It appears the RBA’s 4.0% of interest rate hikes are finally catching up with Australian households.

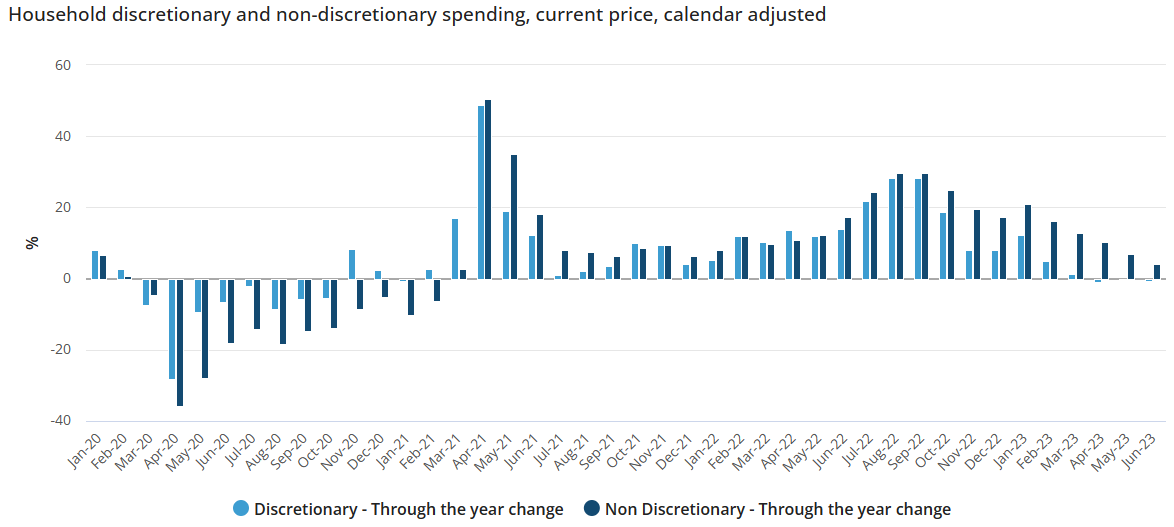

Earlier this week, the ABS released its household spending indicator, which showed that household spending was only 1.8% higher compared to June last year:

With Australia’s CPI inflation running at 6.0% in the year to June, and population growth of around 2.0%, this suggests that real per capita household spending fell heavily.

