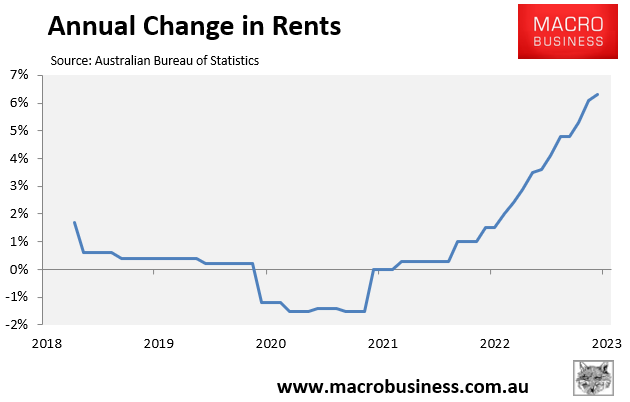

Last week’s monthly inflation indicator, released by the Australian Bureau of Statistics (ABS), showed that rental growth increased by 6.3% across the combined capital cities in the year to May, up from 1.5% a year earlier:

RBA Governor Phil Lowe told May’s Senate Estimates Committee that residential rental growth is anticipated to reach a three-decade high of 10%, which will place further upward pressure on inflation.

Lowe also expected rent inflation to remain high given Australia’s population is growing at a record pace and rental demand is easily outstripping supply.

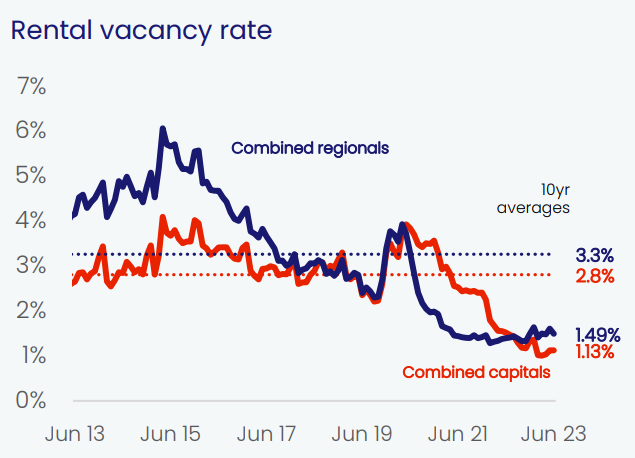

“It’s really hurting some people. The underlying issue here is supply and demand in the rental market. The vacancy rates in many cities are very low”, Lowe told the Senate Estimates Committee.

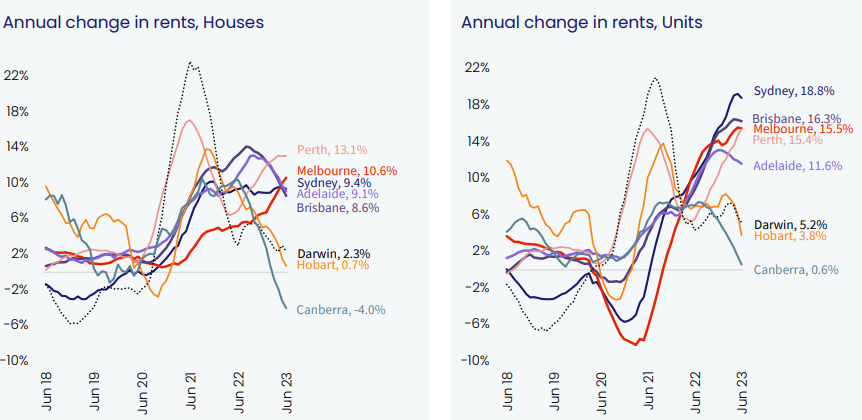

CoreLogic’s June housing market results were released on Monday, which show that capital city rents continue to inflate at an alarming rate.

Across the combined capital cities, rents increased a further 0.7% in June to be 11.5% higher year-on-year:

Source: CoreLogic

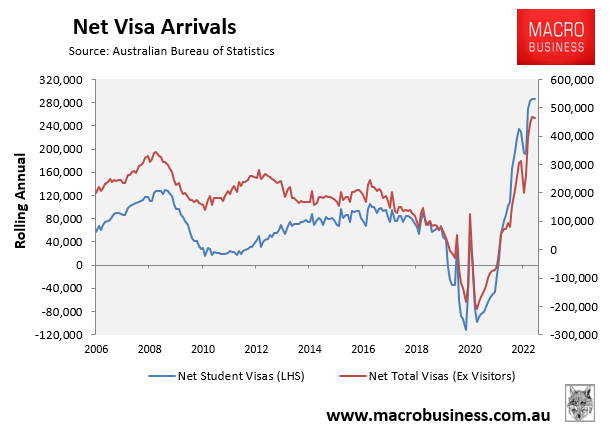

As shown above, rents are growing fastest across the major capitals’ unit markets, which are most popular among international students, who are pouring into Australia at a record pace:

Meanwhile, the rental vacancy rate has collapsed to only 1.13% across the combined capital cities, which is way below the decade average of 2.8%:

Source: CoreLogic

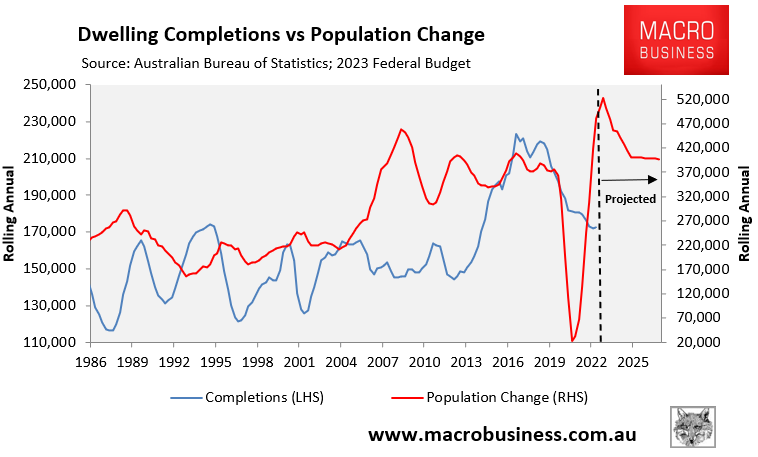

The latest federal budget projects that Australia’s population will grow by a record 2.18 million people in the five years to 2026-27, driven by record net overseas migration of 1.5 million people.

This extreme population growth will also occur at the same time as the actual rate of dwelling construction will fall amid widespread home builder collapses, rampant materials cost inflation, and higher financing costs:

This equation has just one possible outcome: continued rental market tightening and ongoing high rental inflation.

Given residential rents alone account for 6% of Australia’s consumer price inflation (CPI) basket, overall inflation will be pushed higher, forcing the RBA to respond with higher interest rates.