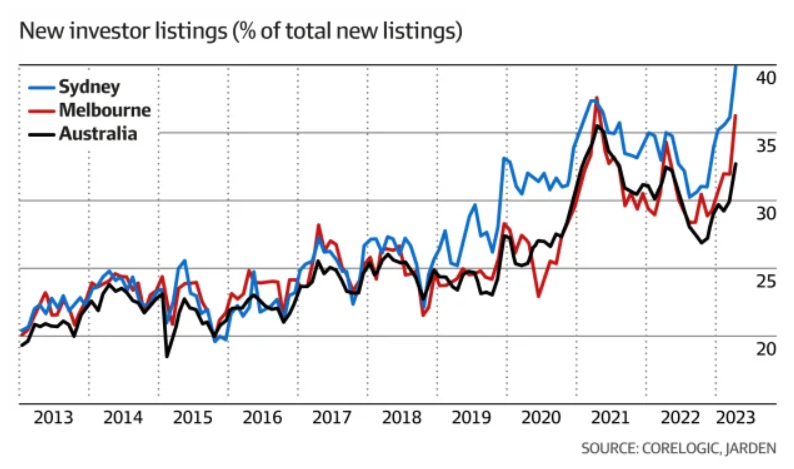

The AFR’s Michael Read published the below chart on Friday suggesting there is a mass exodus of investors from Sydney’s and Melbourne’s housing markets:

The below chart from CoreLogic shows similar:

Investment bank Jarden says investor listings as a percentage of total listings reached a record high of 40% in Sydney in June, while investors made up 36% of listings in Melbourne, just shy of the city’s record.

Jarden chief economist Carlos Cacho said the recent increase in the number of homes selling at a loss and selling within two years of purchase could be due to an increase in “forced” investor sales.

Cacho believes that investors were selling properties to decrease leverage and enhance cashflow as the fastest interest rate tightening cycle on record made servicing multiple loans increasingly onerous.

“Despite surging rents and near record low vacancies, interest costs have risen well above rental yields putting pressure on investor cashflow, while reduced borrowing capacity has locked some investors into more expensive non-bank lenders – where rates can be 1% to 2% above major banks”, he said.

“Given the lack of stock on market has been a key driver of recent housing price strength, this increase in supply, if sustained, could be a catalyst for renewed house price weakness”.

Meanwhile, Ray White managing director Dan White told The AFR that investors were behind a “pretty material” jump in listings across the group.

“We’re seeing more investors come to market this month following the end of the financial year, We expect them to lift even higher in spring”, he said.

Another Ray White agent, Fan Li, noted there has been “more investors selling at the moment as interest rates have gone up and rent often can’t cover the mortgage”.

“We have more properties on the market at the moment with people in similar situations”, he said.

“People are selling their holiday homes”, Ray White Ferntree Gully agent Matthew George said.

Borrowing to invest in real estate made sense when interest rates were low and values were rising.

However, the RBA’s 4% of interest rate rises has lifted repayments on a typical mortgage by around 50%, well in excess of the growth in rents, pulling leveraged investors deep underwater financially.

When choosing between selling an asset that they’re maintaining on the side versus the family home, the choice is pretty obvious.

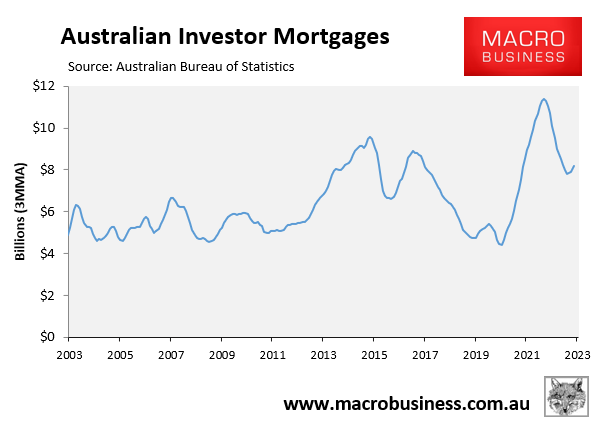

That said, at the same time as lots of investors are selling up, there has been an uptick in new investor mortgage commitments:

Thus, there is some churn going on between investors.

The situation facing investors will obviously improve once the RBA begins cutting interest rates next year.