Despite the Reserve Bank of Australia (RBA) holding the official cash rate (OCR) steady last week, confidence across the Australian economy has collapsed.

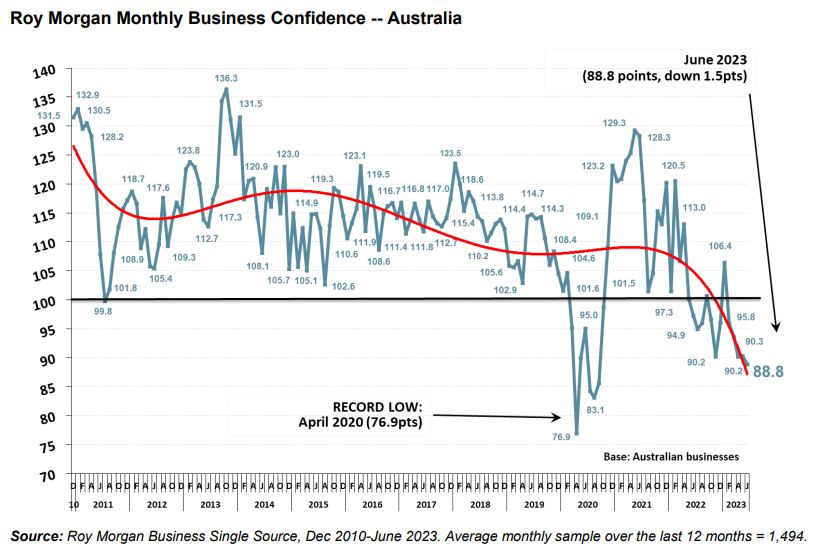

Roy Morgan’s June business confidence survey crashed to its lowest level since September 2020 during Victoria’s second wave of COVID-19:

Business Confidence has now spent five consecutive months below the neutral level of 100, the longest stretch in negative territory since October 2020 during the first year of the pandemic.

Businesses are most worried about the performance of the Australian economy.

61.6% expect ‘bad times’ for the economy over the next five years and only 32.8% expecting ‘good times’ – a net negative of 28.8% points in June.

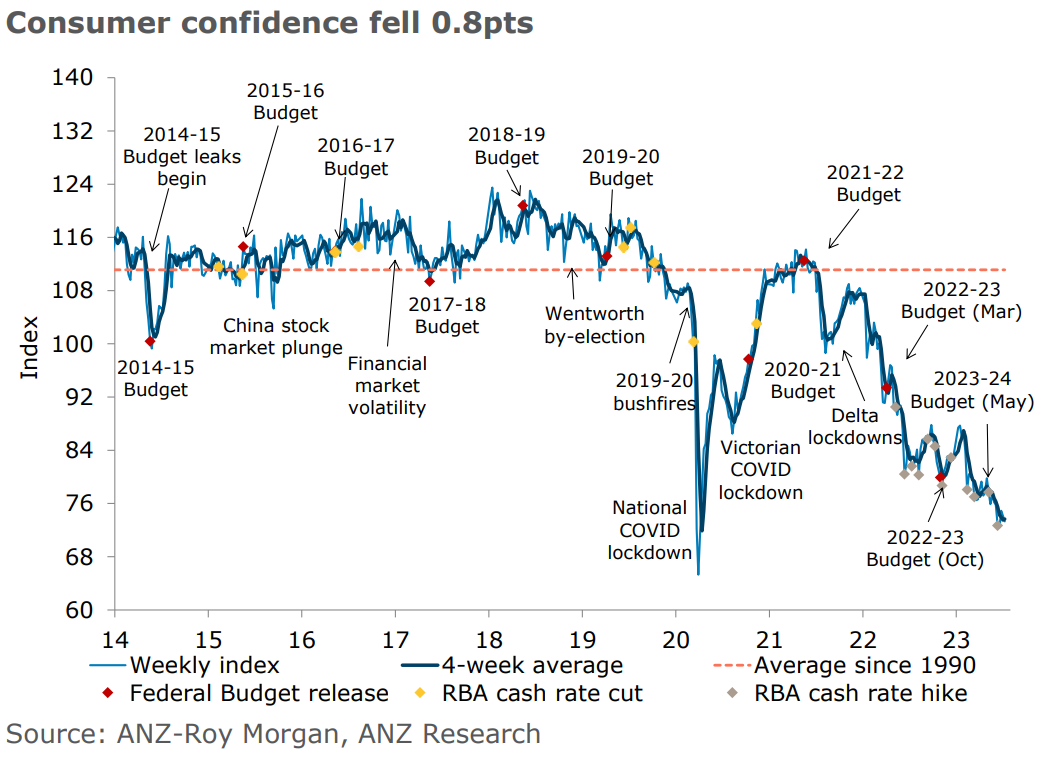

Roy Morgan’s weekly consumer confidence report also fell last week despite the RBA leaving the cash rate unchanged:

Most importantly for household consumption, the ‘Time to buy a major household item’ plunged 6.8pts, falling to its lowest since early April 2020.

Moreover, confidence dropped 3.4pts for those paying off their own homes and fell to its lowest level on record for this cohort.

Clearly, the RBA’s aggressive interest rate hikes are wearing on the economy.

The situation will likely worsen as hundreds of thousands of cheap fixed rate mortgages expire over the remainder of the year, draining household income and suppressing discretionary spending.