Brisbane’s housing market is heating up as desperate renters experiencing ‘fear of missing out’ (FOMO) jostle to purchase a home amid a dearth of stock.

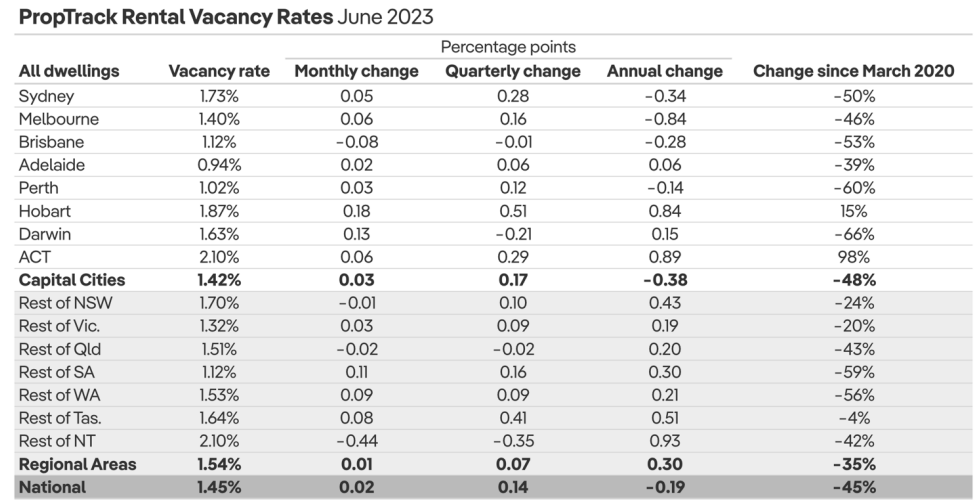

PropTrack’s latest rental report, released last week, showed that Brisbane was the only major capital city to experience a decline in vacancy rate over the month and quarter:

Brisbane’s rental vacancy rate (1.12%) is also the lowest of the east coast capitals.

According to the Courier Mail, “open homes on weekends are overrun with buyers — an increasing number of whom are desperate long-term renters resorting to dipping into their savings or going into debt to try and escape the rental crisis”.

Ray White chief economist Nerida Conisbee told the paper that renters were realising there was no escaping soaring rents and many now see home ownership as their only alternative.

“Brisbane is also so much hotter than the rest of the market. It’s very different to Melbourne and Sydney because it’s seen such strong population growth, and now international migration is back, so that FOMO’s probably even more problematic (for buyers)”, Conisbee said.

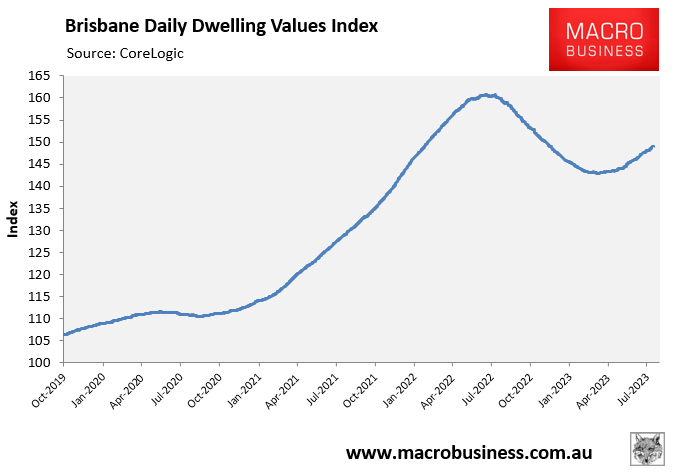

CoreLogic’s daily dwelling values index confirms these claims.

Brisbane dwelling values are rising at the second strongest pace, behind Sydney, with values lifting 3.9% over the past quarter:

Since the pandemic began at the end of February 2020, Brisbane dwelling values have increased in value by 35%, according to CoreLogic.

The primary driver of Brisbane’s housing pressures is the city’s strong population growth.

Queensland (read Brisbane) led the nation’s population growth over the pandemic, driven by strong internal migration:

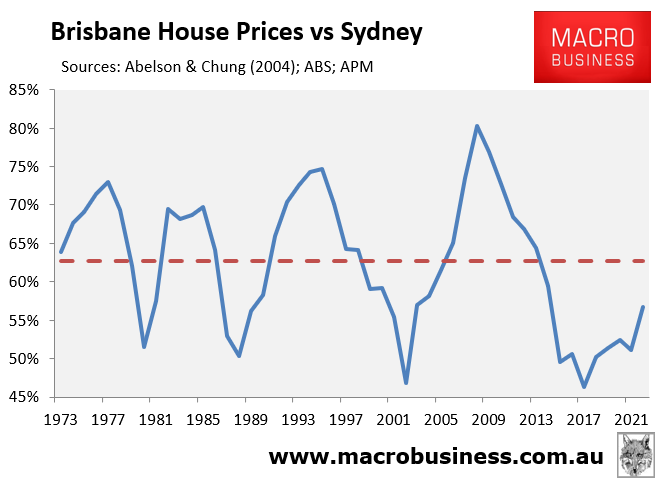

Brisbane’s dwelling values are still much cheaper than Sydney’s and Melbourne’s and should result in more southerners moving north.

Brisbane’s median house price is only 57% of Sydney’s median house price, according to Domain:

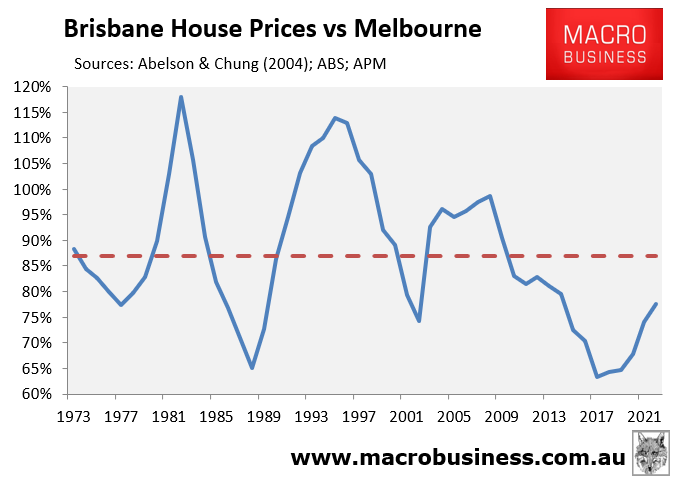

Brisbane’s median house price is also only 78% as expensive as Melbourne’s:

Therefore, Brisbane housing is still relatively affordable, meaning there should be more upside for Brisbane property values over the longer-term relative to its two larger southern cousins.

The 2032 Olympics will also spur infrastructure investment and cement Brisbane as a global city, which could lead to more interest from foreign buyers.

In short, the Brisbane housing pressure cooker is set to boil.