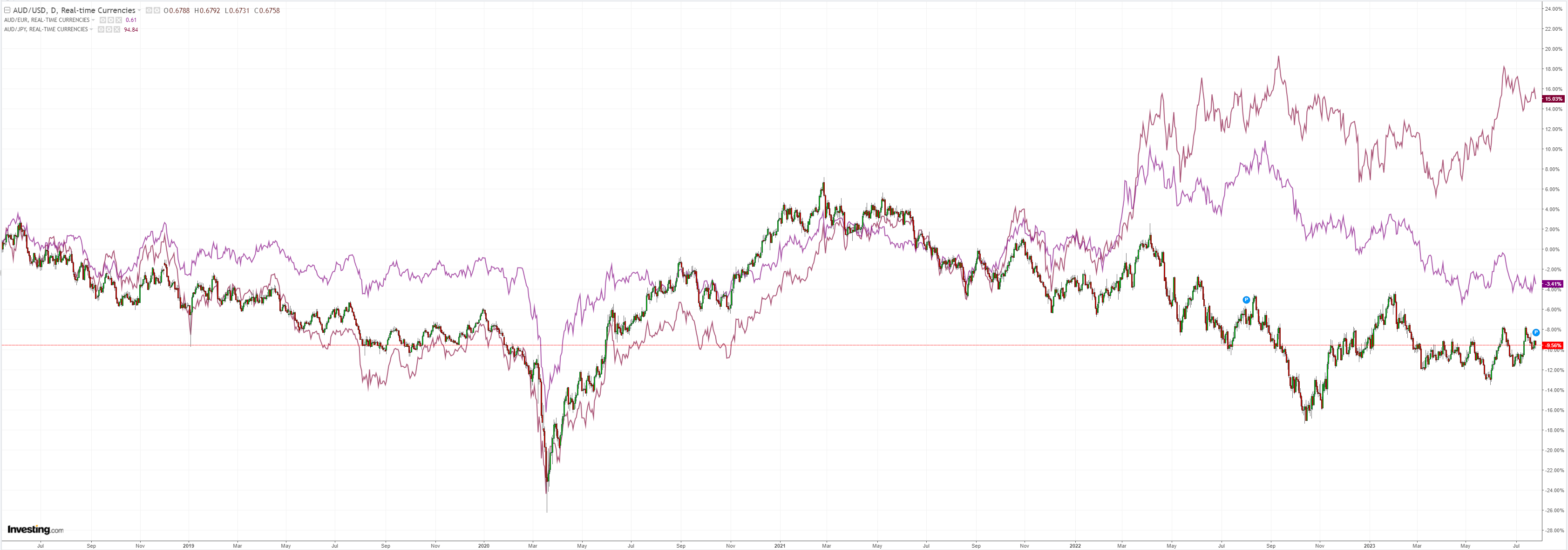

AUD was weak anyway:

Gold firmed, oil fell:

