RBA Governor Phil Lowe gave a speech today to the Economic Society of Australia (Qld) Business Lunch, where he warned that inflation risks had “shifted to the upside” since the last Statement of Monetary Policy in early May:

“Our priority remains to ensure this period of high inflation is only temporary”…

“Our most recent set of forecasts, which were prepared in early May, have inflation returning to the top of the target band in mid-2025”.

“Data received since then had suggested that the inflation risks had shifted somewhat to the upside. The Board responded to this shift in risk with a further lift in interest rates”.

But Lowe also noted that it “remains to be determined” whether rates will rise again, with CPI, labour market and retail data the key:

“It remains to be determined whether monetary policy has more work to do. It is possible that some further tightening will be required to return inflation to target within a reasonable timeframe”.

“Whether or not this is required will depend on how the economy and inflation evolve”.

“At its next meeting, the Board will have an updated set of economic forecasts from the staff as well as a revised assessment of the balance of risks”.

“The Board will also have new readings on inflation, the global economy, the labour market and household spending to help inform its decision”.

Lowe also noted that there are some factors pushing inflation lower that balance potential stickiness elsewhere, which it will weigh-up in coming months:

“On the one hand, there are ongoing pricing pressures from several factors, including: the high level of capacity utilisation; strong growth in unit labour costs (mainly because of weak productivity growth); a big pick-up in rents; and higher prices for electricity”.

“But, on the other hand, there are several factors working in the other direction, contributing to the easing of inflation. These include: an easing of the COVID supply chain disruptions; a decline in commodity prices in global markets; and slow growth in aggregate demand, particularly in household consumption”.

“The slow growth in demand is expected to lead to some rise in unemployment and a moderation in growth in unit labour costs. It is also expected to reduce cost pressures on firms and to lead to greater discounting than has been the case over recent times”.

In short, the RBA will remain on hold until data surprises to the upside.

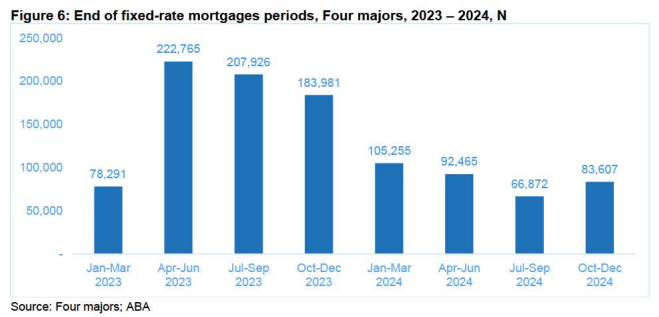

That is a sensible stance given there is significant monetary tightening ‘built in’ with hundreds of thousands of fixed rate borrowers yet to reset from rates of around 2% to nearly 7%:

To continue tightening risks driving the economy deeper into recession.