Data from the Australian Securities & Investments Commission (ASIC) shows that 2,117 businesses in the building and construction sector went into external administration in the year to 18 June.

This is 75.4% higher than the previous corresponding period.

The level of construction companies in administration was double the next largest category of accommodation and food services, where 1058 external administration were reported in the year to 18 June.

The combination of high interest rates, growing input costs, and difficulties sourcing labour and funding is prompting developers to delay projects and putting others at risk of collapse.

Jarvis Archer from Revive Financial notes that insolvencies in the construction sector are significantly higher than across the rest of the economy.

“While total insolvencies have increased by 54% compared to last financial year, construction insolvencies have increased by 65%”, he said.

Archer also believes the situation facing builders will get worse before it gets better:

“Various construction businesses we’ve spoken to in the residential building sector reported a drop in new projects in early 2023 when interest rates were rising, house prices were falling and the economic outlook was generally bleak”.

“Combined with some major builder collapses, people were scared off building”.

It is a view shared by Russ Stephens, co-founder of the Association of Professional Builders, who said there is a significant gap between builders losing money and going out of business:

“This slowdown is going to catch them out, and that’s the reason why we will see a lot more liquidations over the next six months – it’s going to get worse before it gets better”.

“The sales process can take up to six to 12 months for builders. We are seeing consumers in that process have second thoughts and sit back and wait and see what happens with builders, interest rates and inflation. We are also seeing the amount of new inquiries start to slow down as well”.

“The negative effect of these building companies going down is that the subcontractors get burnt, maybe more than most”.

“These guys live hand-to-mouth and they’re the ones who tend to get hit hardest. When a subcontractor goes down, all the orders that other builders may have placed with the subcontractor then have to be sourced at higher prices – so it does have a knock on effect”.

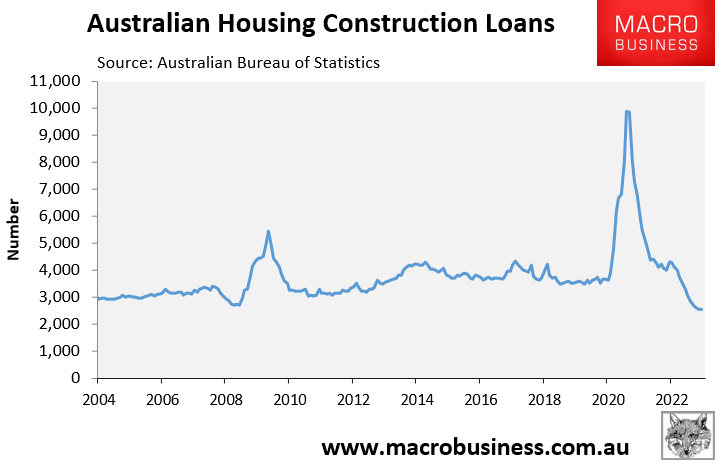

The forward-looking indicators are dire for the housing construction industry.

This week, the Australian Bureau of Statistics (ABS) revealed that the number of loans for the construction of new dwellings fell to a historic low in May, down 74% from their January 2021 peak:

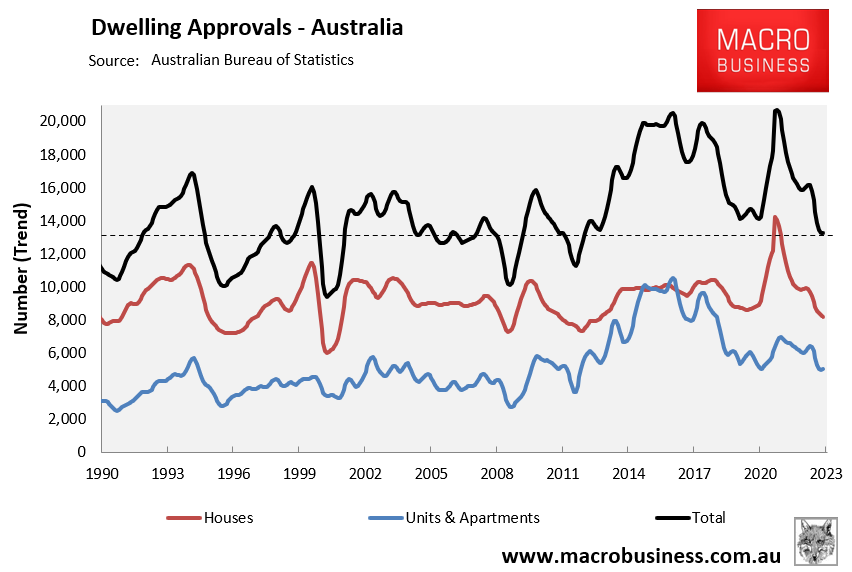

The ABS also reported that trend dwelling approvals had also fallen to an 11-year low:

Treasury Secretary Steven Kennedy told the latest Senate Estimates hearing that the downturn in dwelling approvals will run until 2025, with investment in new dwellings expected to fall by 2.5% this year, 3.5% in 2023-24, and 1.5% in 2024-25.

Oxford Economics Australia likewise forecast that total building work will fall a cumulative 21% over the three years to financial year 2025, with activity bottoming at $104.5 billion.

“New-home sales, dwelling approvals, and home construction loans have deteriorated, setting the scene for a deep residential downturn”, Oxford Economics head of construction and property forecasting Timothy Hibbert said.

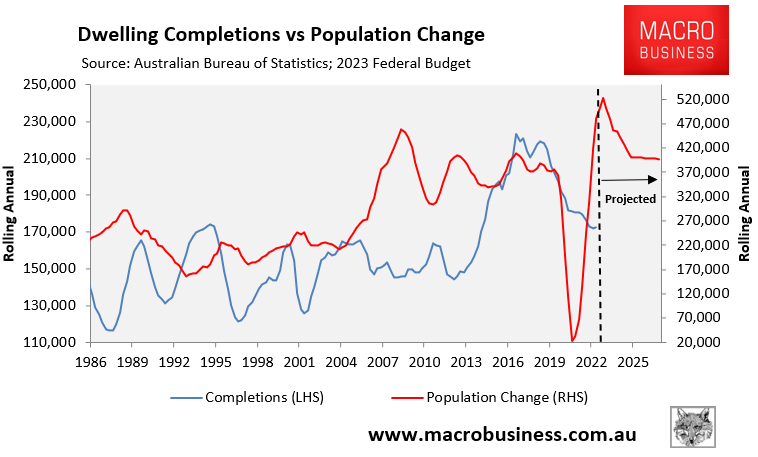

These forecasts are a disaster for Australia’s housing market, which is already experiencing falling rates of construction amid the fastest population increase on record:

Australia needs to add 329 dwellings to its housing stock every day (net of demolitions) just to accommodate the 1.5 million net overseas migrants projected to land in Australia by 2026-27.

Achieving such a high rate of construction is an impossible task under the very best housing conditions.

It is even worse when the entire construction industry is on its knees suffering widespread insolvencies, high material costs, and high financing costs,

Australia’s housing crisis will, therefore, intensify. And this will drive rents higher and push thousands more people into homelessness.

The Albanese Government’s extreme immigration policy is pure policy insanity and an inequality disaster in the making.