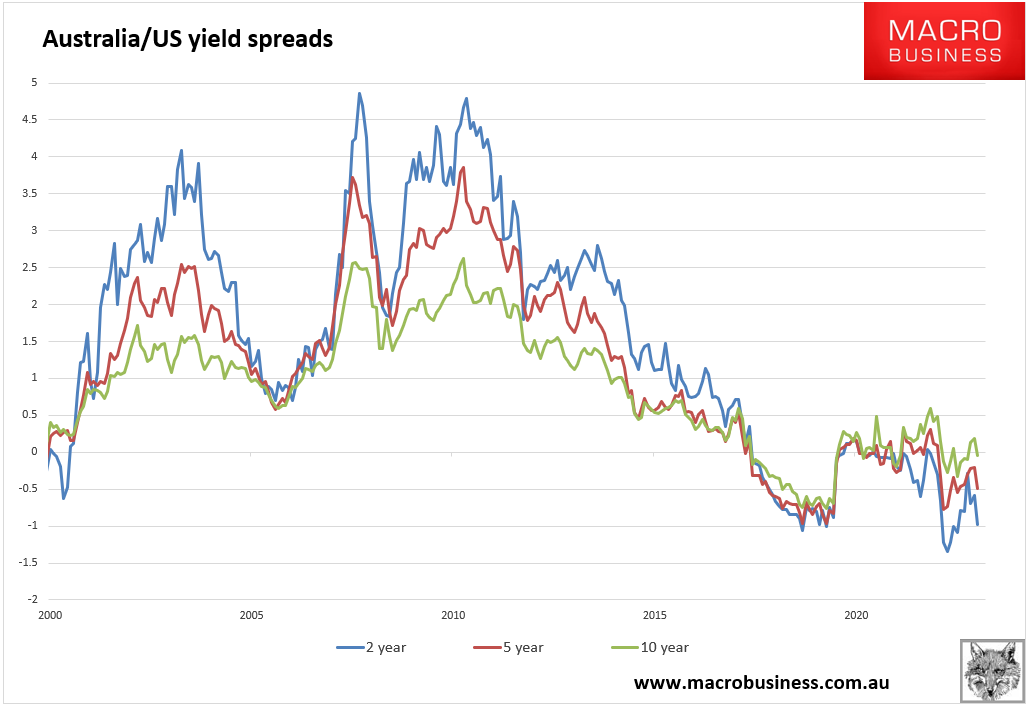

Big moves are underway in bond markets. For the last year, Aussie yields have been treading on Australia’s lagged inflation cycle as the US deflated, which led to a yield uplift for Australia.

This was always delusional, given Australia’s much greater sensitivity to floating rate mortgages, and now yields have inverted negative. Needless to say, this is not helping the AUD:

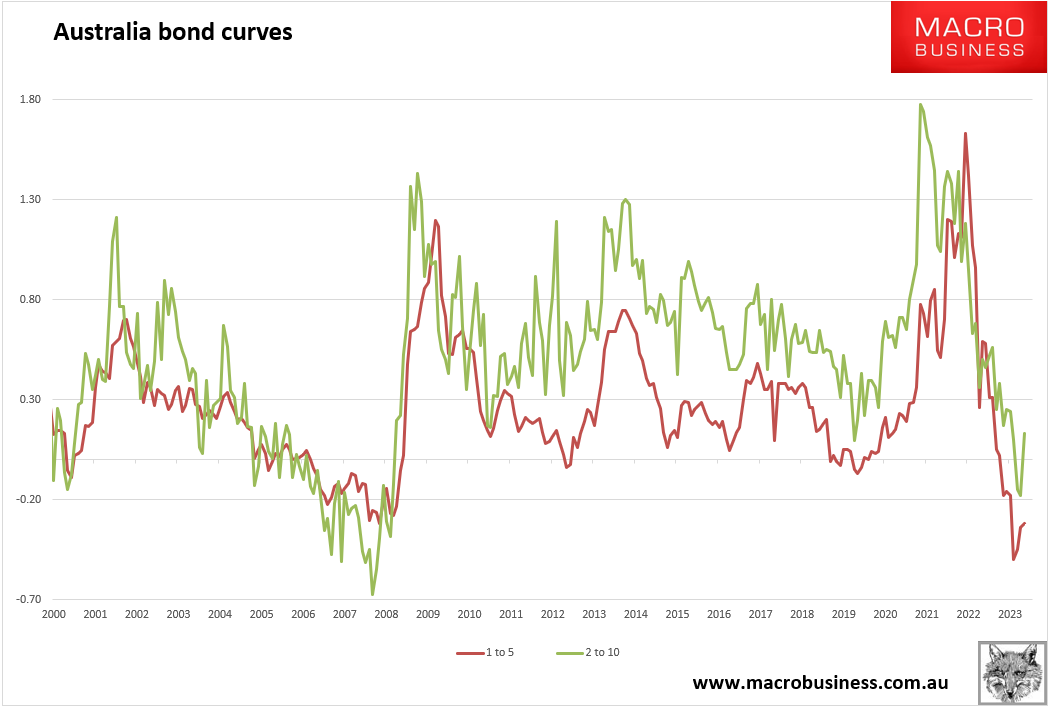

The Aussie curves have steepened somewhat, but that’s not comforting. This always happens at the threshold of recession:

Advertisement