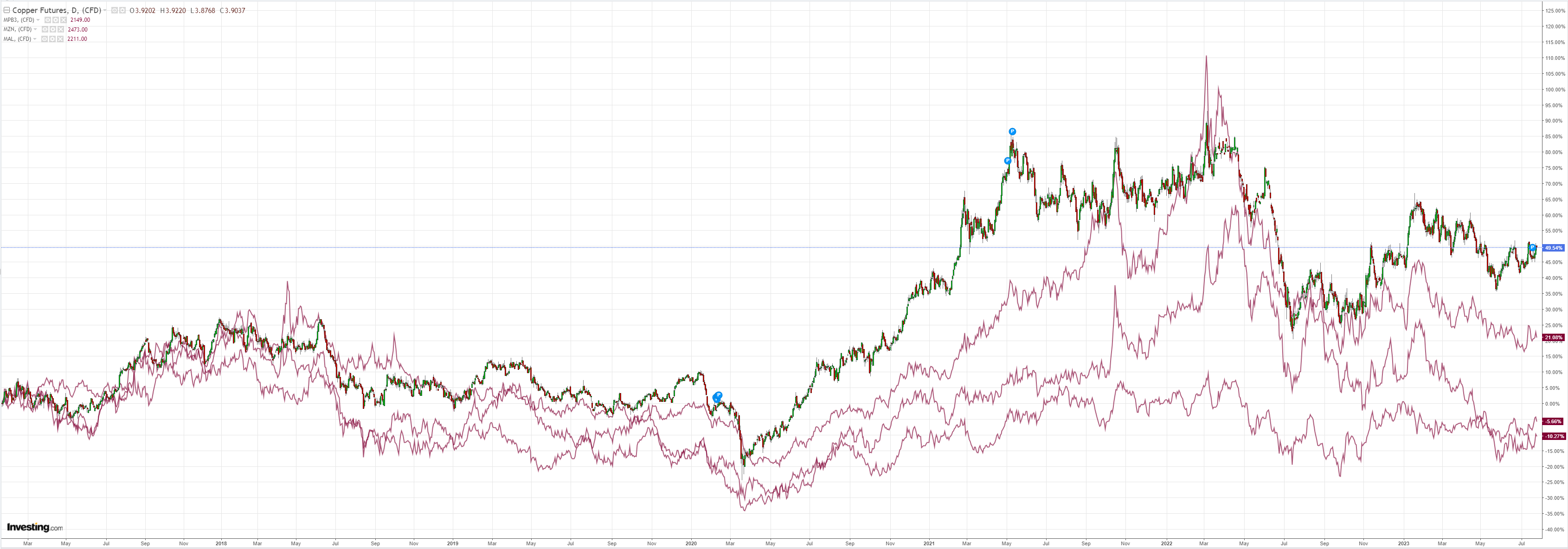

Dirt is not very excited about China stimulus:

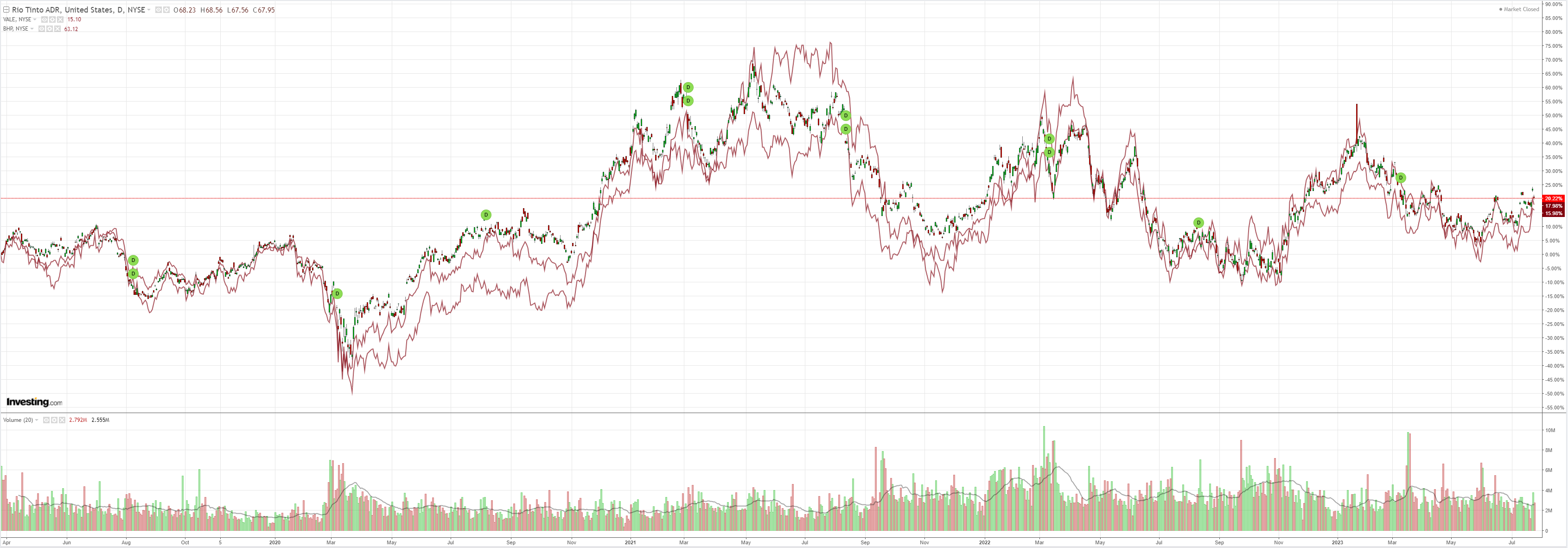

Miners reversed:

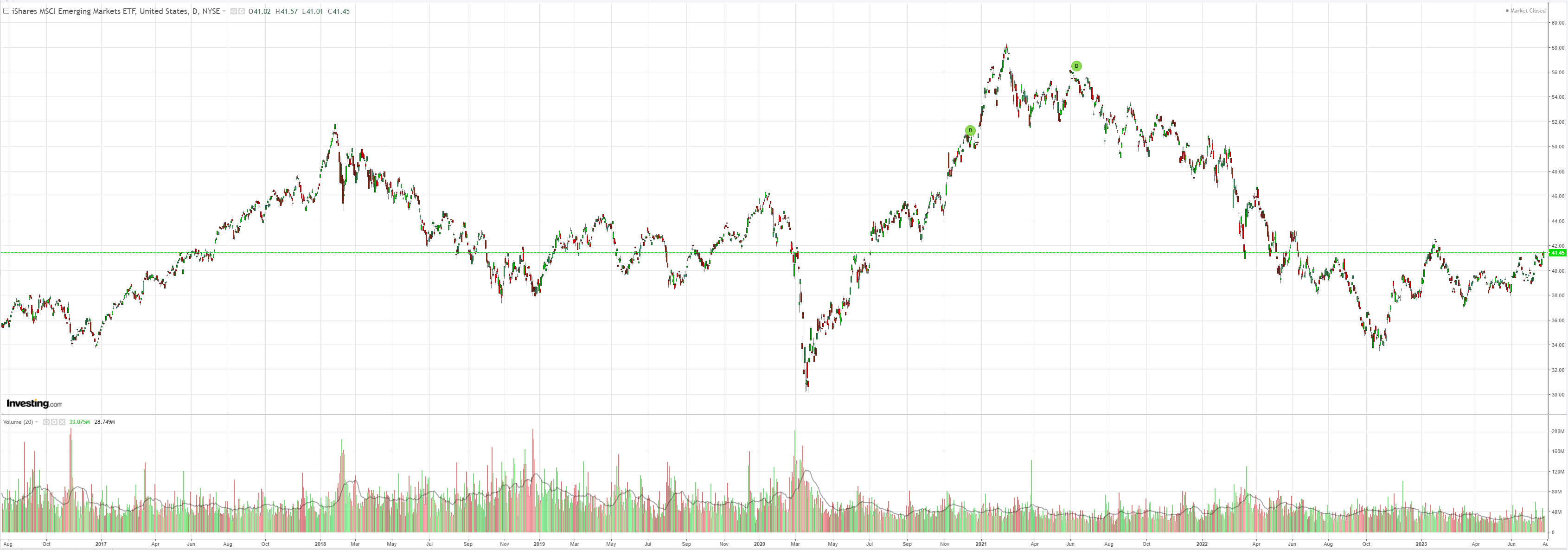

EM shows glimmer of hope:

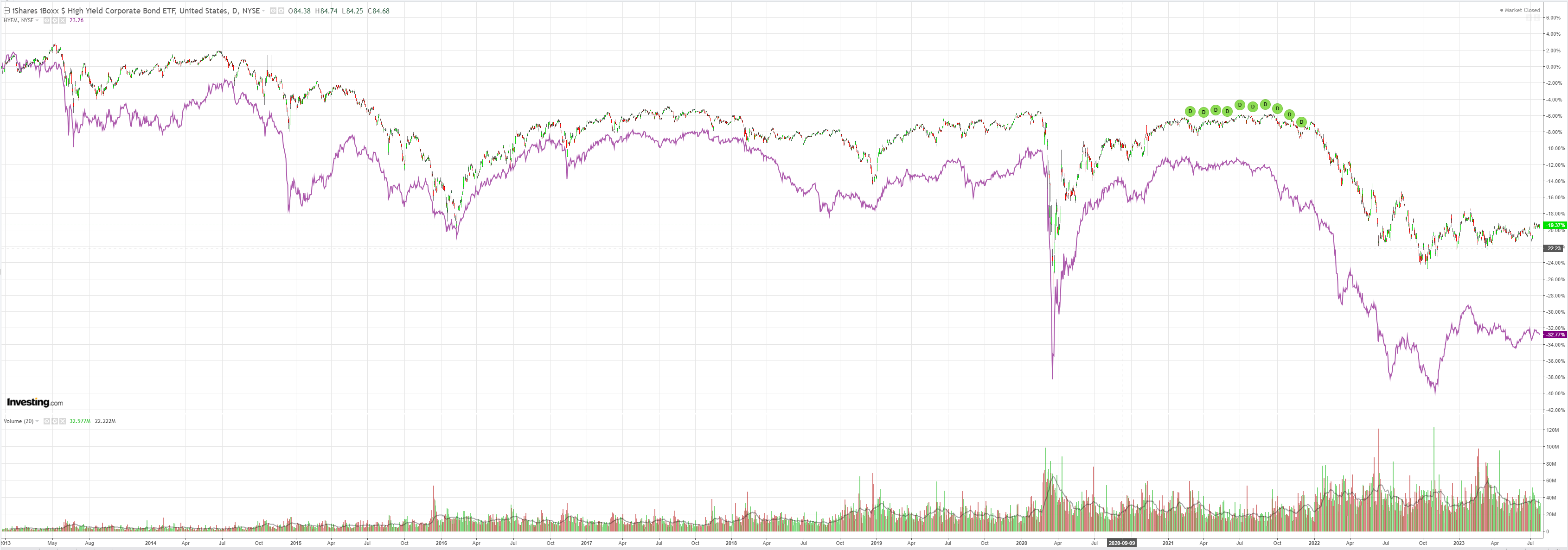

But junk is the leading indicator:

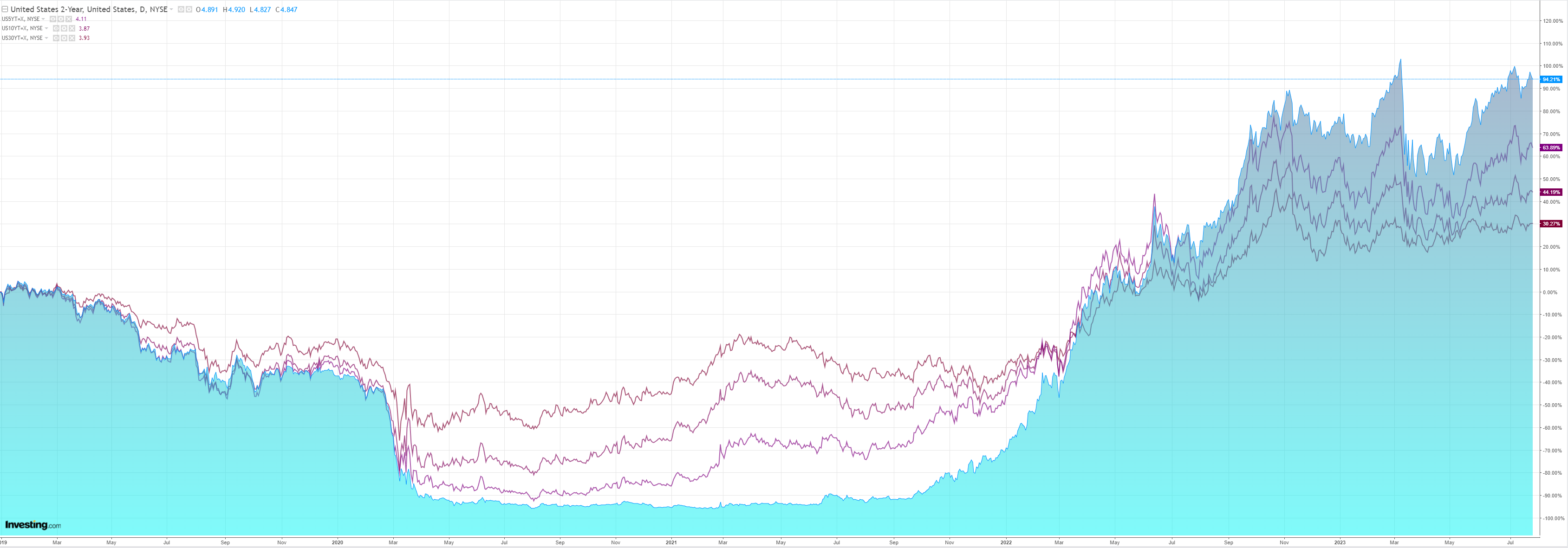

Yields eased:

Stocks stalled:

The Fed hiked 25bps and kept a tightening bias:

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 5-1/4 to 5-1/2 percent. The Committee will continue to assess additional information and its implications for monetary policy. In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

Powel headlines were pretty dour:

