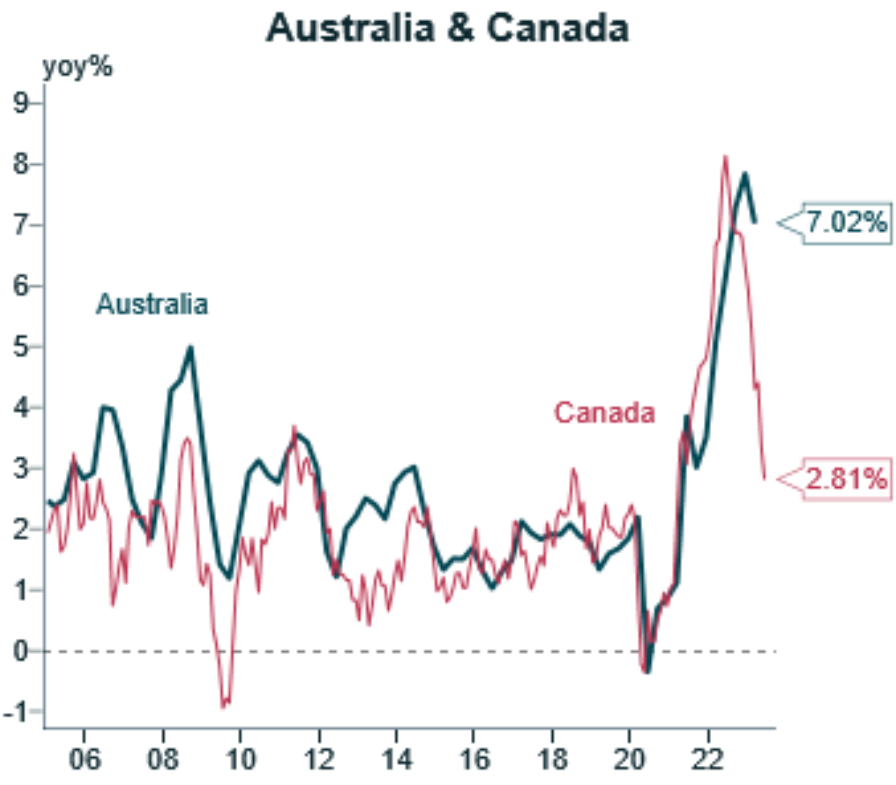

IFM Investors chief economist, Alex Joiner, published the following chart on Twitter showing that Canada’s inflation has plummeted to just 2.8% year-on-year:

However, Joiner notes that Canada’s unemployment rate is 5.4%, versus 3.6% in Australia.

