ABC business reporter, Daniel Ziffer, reported that over an 18 month period, more than one million Australian households with home loans will face a significant financial shock.

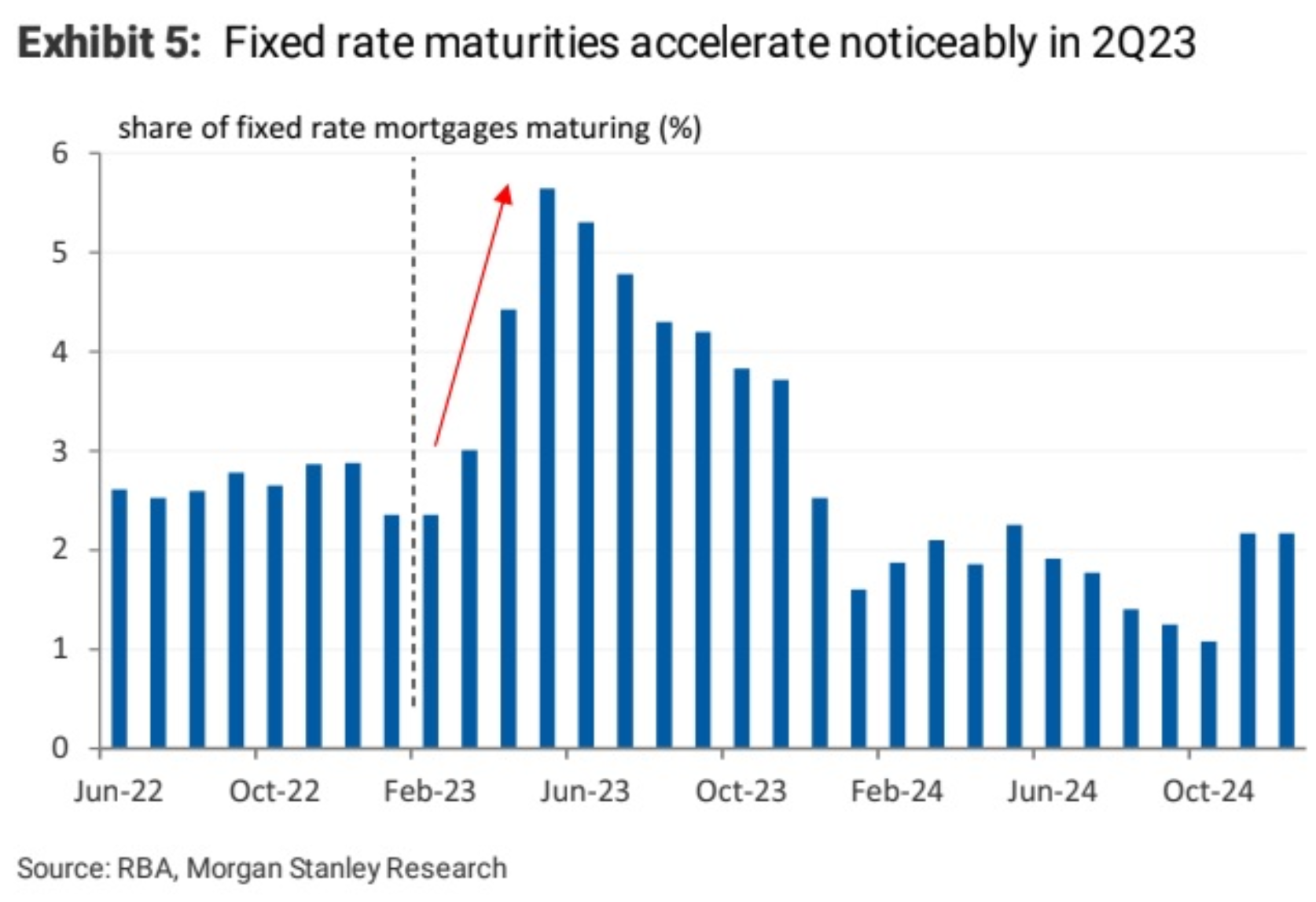

By the end of this calendar year, at least 880,000 fixed-rate mortgages will have expire, followed by another 450,000 in 2024.

The next chart shows the expiry schedule, with nearly 500,000 to expire over the second half of 2023 alone:

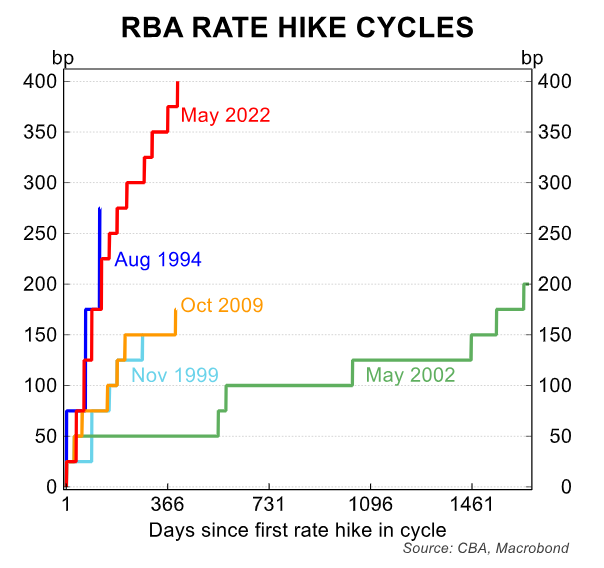

Borrowers will be switched from mortgages fixed at the pandemic’s emergency low rates — some of the lowest rates on record — to variable loans that will soon approach 7% after the steepest-ever increase in official interest rates:

Borrowers will have to find thousands of dollars extra each month to service their mortgages, with further rate hikes still possible.

The amount Australians spend on mortgage interest payments increased by 106% last year — more than double — before most consumers reached the fixed-loan cliff, notes Ziffer.

Sebastian Watkins, co-founder of home loan company Lendi, told the ABC that the situation is “incredibly concerning”.

“I don’t think we talked about it enough, there’s going to be a severe amount of whiplash”, he said.

“It’s a substantial shift, you’re talking about some people paying 3 or 4 per cent more on their mortgage … overnight”.

“More properties have sold in June than any other month this year. So I think that’s talking to people that are dropping onto these higher rates, and just not being able to afford the loan”.

Watkins also warned that many fixed rate borrowers may not be able to refinance because they do not meet banks’ mortgage serviceability requirements, meaning their will become ‘prisoners’ to their existing lenders.

“Our data is showing a significant percentage of customers who took out their loan over the course of 2020 and 2021 would not be able to meet their financial commitments with one or two more rate rises”. he said.

Financial councilor for the National Debt Helpline, Shae Robbins, said he clientele had changed from low-income earners and welfare recipients to “people who are in great jobs, they’ve got really good incomes, and now they’re struggling to just pay their mortgages and the everyday essentials”.

“They’re working full-time, but they’re still struggling”, she said.

This is why RBA governor Phil Lowe was right on Wednesday to suggest that interest rates will remain on hold.

Because there is significant monetary tightening already ‘built in’ huge volumes of fixed rate borrowers yet to reset from rates of around 2% to above 6%.