A month ago, prominent Sydney real estate agent and auctioneer, Tom Panos, warned that the Reserve Bank of Australia’s (RBA) 0.25% increase in the official cash rate had pushed rates to a “tipping point” that will push the housing market over the edge.

“I think this is the tipping point. I think this is the bit where mum’s and dad’s today are going to sit home with a calculator and say ‘you know what? How are we going to do this? We can’t do this anymore'”, Panos said.

“You know what’s going to happen? You are going to start seeing the property market affected”.

“At the moment we’ve got this artificial housing market that’s going gangbusters. Not because of any economic reasons. Purely because of demand and supply”.

“Wait until you see the stock that comes on the market. Let’s see how the demand and supply curve works then”.

“I’m calling this the tipping point”, Panos warned.

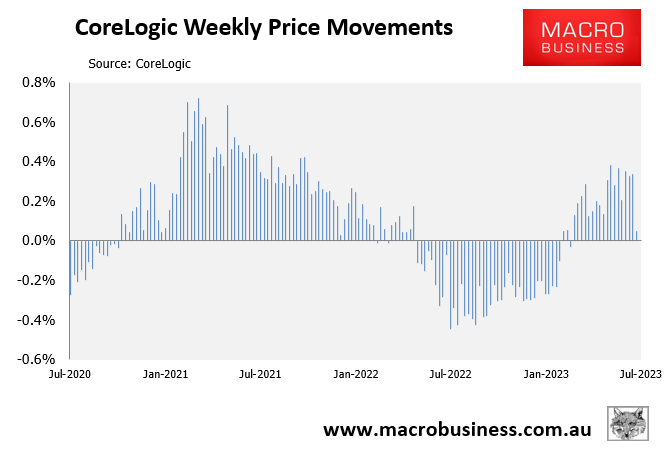

We have just gotten our first indications that the housing market is hitting this “tipping point” with both CoreLogic’s daily dwelling values index and the auction market stalling.

Dwelling values at the 5-city aggregate level grew by only 0.05% in the week ended 6 July, which was the weakest price growth since mid-February:

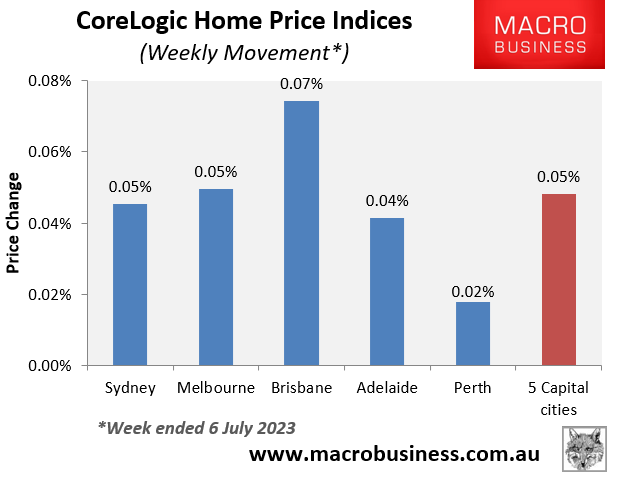

While weekly values rose across all major markets, the rate of growth slowed to a crawl:

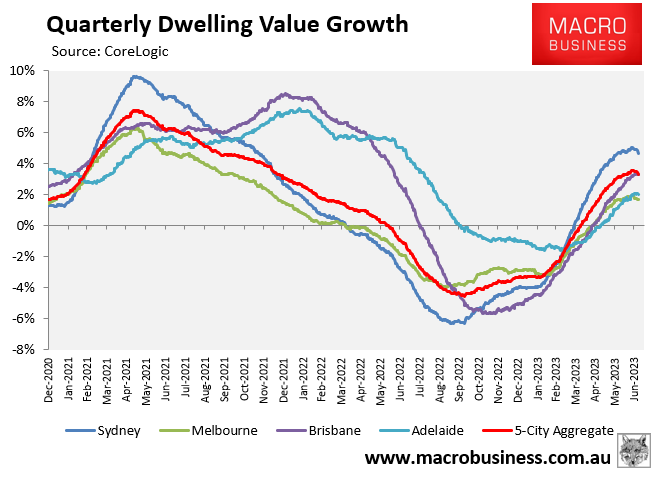

The quarterly rate of growth has also turned down across all major markets, according to CoreLogic:

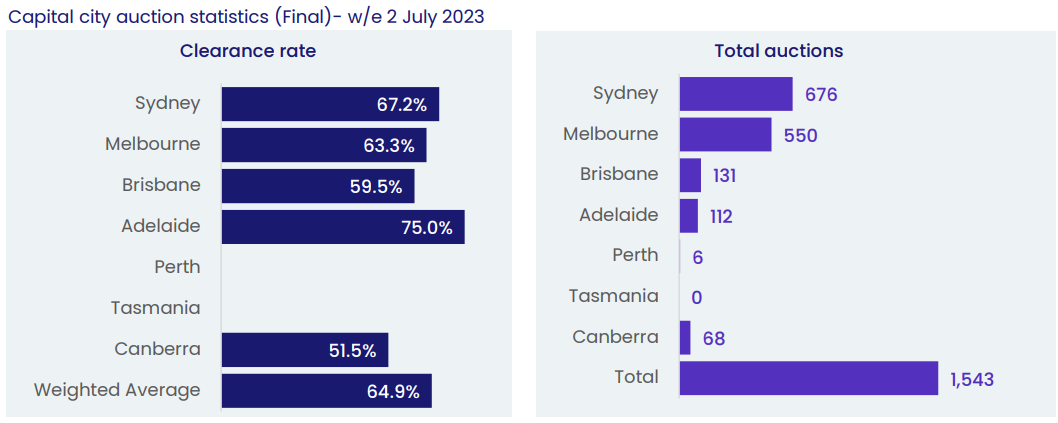

Meanwhile, CoreLogic has released final auction results for last weekend, which recorded the weakest clearance rate since the week ended 23 April off a large reduction in volumes:

“There were 1,543 homes taken to auction across the combined capital cities last week, down 13.8% compared to 1,791 held over the previous week and 18.0% below the 1,881 auctioned this time last year”, noted CoreLogic.

“The final clearance rate came in weaker at 64.9% last week – the lowest clearance rate recorded since the week ending 23rd April 2023 (64.9%)”.

Sydney recorded its lowest clearance rate in 10 weeks, whereas Melbourne recorded its lowest final clearance rate since the week ending 12th March 2023 (excluding Easter).

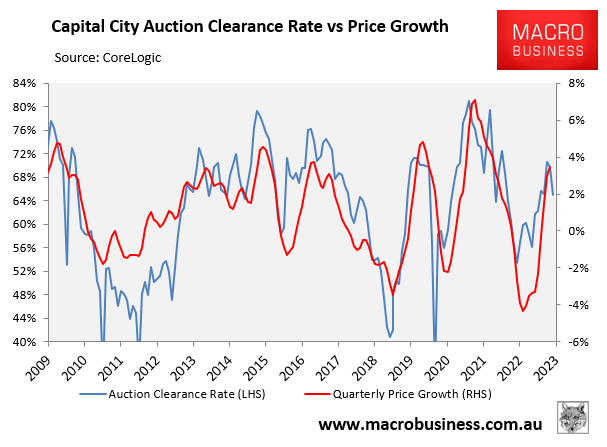

The next chart plots the final auction clearance rate against dwelling values:

As you can see, the downturn in clearance rates is pointing to slower price growth.

While we need more data to make a definitive judgement, it does appear that the RBA’s June rate hike was one too many for the housing market.