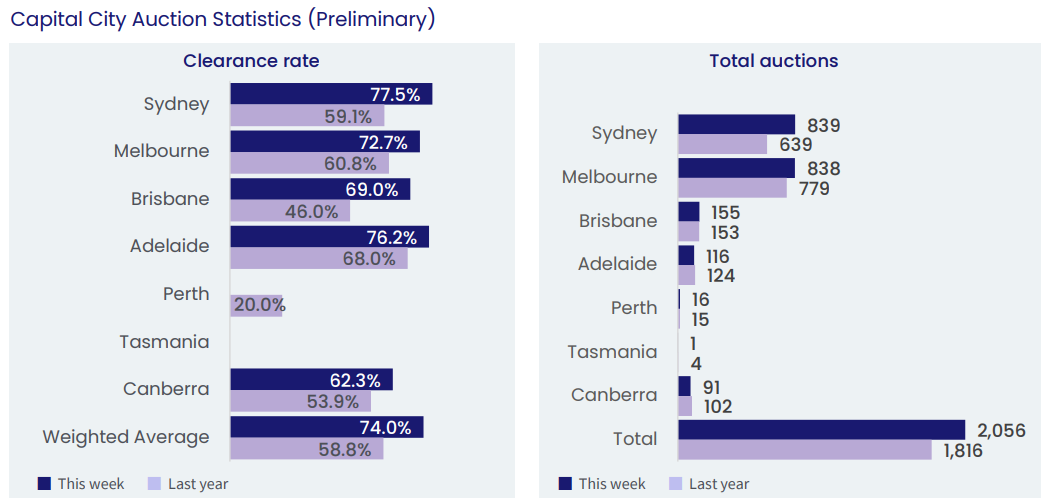

CoreLogic has released preliminary auction results for the weekend, with the combined capital cities recording their highest preliminary clearance rate (74.0%) in six weeks on the highest volume of auctions (2,056) since before Easter.

Sydney narrowly beat out Melbourne as the nation’s busiest auction market, with 839 auctions held this weekend.

It was Sydney’s busiest week since early April with the city recording its highest preliminary clearance rate since late June (78.7%), and 77.5% of auctions recording a positive result.

Melbourne was the nation’s only market to record a drop in week-on-week auction activity, with 838 homes going under the hammer, down from 877 the previous week.

Melbourne’s preliminary clearance rate improved 3.2 percentage points to 72.7% after falling below 70% the previous week (69.5%, corrected to 60.6% at final figures).

This week’s preliminary clearance rate was Melbourne’s highest in five weeks, with 699 results collected so far.

Source: CoreLogic

After only four of his eight auctioned homes sold on Saturday, leading Sydney agent and auctioneer, Tom Panos, warned that there has been a jump in recent buyers selling at a loss into the market, presumably in response to rolling off cheap fixed rate mortgages:

“I am doing two properties in Glendenning which I have just completed. I did two homes side by side”.

“Four out of eight that is a 50 clearance rate today and I have to say to you that the result I’m leaving from in Glendenning right now is a little bit disappointing”.

“It has sold for $1,175,000. This is number 65 Samantha Crescent Glendenning. But this property was sold a year ago and it sold for $1.2 million. So, yet again another pair that shows that resales that happen in certain parts of Australia that are done within a 12-month or two year period are selling for lower”.

“Not only that he paid $1.2 million, this family did spend money renovating this property. But they have to sell it now and they sold it for $1,175,000. So that’s $25,000 less than they purchased it last year and in addition to that, it doesn’t take into account stamp duty, legal fees, agents costs, marketing, you name it”.

“So quite possibly, we’re tearing up over a hundred thousand dollars. But that’s life in real estate when you’re selling within a short period of the purchase time”.

“I’m letting you know that I think that there’s a feeling there that people think ‘hey you know what, that’s the end of the rate rises’ and that gives people confidence on the one hand. But on the other hand, people are also aware that people still have money”.

“And the reason why is it’s only been really a few months that most people are actually paying a higher loan repayment. And they’ve got money that they can draw upon. They’ve got stuff in their line of credit. You know their redraw, their offset account in their savings account”.

“But what’s going to be interesting is what will it be like in six months time when there are more and more people that are going to be finding that the loan repayments are challenging” What will happen then?

“But the great news is that if you’re a buyer right now, you’ve got more choices for real estate now than you’ve had for a very long time. It’s like the lollipop shop has opened up and there’s plenty to pick from”.

“I’ve been saying it for a long time: sell before the listings come in. Well guess what? We’re not even in Spring and there is a listings assault going on and it’s just beginning”.

“We’re going to have even more listings in September and then more listings in October because people have been holding off”.

“Many people sell during the Spring period. But there’s many people now. It’s not even to do with the seasons. It’s got to do with economic conditions”.

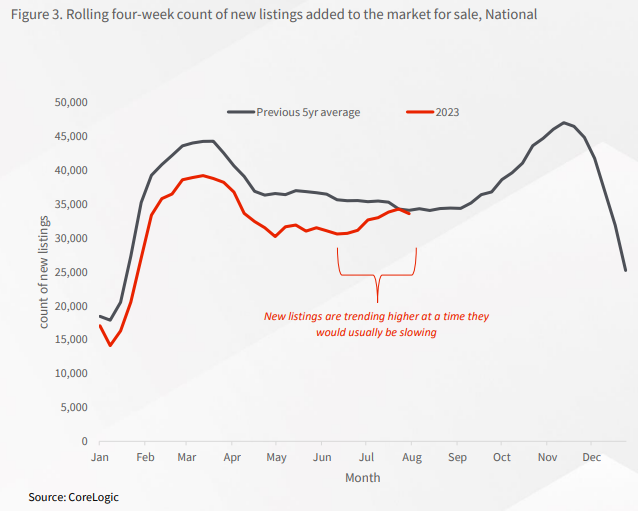

Interestingly, CoreLogic has reported an unseasonal lift in new property listings:

This trend has been especially notable in Sydney where new listings moved 7.6% higher through July, and in Melbourne where new listings moved 8.6% higher.

Thus, it does appear that the delayed impact of the RBA’s 4.0% of rate hikes is beginning to push more homes onto the market.

Households resetting from ultra cheap pandemic fixed rate mortgages of 2% to variable rates above 6% are the most at risk of forced selling.

The ‘good’ news is that demand remains robust. Hence the rise in auction clearance rates alongside the surge in volumes.