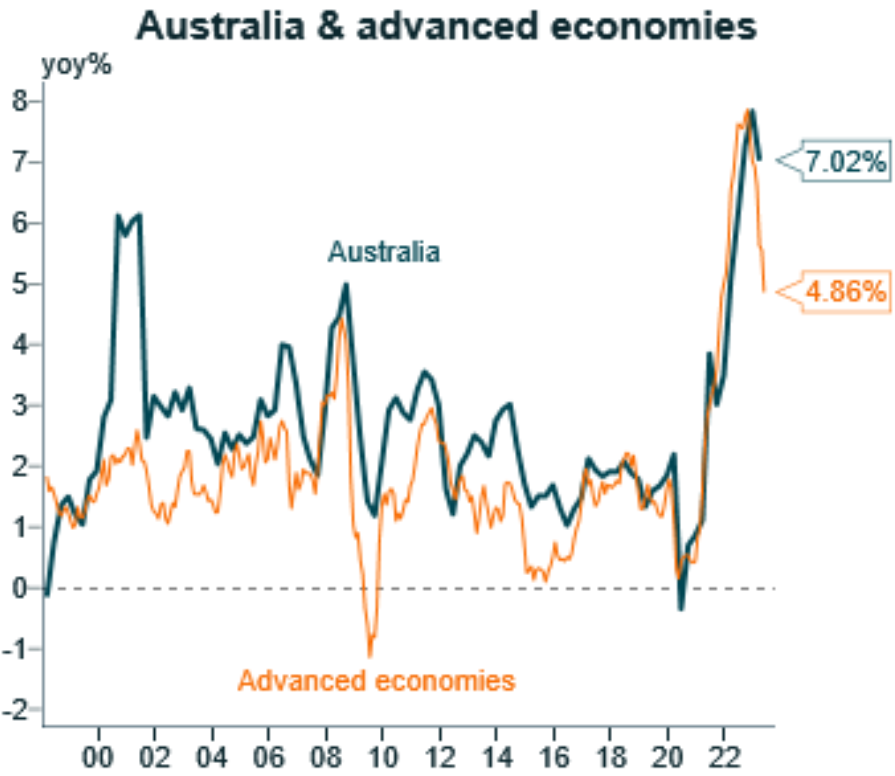

Joiner also published the below chart showing inflation fall across developed countries:

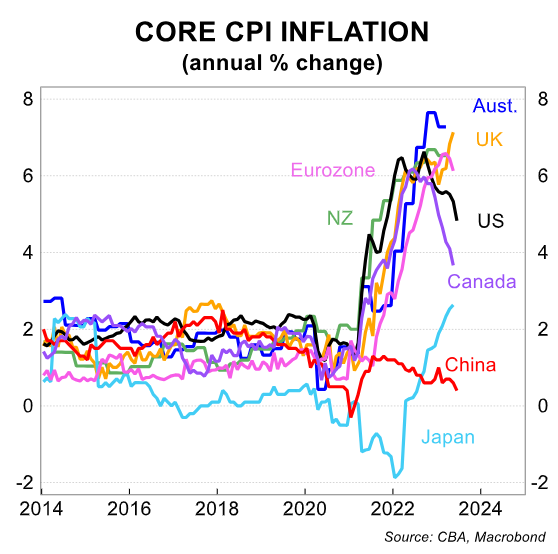

The next chart from CBA shows that Australia’s core inflation is higher than most other nations:

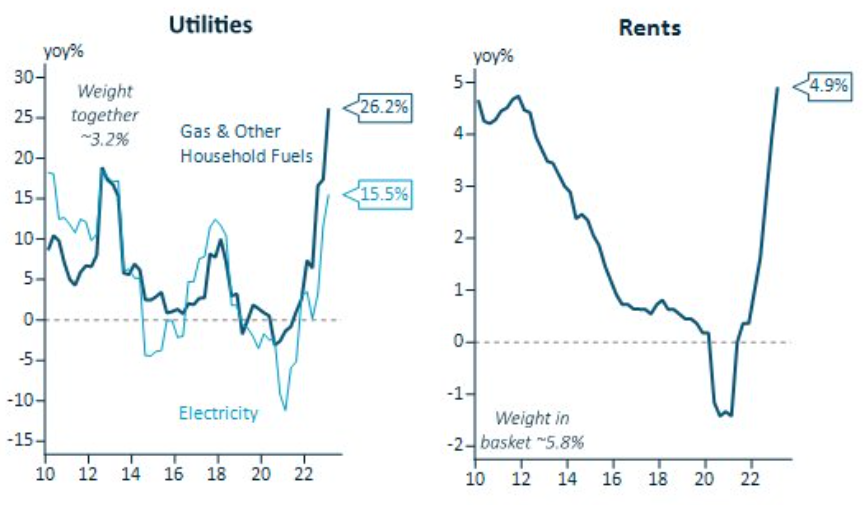

Alex Joiner argues that there are idiosyncratic factors keeping Australia’s inflation elevated, particularly soaring energy costs and rents:

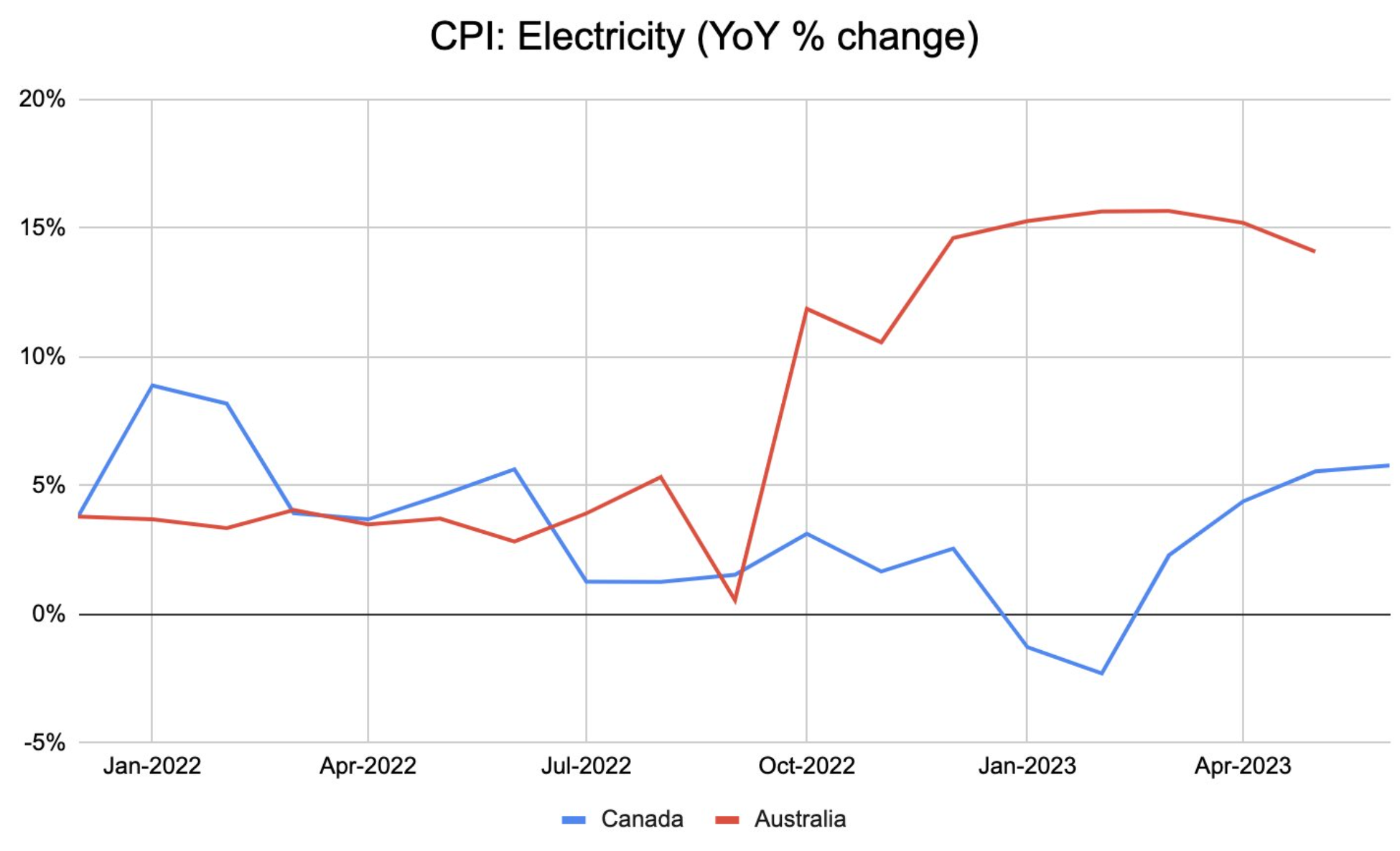

Circling back to Canada, Twitter user Michael Lane responded to Joiner showing that Australia’s electricity CPI is rising at more than double the rate of Canada’s:

