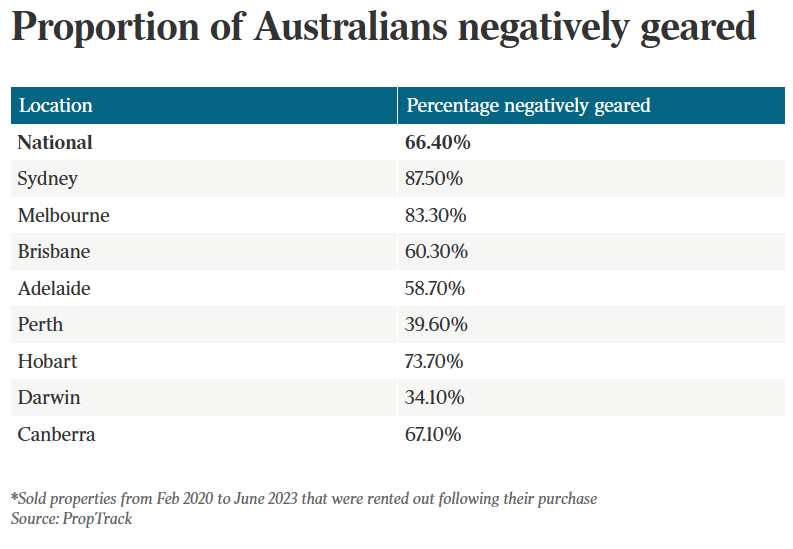

More than four out of every five investors in Sydney and Melbourne who purchased property since the start of the pandemic in February 2020 are negatively geared as a result of skyrocketing mortgage rates, according to PropTrack data provided to The Australian.

In Sydney, 87.5% of investment homes purchased since the beginning of the pandemic are operating with negative cashflow, whereas in Melbourne the figure is 83.3%.

Nationally, 66.4% of recent property investors are losing money.

“What we’re seeing since the pandemic is mortgage rates increase faster than rents, although rents have increased very quickly”, said senior economist Paul Ryan.

“The balance has shifted as we’ve come out of the pandemic and interest rates have increased”.

Simon Pressley, the founder of investor buyers agency Propertyology, estimates the average property investor in Sydney and Melbourne will lose $40,000 each year.

He claims that not only have interest rates risen, but so have other common charges such as property management fees, council rates, insurance, repairs, and maintenance.

“All the commentary today has been around the tenant not being able to afford rising rent, and then the blame has been pointed at the people charging the rent”, Pressley said to The Australian.

“The facts are the facts – for the people providing the accommodation, expenses have blown out by a heap more than for the person living in the accommodation”.

Meanwhile, CoreLogic data shows that investors are selling-up amid mounting losses.

The proportion of investor-owned listings in Sydney reached a record high of 39.8% last month.

The share of investor-owned listings grew to 32.7% nationwide, the highest level in a year.

In Melbourne, the proportion of ex-rental properties increased to a two-year high of 36.2%, while in Brisbane it increased to a 12-month high of 34.7%.

CoreLogic’s head of research, Eliza Owen, explained that “the motivation to sell this year is likely to have come from rapid increases in interest rates, where investors have inherently higher mortgage rates”.

“When you look at the pressures around mortgages, investors may have the choice between offloading an asset that they’re maintaining on the side versus the roof over their head and the choice is pretty obvious there”, Owen said.

More investor-owned properties are expected to join the market in the coming months, according to Thomas McGlynn, CEO of Sydney-based real estate agency BresicWhitney.

“We’ve certainly seen a lot more landlords list their rentals for sale over the past month, and we expect that trend to continue as interest rates rise further”, McGlynn said.

“We’re starting to see the effects of rising inflation and rising interest rates on investors who largely own one or two investment properties”.

Whereas veteran property investor, Margaret Lomas, claimed that holding an investment property for the long term had become almost impossible.

“Many investors are now looking at $1500 a month higher repayment on each investor loan they have, and this is an amount which is impossible to offset with rent increases”, she said.

Borrowing for real estate investment makes financial sense when interest rates are low and values are growing.

When the opposite happens, as it has recently, investing in real estate can be a financial nightmare.

The situation probably won’t improve until the RBA begins cutting interest rates.