CBA’s economics team still expects the Reserve Bank of Australia (RBA) to hold the official cash rate steady at this afternoon’s monetary policy meeting in what it believes is a ‘line ball decision’.

However, CBA warns that Monday’s stronger than expected housing market data could force the RBA to hike by 0.25% later today.

Key Points:

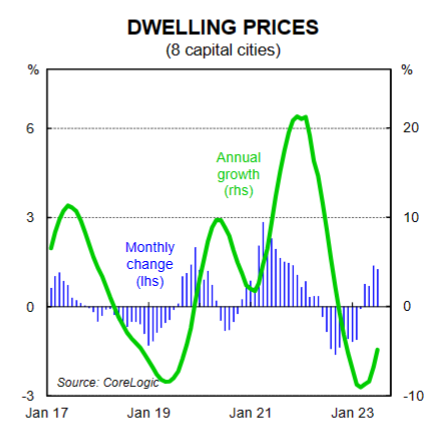

- Dwelling prices rose by 1.2% across the eight capital cities in June.

- New housing lending rose by 4.8% in May, a strong number, up from an upwardly revised 1.0% fall in April.

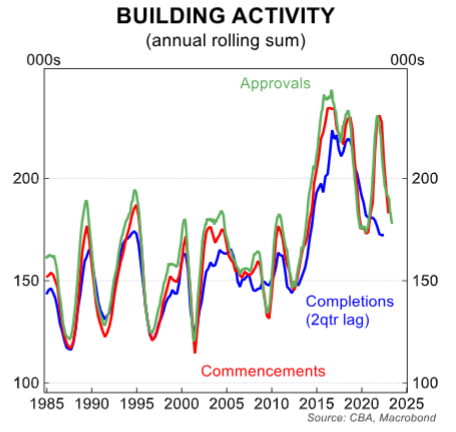

- Building approvals rose by 20.6% in May 2023, driven by a large gain in multi-unit dwelling.

The three pieces of housing related data released today were on the strong side.

As Stephen Wu noted in the home price note, prices nationwide rose again in June.

The eight-capital city benchmark index recorded a 1.2% increase. Nationally, home prices rose by 1.1%, reflecting a smaller 0.5% increase in regional prices.

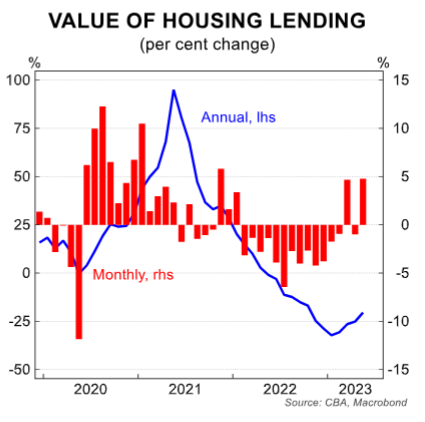

Lending for housing rose by 4.8% in May and building approvals recorded a much needed lift of 20.6% in what is a volatile series.

The RBA will factor this latest data into the decision on the cash rate on Tuesday (04/07). We expect the RBA to leave the cash rate on hold in a line ball decision.

The deceleration in the monthly CPI should be enough for the RBA to pause its hiking cycle. Although today’s stronger housing related data could, together with a tight labour market and lingering inflation concerns, tip the decision the other way. You can read our full preview here.

New housing lending –May 2023

New housing lending rose by 4.8% in May, much stronger than the consensus call of 1.4% (CBA above consensus expecting +3.0%).

Our internally generated data has done a good job of predicting the monthly moves in this volatile series. The rise in May follows a 1.0% fall in April (originally printed at a decline of 2.9%).

Over the past year new housing lending is down by 20.5% for the year to May, after reaching a fall of 32.3% in January. The turnaround in lending the last three months has helped boost the recovery in home prices over the same time period.

The RBA is watching this development closely, noting in the June Board Minutes “stabilisation in housing loan approvals suggested that financial conditions may not have been as tight as they had previously judged.”

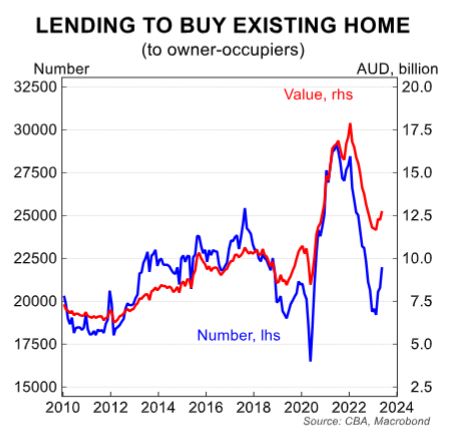

To the detail in May and the lift higher in home lending was driven by all three categories with owner occupier ex first home buyer (+3.5%), investor (+6.2%) and first home buyer (+5.5%) all rising.

As the last chart shows, there has been a pick up in both the number and value of lending in recent months although the divergence between the two is very large.

First home buyers are likely responding to a number of forces. Rental shortages and rising rents are likely seeing first home buyers take the plunge and purchase. There are also a number of Federal and state government programs in place to help this cohort enter the housing market.

Over the past year lending to first home buyers is down 15.1% compared to owner occupiers ex first home buyers (-21.8%) and investors (-20.9%).

