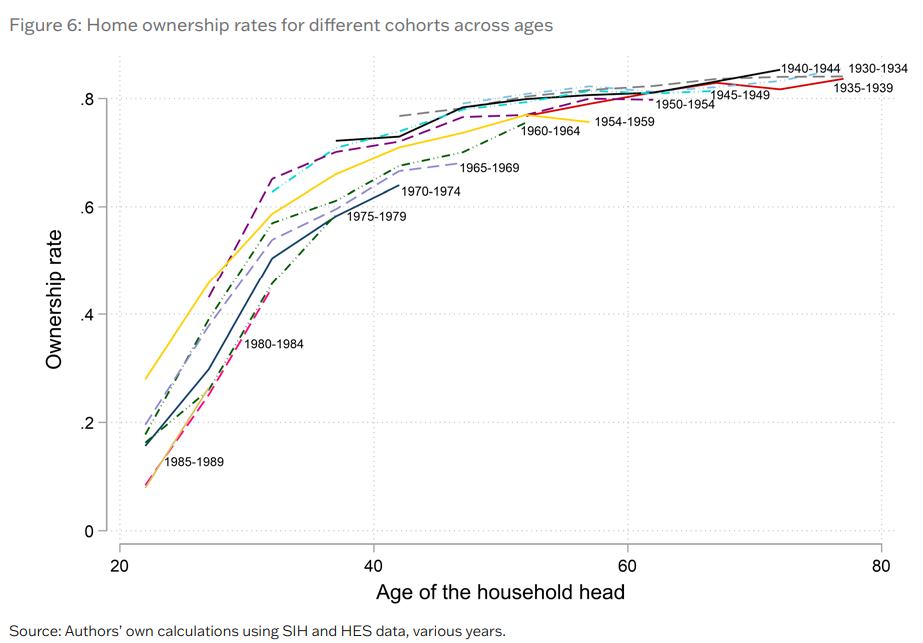

A new report from the Australian Housing Urban Research Institute (AHURI) shows that “successive cohorts of Australians have experienced lower rates of home ownership at any given age”.

“This fall in ownership rates has coincided with rising house prices and deteriorating affordability. The decline remains after controlling for changing socio-demographic trends”.

“Home ownership rates at age 30 have fallen from a high of 65% among those born in the late 1950s to around 45% among those born in the 1980s”.

“By age 50 there is incomplete catch-up in home ownership rates—which means that younger cohorts do not close the gap and catch up with their older counterparts”.

“Around 25% of the home ownership gap remains”, the AHURI reports.

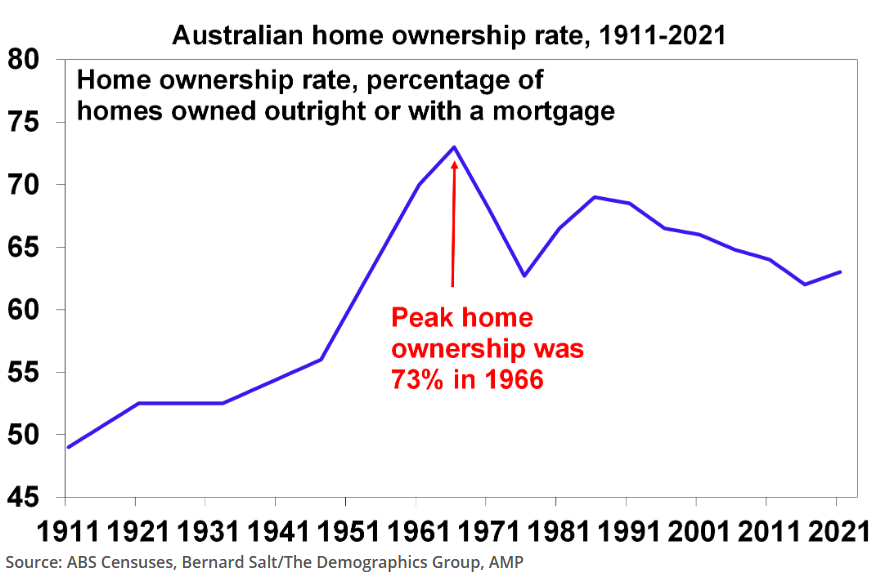

A recent joint analysis by AMP Capital chief economist Shane Oliver and demographer Bernard Salt also showed that 73% of Australians owned a property outright or with a mortgage in 1966, but this has now dropped to 63%:

