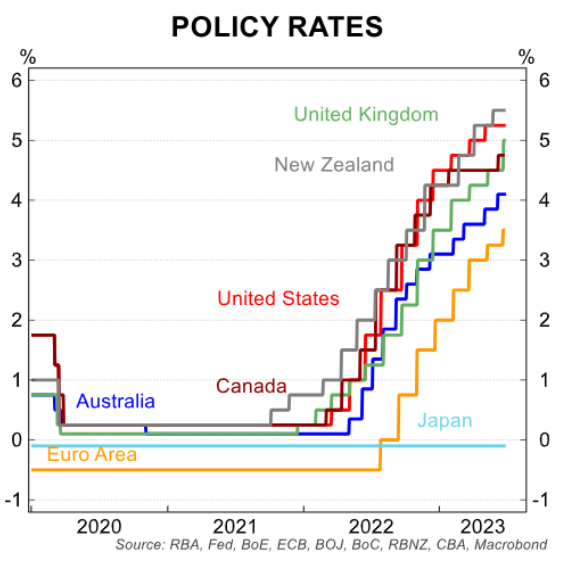

The below chart from CBA shows that the Reserve Bank of New Zealand has lifted official interest rates higher than nearly every other central bank:

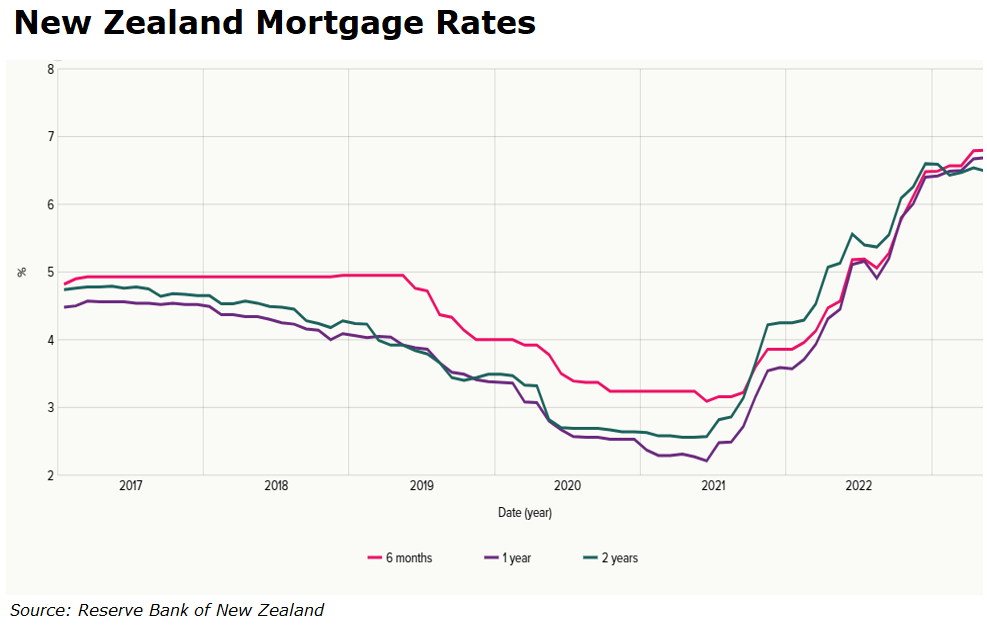

In turn, New Zealand mortgage rates have more than doubled from their pandemic lows:

Earlier this week, Big Four bank ASB pushed up a key fixed mortgage rate to a 15 year high, according to Interest.co.nz:

“ASB is following wholesale rates up and raising its fixed rate card for all rates from six months to two years. These increases take them to the highest in the market”.

“ASB’s new one year rate is now 7.25%, up 20 basis points and still the only bank with a one year rate above 7%”.

“You have to go back to December 2008 to find a higher one year rate from any main bank. Back then rates were falling fast but they weren’t inverted like they are today”.

“ASB’s new two year rate is now 6.79% and also up 20 basis points”.

“ASB is often the first mover higher, signaling to other banks that it is time to raise home loan rates”.

Kiwibank quickly followed by hiking mortgage rates by 10 to 30 basis points depending on loan term, with others expected to follow.

Meanwhile, average asking house prices on Realestate.co.nz declined for the fourth consecutive month in June amid collapsing demand, according to Interest.co.nz:

“The property website received 6218 new residential listings in June, down 21.2% compared to June last year and down 17.6% compared to pre-Covid levels in June 2019″, reported Interest.co.nz”.

“However, buyers will still have plenty to choose from, with the total amount of stock available for sale on the website remaining at elevated levels”.

“Realestate.co.nz had a total of 24,676 residential properties available for sale at the end of June, which was down just 6.1% compared with June last year in spite of the huge reduction in new listings”.

“However, the stock levels in June this year were up by 78% compared to June 2021 and up by 4.9% compared to pre-Covid levels in June 2019”.

“Asking prices continued to weaken, with the national average asking price declining for the fourth consecutive month to $841,688 in June, which means it has declined by $80,744 (-8.8%) since June last year”.

Finally, Statistics NZ revealed there were 5856 fewer new homes consented in the May this year versus the previous 12 months:

“In the 12 months to the end of May 2023, 45,159 new dwellings were consented, down 11.5% (-5856) compared to the previous 12 months”.

“The total value of new dwelling work consented is also on the slide, declining by $932 million (-4.7%) in the year to May, from $19.997 billion in the 12 months to May 2022 to $19.065 billion in the 12 months to May 2023”.

Rising mortgage rates, falling house prices, falling sales volumes, elevated inventory, and falling dwelling consents.

The Reserve Bank has clearly smashed the housing market into capitulation.