External refinancing rose by a large 8.1% in May and was 22.4% higher compared to a year ago. The rapid increase in interest rates has led to a large number of mortgage holders seeking out a better deal and there are limited signs to show this is abating.

The fixed rate roll-off currently underway will also be incentivising refinancing as borrowers look for lower variable rates to move to after their fixed rate expires.

Owner-occupier refinancing reached a record high in May.

By state the value of home lending rose in every state and territory in May. The largest lifts were in the NT (+13.5%), NSW (+9.4%), Tasmania (+9.0%), the ACT (+8.8%), Vic(+6.3) and SA (+5.8%).

Smaller rises were recorded in Qld (+2.8%) and WA (+2.9%). Over the past year WA and the NT have recorded the smallest falls, while Vic and the ACT have recorded the largest.

Building approvals –May 2023

Building approvals rose by 20.6%/mth in May 2023. The gain was much larger than our estimate of a flat outcome and market consensus of a 3.0% increase.

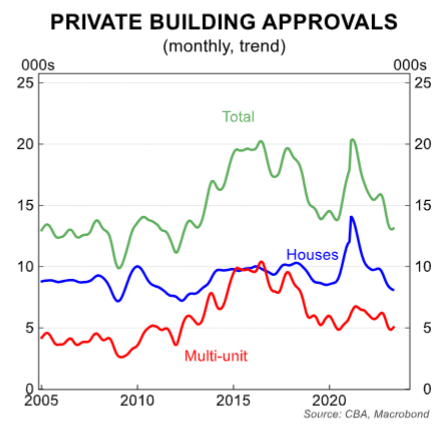

Large swings are common in what is a volatile series with the May numbers boosted by a 59.3% jump in multi-unit dwellings (apartments and townhouses).

Private detached housing approvals is much less volatile than multi-unit, and rose by 0.9% on a seasonally adjusted basis in the month. At 8.1k houses approved, the level remains 15.3% lower than a year ago and 42.3% lower than the HomeBuilder driven peak in 2021.

The trend measure however recorded a fall, down 0.6% and indicates that broader weakness persists.

Private multi-unit dwellings rose by 59.4% in the month. The chunky gain was driven by a large number of developments approved in NSW. The trend measure is of particular use for multi-unit dwellings due to inherent volatility and on this measure approvals rose by 3.7%.

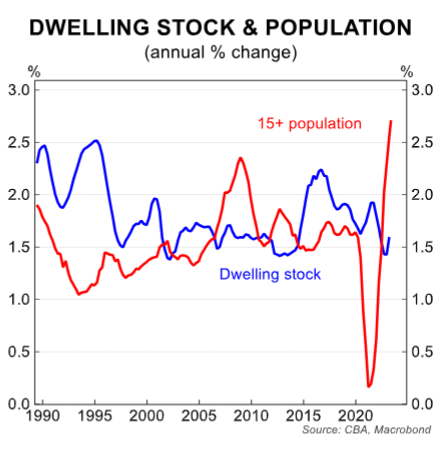

The current rate of population growth is far outstripping growth in the dwelling stock. Any increase in momentum of multi-unit dwellings is a positive for strained rental markets as a high proportion of new apartment builds flow into the rental stock.

Clearly though this has an impact in the medium term and will not materially move the needle for the current issues in Australia’s rental market.

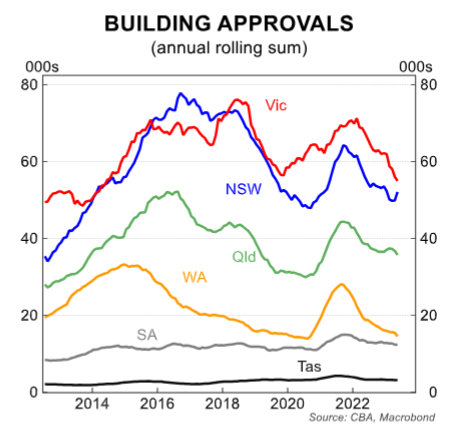

By state and on a seasonally adjusted basis, NSW (+52.9%) drove the result for the increase in total approvals. As above, the strength in the state was entirely due to a large jump in large-scale development approvals with house approvals registering a fall (-3.4%).

Elsewhere, approvals were mixed with Tas (+41.1%), Vic (+15.0%) and Qld (+0.9%) recording gains. Approvals in WA(-11.1%) and SA (-4.8%) contracted in the month.

A rolling aggregate of the past 12 months reveals that most states are still trending broadly lower with the exception of NSW. The value of non-residential building approvals rose by 6.6% in the month and is now the highest since early 2021.

Renovation approvals remains elevated, supported in part by higher prices in the construction sector. The value of renovations rose by 4.3% in the month and is 4.5% higher over the year. The level remains well above that prior to the pandemic.

Overall, Monday’s numbers are a positive development though do not represent a material change of trend as of yet. Detached housing remains on a downward trajectory and apartment approvals while volatile are still well below the apartment boom period during the 2010s.

There is still not enough dwellings being approved and completed to absorb population growth and changes to household formation. This as well as subdued dwelling listings are contributing to higher property prices as we saw in CoreLogic numbers.