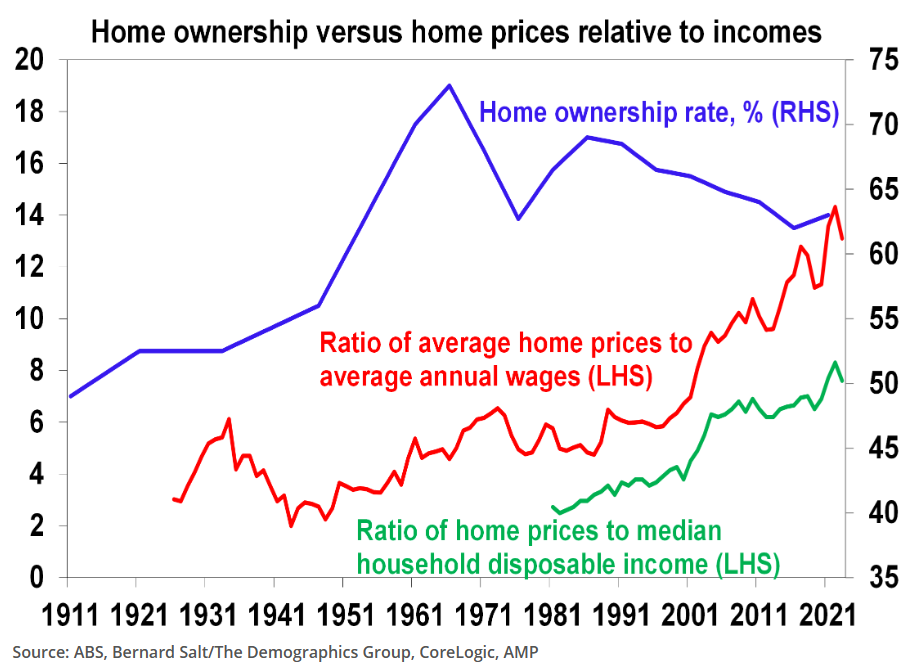

This decline in home ownership has also coincided with a sharp rise in house prices relative to incomes:

Meanwhile, Finder.com.au analysis shows that home purchasers now need a household income of around $140,000 a year to afford the typical Australian home.

A Sydney buyer purchasing a house priced at the city average would need to earn $250,000 a year in household income, whereas a Melbourne buyer would be nearly $175,000 annually.

Finder head of consumer research Graham Cooke said home ownership was slipping out of reach of new buyers faster than even during pror housing booms.

“Every time the cash rate goes up, the first rung of the property ladder gets higher”, he said.

The current state of home ownership is significantly worse than the data above.

First, according to Bernard Salt’s analysis of the most recent Census data, Australians are increasingly being crammed into high-rise apartments and granny flats, which were the fastest growing housing types (place of enumeration) in the 2021 Census:

As a result, the quality of housing (both location and form) has deteriorated.

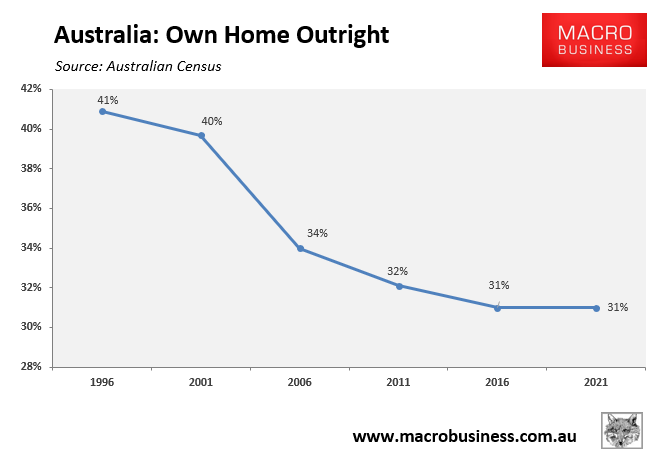

Second, the proportion of Australians who own their property outright without a mortgage has plumetted from 41% in 1996 to 31% in 2021:

Third, according to the OECD’s housing database, Australia has fallen far behind the OECD average in terms of outright home ownership:

Finally, the median age of first-time homebuyers in Australia has increased by nearly ten years this century, rising from 24 in 2002 to 34 in 2022:

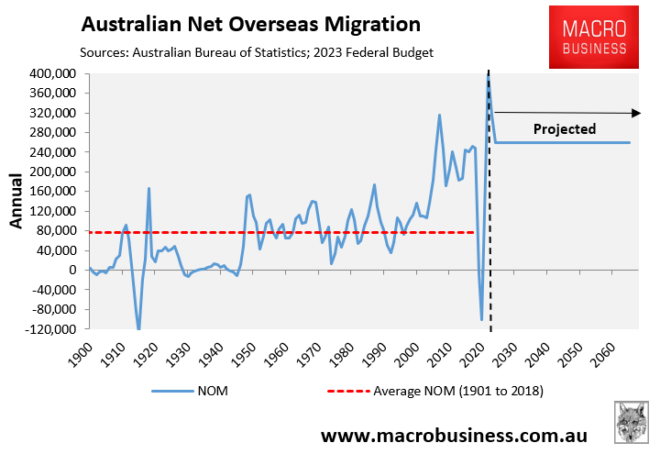

The housing crisis for younger Australians will only worsen under the Albanese Government’s unprecedented mass immigration program:

There are few policies that are worse for young Australians seeking a place to live than forcing them to compete for housing with hundreds of thousands of new migrants each year.