The Australian Bureau of Statistics (ABS) on Wednesday released building activity data for the March quarter, which reported a quarterly rise in both dwelling commencements and completions.

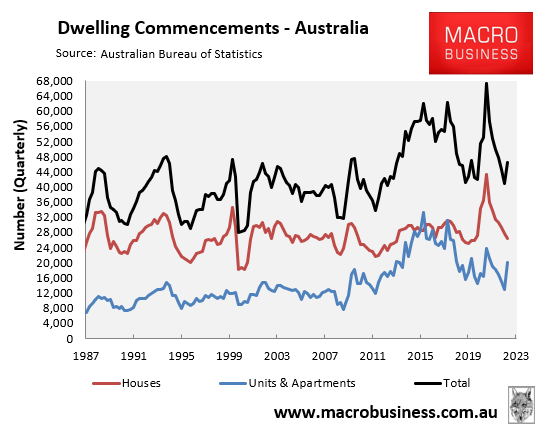

Total dwelling commencements rose 14.0% to 46,546 dwellings, but were down 6.6% year-on-year:

As shown above, the quarterly jump was driven by 57% lift in unit & apartment commencements, which more than offset a 5.5% decline in house commencements.

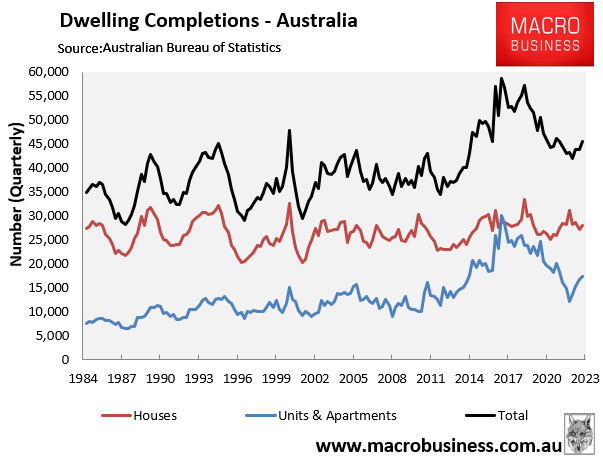

Dwelling completions also rose by 3.9% over the quarter to be up by 5.2% year-on-year:

The quarterly rise was broad-based, whereas the year-on-year increase was driven by a 43% surge in unit & apartment completions.

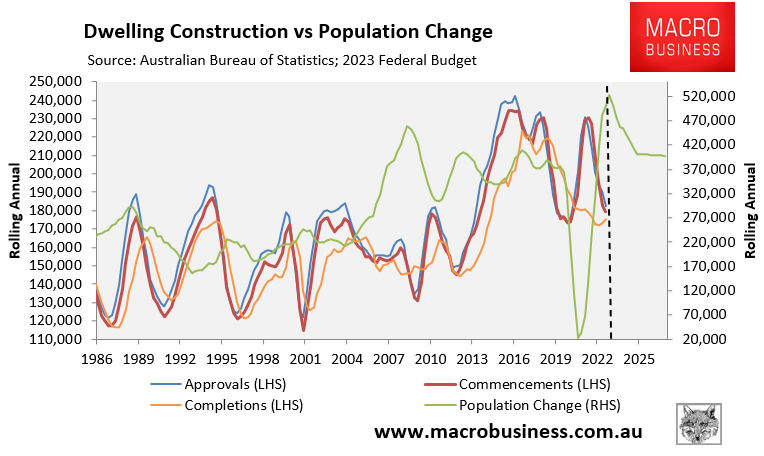

While the quarterly increases in commencements and completions were positive, they were not enough to keep pace with the nation’s rapid immigration-driven population growth.

The next chart plots the annual change in dwelling approvals, commencements and completions against actual and projected population growth, as outlined in the May federal Budget:

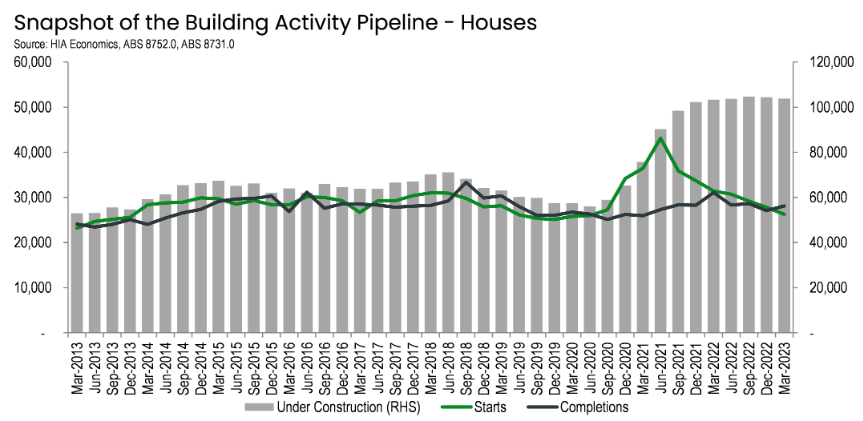

The gap between commencements and completions means there is a pipeline of around 100,000 unfinished houses, according to the HIA, which is roughly double pre-pandemic levels:

However, there is concern that dwelling completions will never catch up with commencements and approvals, given many projects have been delayed or cancelled:

“Developers are holding off building tens of thousands of homes across Australia, despite already gaining planning approval, largely because of surging construction costs, with apartments and townhouses the majority of those shelved”, reported The Guardian last month.

According to KPMG urban economist Terry Rawnsley, the rising cost of building over the last three years – which has increased 29% in Sydney and 32% in Melbourne – is prompting developers to postpone certain projects.

“The sticks and bricks, tiles and other input pieces you need to build a home that used to turn up from China in a reliable manner before the pandemic have been disrupted, and due to the stimulus the housing sector has seen in many countries since Covid, there is more demand for those sticks and bricks from around the world”, he said.

Rawnsley also said that rising mortgage rates had a negative impact on potential homebuyers’ purchasing power. As a result, developers were unable to pass on increased building costs to consumers in a “lacklustre” market.

The federal budget projected that Australia’s population will balloon by 2.18 million people over the five years to 2026-27, driven by record net overseas migration of 1.5 million people.

That is the equivalent of adding a Perth’s worth of population in only five years, with an Adelaide’s worth of population to arrive via net overseas migration.

Providing a Perth’s worth of housing (let along infrastructure) in only five years was always going to be an impossible task.

It is even more delusional when construction projects are being postponed and cancelled in response to widespread builder failures, soaring materials and insurance costs, as well as rising interest rates.

Australia’s housing shortage continues to worsen by the day thanks to the Albanese Government’s reckless mass immigration program.