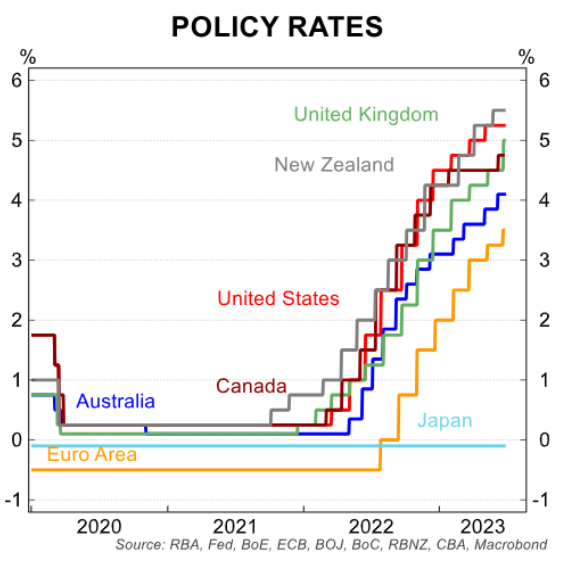

The Reserve Bank of New Zealand has hiked official interest rates further than most other central banks:

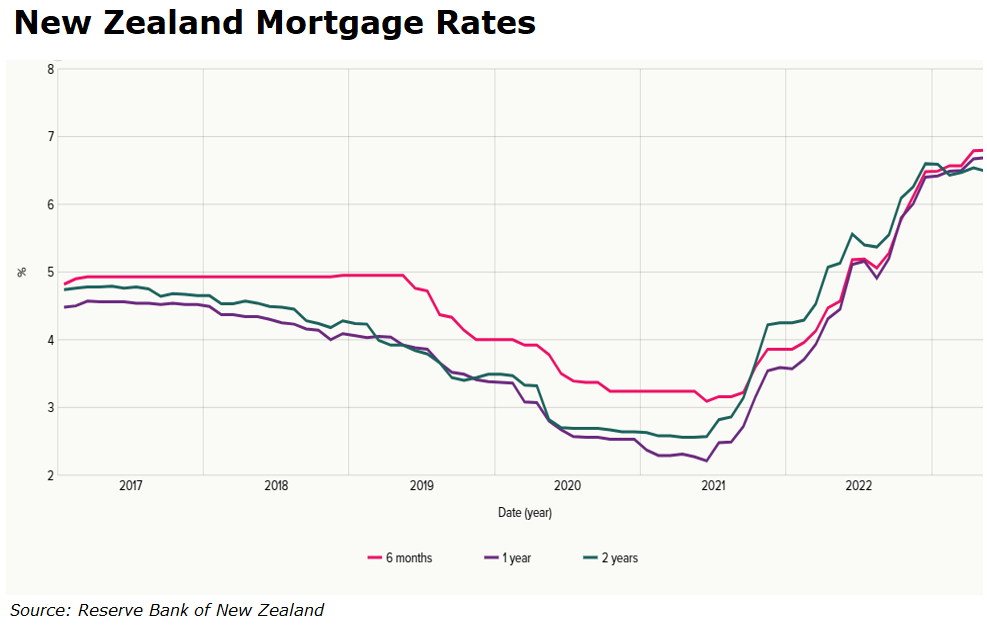

This tightening has more than doubled New Zealand mortgage rates from their pandemic lows:

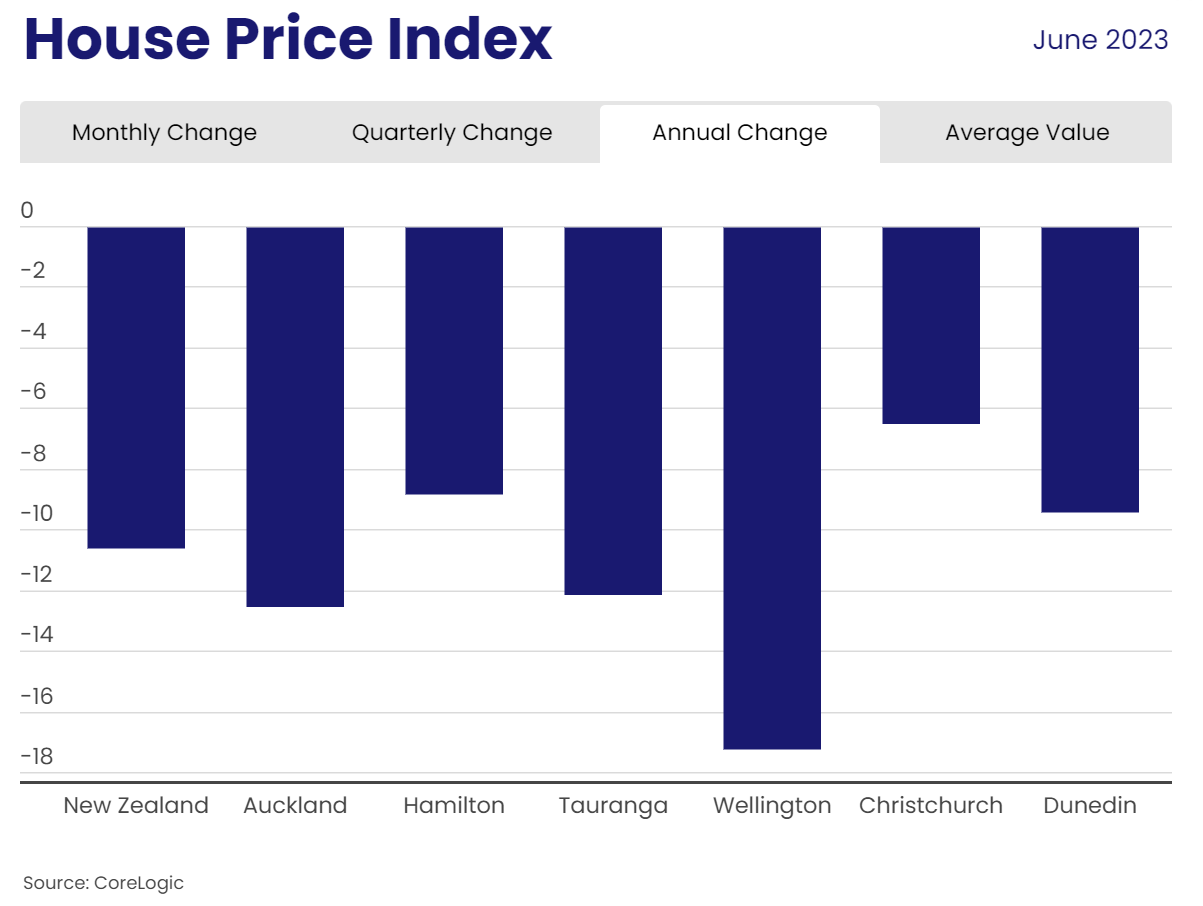

The impact on New Zealand house prices has been brutal.

This week, Realestate.co.nz reported that average asking house prices listed on its portal had fallen for the fourth consecutive month in June to $841,688.

This meant that average prices had declined by $80,744 (-8.8%) since June last year.

CoreLogic also reported “accelerating” house price declines in June, with values tumbling 1.2% month-on-month to be 10.6% lower year-on-year:

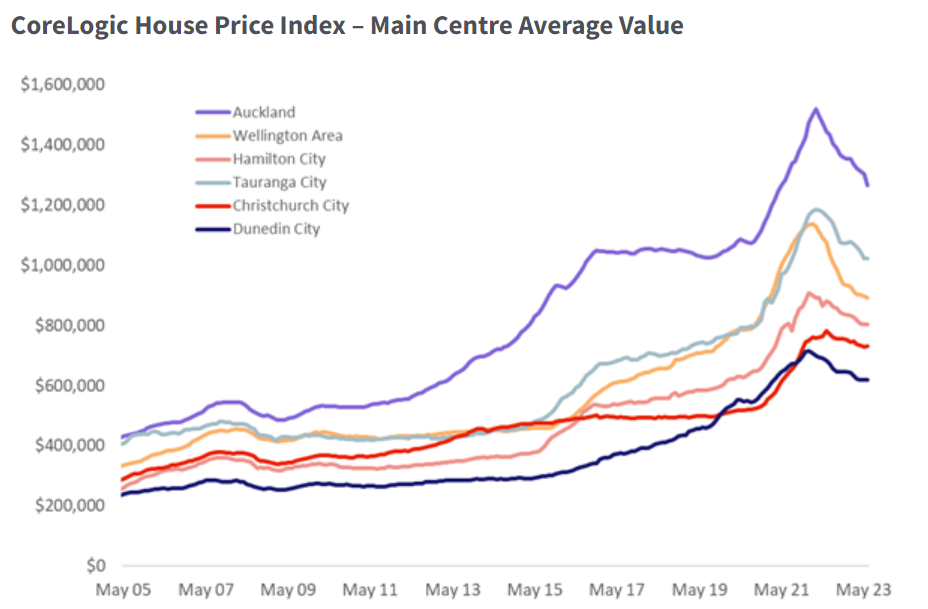

The next chart shows that Wellington and Auckland have experienced the strongest housing corrections:

I noted earlier in the week how Big Four bank ASB had lifted key fixed mortgage rates to a 15 year high, with other banks expected to follow suit.

This suggests that New Zealand house prices could continue to fall given affordability remains stretched.

According to the latest CoreLogic Housing Affordability report, more than 50% of the average household income is required to service an 80% LVR mortgage in NZ compared to 43% in Australia.

On the other hand, CoreLogic NZ Head of Research, Nick Goodall, believes the market could soon bottom:

“The flow of properties being listed for sale has been weak all year – tracking below each of the past three years”.

“This, alongside property sales ticking higher, has meant the overall volume of properties on the market is reducing”.

“Reduced supply, paired with high net migration, increased confidence, looser credit requirements (CCCFA and LVR) and near-peak mortgage interest rates, have supported demand and provided the setting for upcoming market change”.

For what it is worth, I am tipping that New Zealand house prices will rebound after the general election on 14 October.

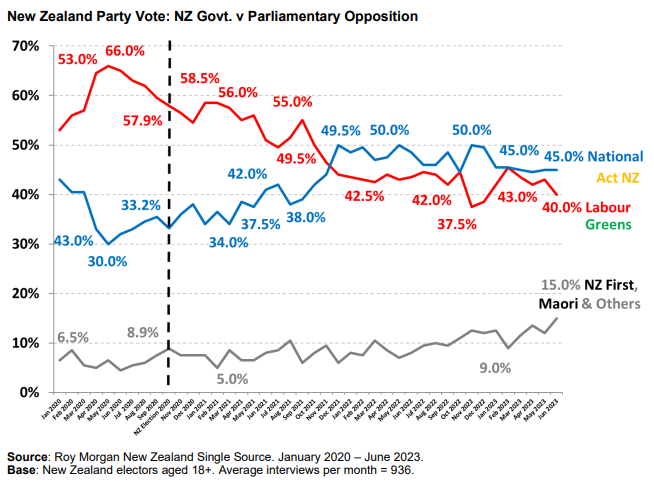

National is tipped to form government and has promised to return mortgage interest deductibility and reduce the bright-line (capital gains) test from between five to ten years to only two.

The Reserve Bank will likely also be at the top of its rate tightening cycle.