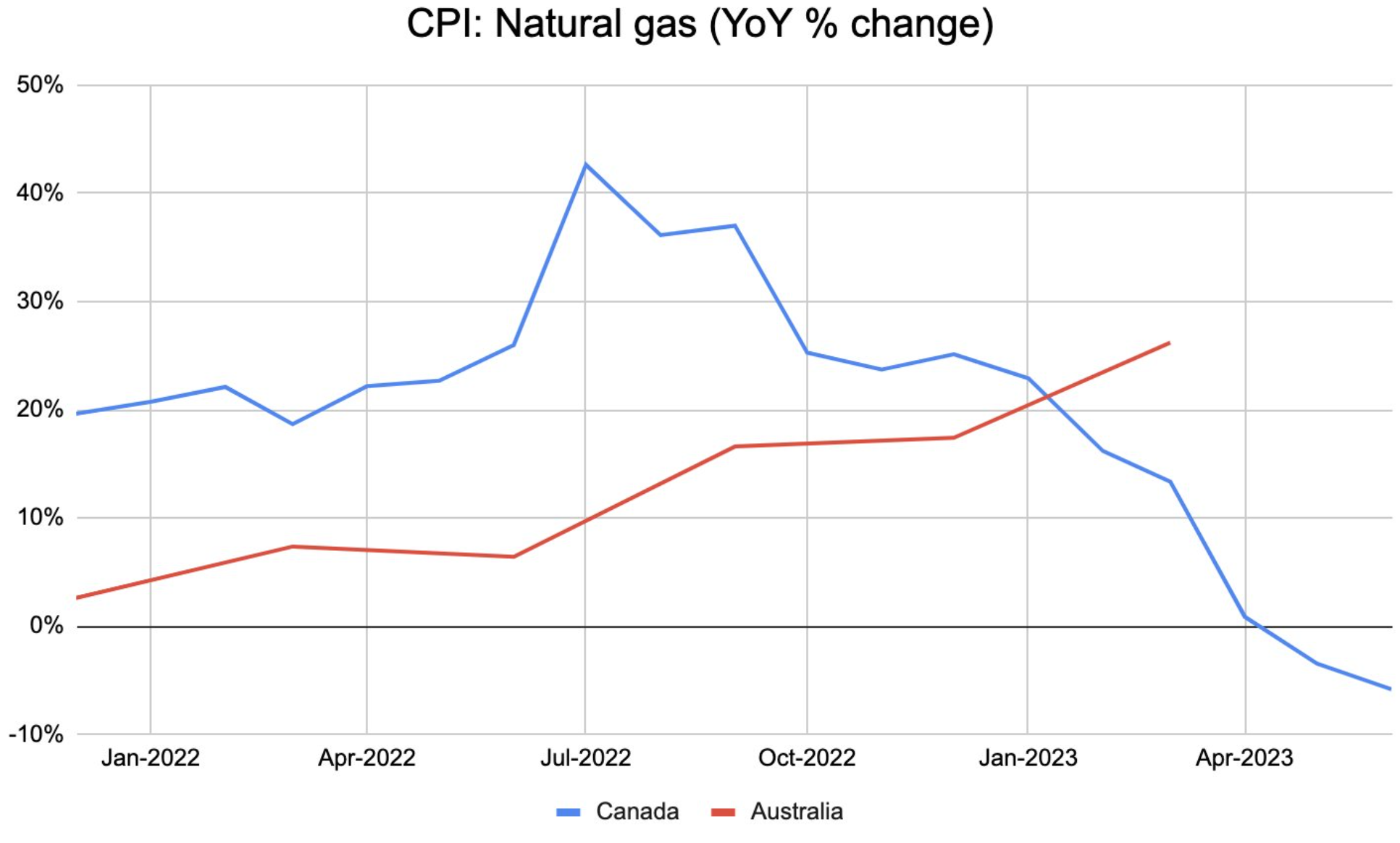

This has been driven by natural gas prices, which have soared in Australia but are now falling in Canada:

Basically, the Albanese Government’s maniac mass immigration policy is driving rental inflation higher, while its total failure to curtail energy cartels has delivered energy bill shock that will drive inflation higher across the economy, making inflation sticky.

The fact that Australia is the world’s biggest gas exporter but is paying some of the world’s highest gas and electricity prices is the hallmark of policy failure.

Global inflation is falling fast via deflating goods, while Australia’s inflation problem is homegrown by the inept Albanese Government.