*POWELL: FOMC STRONGLY COMMITTED TO GETTING INFLATION TO 2%

*POWELL: WON’T ACHIEVE STRONG LABOR MKT WITHOUT PRICE STABILITY

*POWELL: FULL EFFECTS OF TIGHTENING YET TO BE FELT

*POWELL: FOMC TO TAKE DATA-DEPENDENT APPROACH ON FUTURE HIKES

*POWELL: ECONOMIC ACTIVITY EXPANDING AT MODERATE PACE

*POWELL: HOUSING SECTOR PICKED UP BUT WELL BELOW 2022 LEVELS

*POWELL: FOMC TO TAKE DATA-DEPENDENT APPROACH ON FUTURE HIKES

*POWELL: CONTINUING SIGNS THAT LABOR SUPPLY, DEMAND BALANCING

*POWELL: NOMINAL WAGE GROWTH HAS SHOWN SOME SIGNS OF EASING

*POWELL: PROCESS OF GETTING INF TO 2% HAS A LONG WAY TO GO

*POWELL: HIGH INFLATION RATE POSES SIGNIFICANT HARDSHIP

*POWELL: HIGHLY ATTENTIVE TO RISKS INFLATION POSES TO MANDATE

*POWELL: HAVE BEEN SEEING EFFECTS OF TIGHTENING IN SOME SECTORS

*POWELL: WILL TAKE TIME FOR FULL EXTENT OF HIKES TO BE REALIZED

*POWELL: FOMC WILL TAKE CUMULATIVE TIGHTENING, LAGS IN ACCOUNT

*POWELL: WILL CONTINUE TO MAKE DECISIONS MEETING BY MEETING

*POWELL: WILL CONTINUE TO MAKE DECISIONS MEETING BY MEETING

*POWELL: REDUCING INFLATION LIKELY TO MEAN BELOW-TREND GROWTH

*POWELL: HAVEN’T MADE DECISION TO GO TO EVERY OTHER MEETING

*POWELL: SLOWDOWN IN JUNE CPI WELCOME, BUT ONLY ONE MONTH

*POWELL: POSSIBLE WE’D RAISE OR HOLD IN SEPT. IF DATA WARRANTED

*POWELL: ECONOMIC RESILIENCE IS `A GOOD THING’

*POWELL: AT MARGIN, STRONGER GROWTH COULD LEAD TO MORE INFLATION

*POWELL: INTERMEETING DATA WAS BROADLY CONSISTENT W/ EXPECTATION

*POWELL: INFLATION REPORT WAS `A LITTLE BETTER THAN EXPECTED’

*POWELL: SEPT. MOVE IS DEPENDENT ON DATA; WE DON’T HAVE IT YET

*POWELL: AS STANCE IS MORE RESTRICTIVE, INCREASINGLY FACE RISK

*POWELL: FOMC WANTS CORE INFLATION TO COME DOWN, STILL ELEVATED

*POWELL: SOME DISINFLATION W/O MORE UNEMP. IS `A REAL BLESSING’

*POWELL: POLICY NOT RESTRICTIVE ENOUGH FOR LONG ENOUGH

*POWELL: PREPARED TO FURTHER TIGHTEN IF IT’S APPROPRIATE

POWELL: SLOOS WILL COME OUT NEXT WEEK AND CONFIRM WHAT YOU’D EXPECT; YOU’VE GOT PRETTY TIGHT CONDITIONS IN THE ECONOMY

*POWELL: FED WON’T BE CUTTING RATES THIS YEAR

*POWELL: HAVE SEEN SOFTENING THROUGH JOB OPENINGS COMING DOWN

*POWELL: IDEA OF HIKING RATES UNTIL INF. AT 2% IS WAY PAST TARGET

*POWELL: WOULD STOP RAISING BEFORE GETTING TO 2% INFLATION

*POWELL: DON’T SEE INFLATION BACK AT 2% UNTIL ABOUT 2025

*POWELL: FOMC CAREFULLY MONITORING CONDITIONS IN BANKING SECTOR

*POWELL: HARD TO TEASE OUT EFFECTS OF BANKING TURMOIL ON ECONOMY

I am leaning towards the market on the Fed being done, but it hangs on whether the stock bubble fires enough animal spirits to shift inflation up a gear.

I am more convinced that the RBA is done. Yesterday’s quarterly inflation was weak and its target is 3% not 2%. Sure, services inflation was still strong but that pattern has begun to break down elsewhere and probably will in Australia too.

The Aussie economy has been stalled out for nearly six months, and there is still heaps more embedded tightening to come.

The only reason I can think of for more is to give incoming Captain Bullock a red-carpet ride to cuts. But an unnecessary hike is a very large price to pay.

If I am right about the Chinese stimulus failing, the risks to AUD are still asymmetric to the downside.