Prominent Sydney real estate agent and auctioneer, Tom Panos, has uploaded a video on YouTube claiming that “the property listings drought is coming to an end”:

“We’ve had a shortage of listings for a very long time and then all of a sudden out of the blue we are having listings flying onto the market in the middle of July”, Panos says.

“Normally stock comes on the market mid-august for spring, but it’s very clear this is changing at the moment and what’s interesting is [we’re in the] middle of school holidays, middle of winter”.

“Up until now we’ve had this artificial number driven by low volume. This is now changing. I’m fascinated to see what it’s going to do to real estate prices”.

“All I can say to you is it’s going to happen more and more because come spring, there will even be more stock”.

Panos previously warned that there would be a rise in distressed sales as homeowners succumb to the RBA’s aggressive interest rate hikes and hundreds of thousands of borrowers switch from cheap fixed mortgage rates of 2% to variable rates approaching 7%.

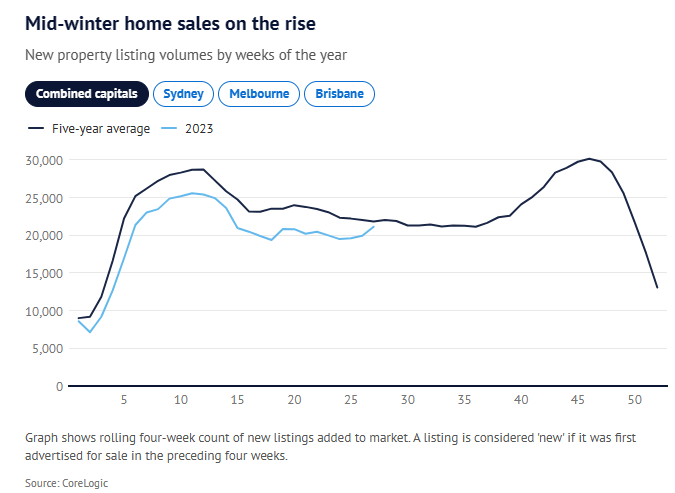

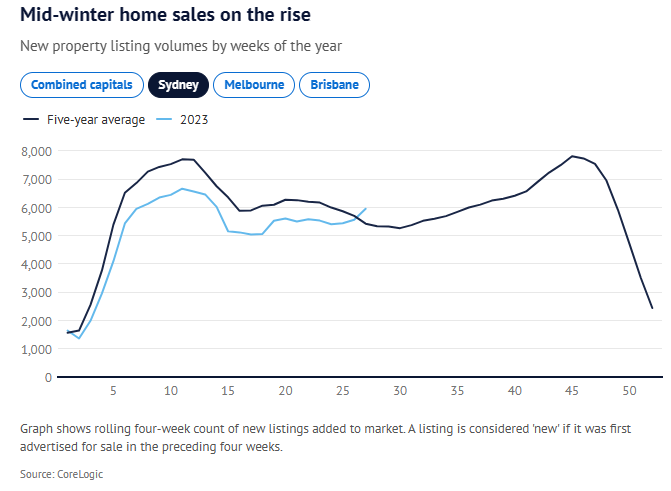

New data from CoreLogic shows a nascent unseasonal uptick in new listings numbers concentrated in investor-heavy inner cities and mortgage-belt outer suburbs:

The number of new property listings in Sydney increased by 7% at the beginning of July, while Melbourne increased by 4.2% and Brisbane increased by 9.4%.

The data is a rolling count that compares new listings in the four weeks ending 2 July to those in the four weeks ending June 25.

Since mid-May, the number of properties offered for sale in all three cities has been increasing, with new listings in Sydney being 10% more than the five-year average for this time of year:

“It’s quite an unusual trend, particularly for Sydney”, noted CoreLogic Australia’s head of research Eliza Owen.

“People would be able to see on the horizon whether they can afford the home they are in, and they might be making a decision now to get ahead of being in that situation”, she said.

BresicWhitney chief executive Thomas McGlynn has noticed more Mum and Dad investors selling up amid the pressure of rising costs.

“Not only have their mortgage payments gone up, but utilities have gone up and even in many cases strata fees have gone up”, he said.

Real Estate Institute of Australia president Hayden Groves noted that a lot of first home buyers are exiting cheap fixed rate mortgages and are deciding to sell.

“It’s really starting to bite … we do expect that more stock will come to market as a result of interest rate pain”, he said.

Areas with an increase in new listings tend to be heavily mortgaged, implying that some borrowers are experiencing mortgage serviceability issues.

Other areas that have experienced a significant proportion of investors selling include inner-city Sydney and Melbourne.

Whether the rise in distressed sales will be large enough to topple the market remains to be seen.

If the RBA continues to tighten and unemployment lifts materially, there could be significant problems.