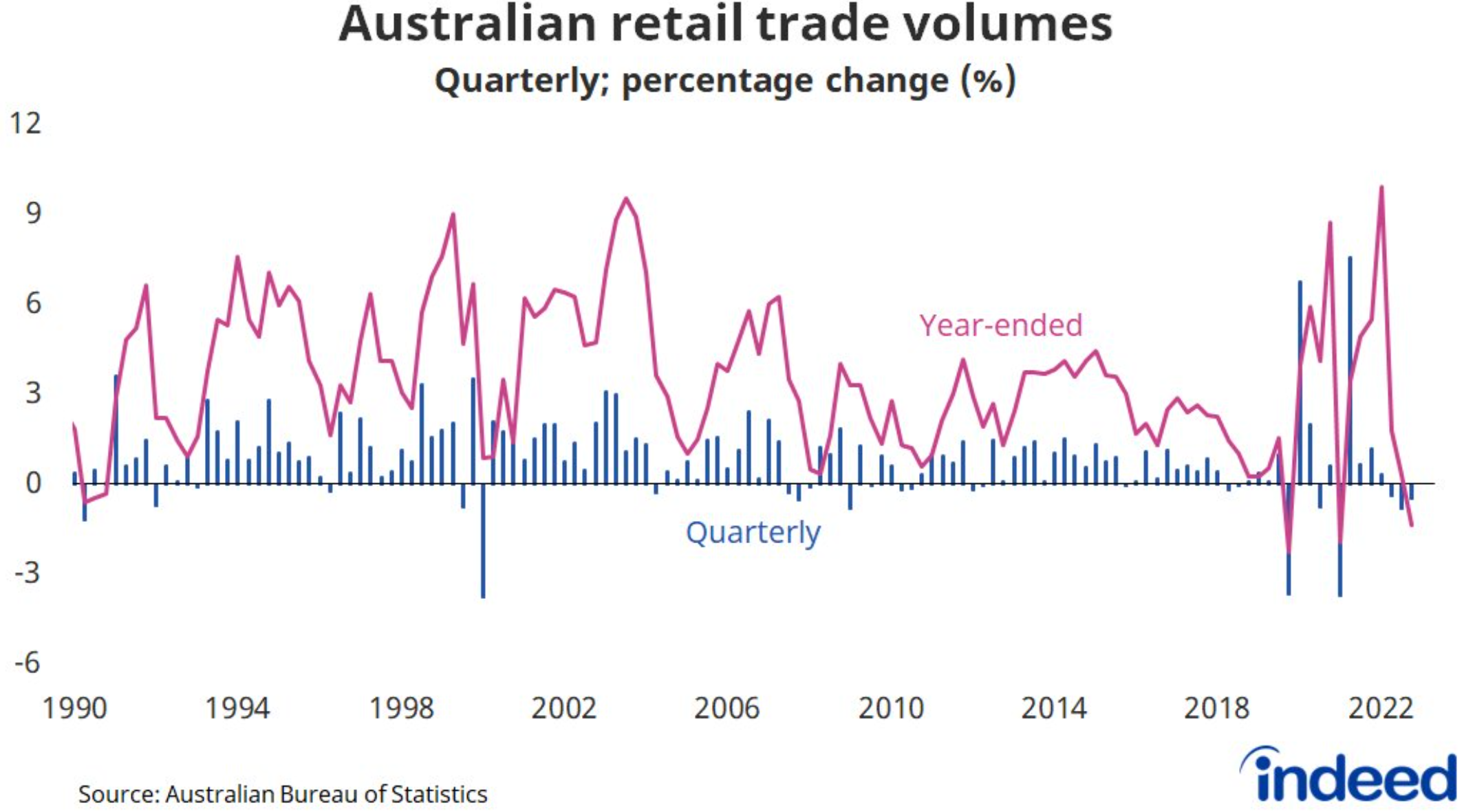

Indeed senior economist Callam Pickering noted on Twitter that “retail volumes fell for the third consecutive quarter – the first time that’s happened since 2008”.

“Retail volumes are down 1.4% over the past year – the first time annual retail volumes have declined since 1990 (ex. pandemic)”:

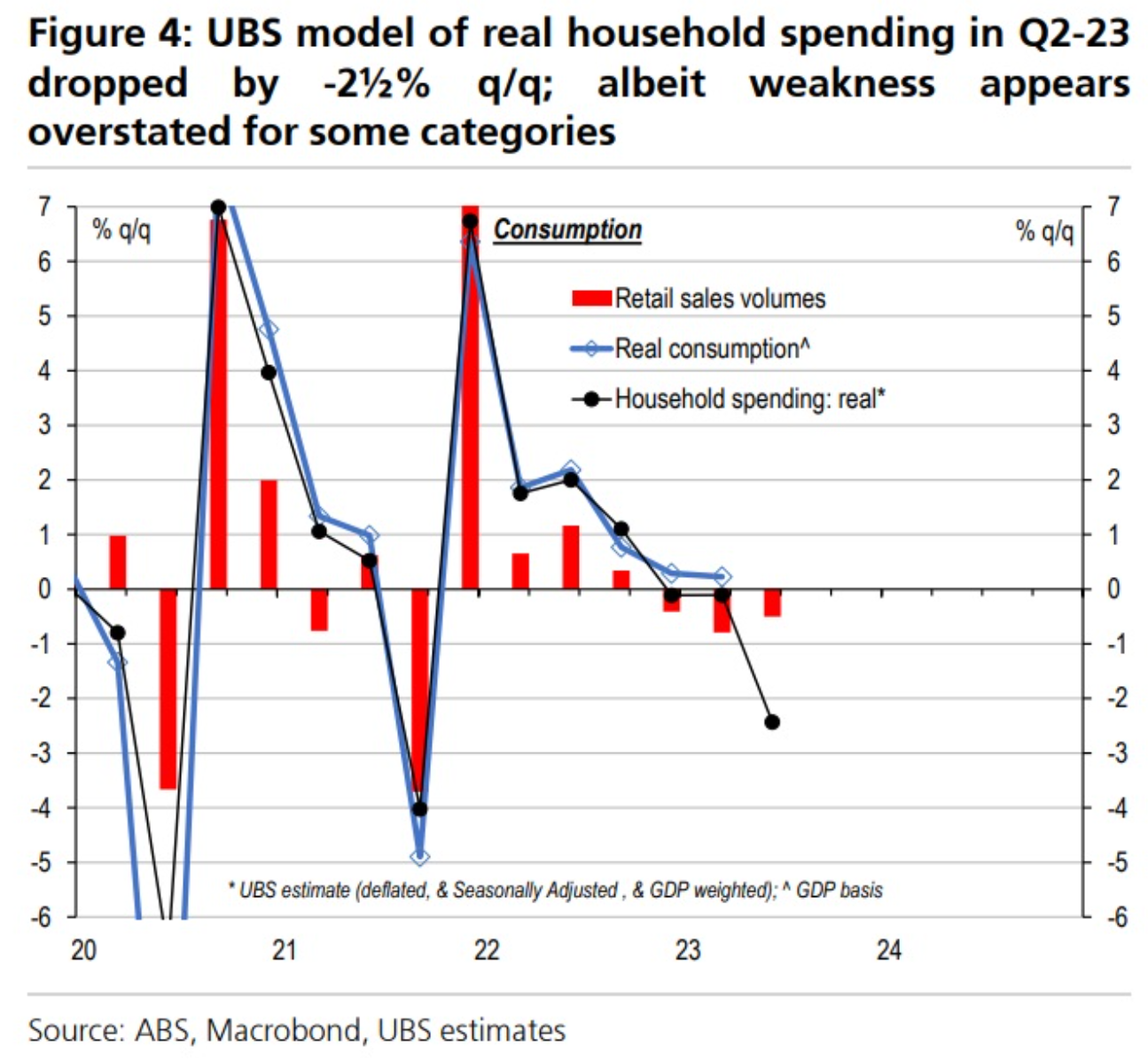

UBS also released its model of real household spending, which shows that real spending swan dived in the June quarter, plunging by 2.5%:

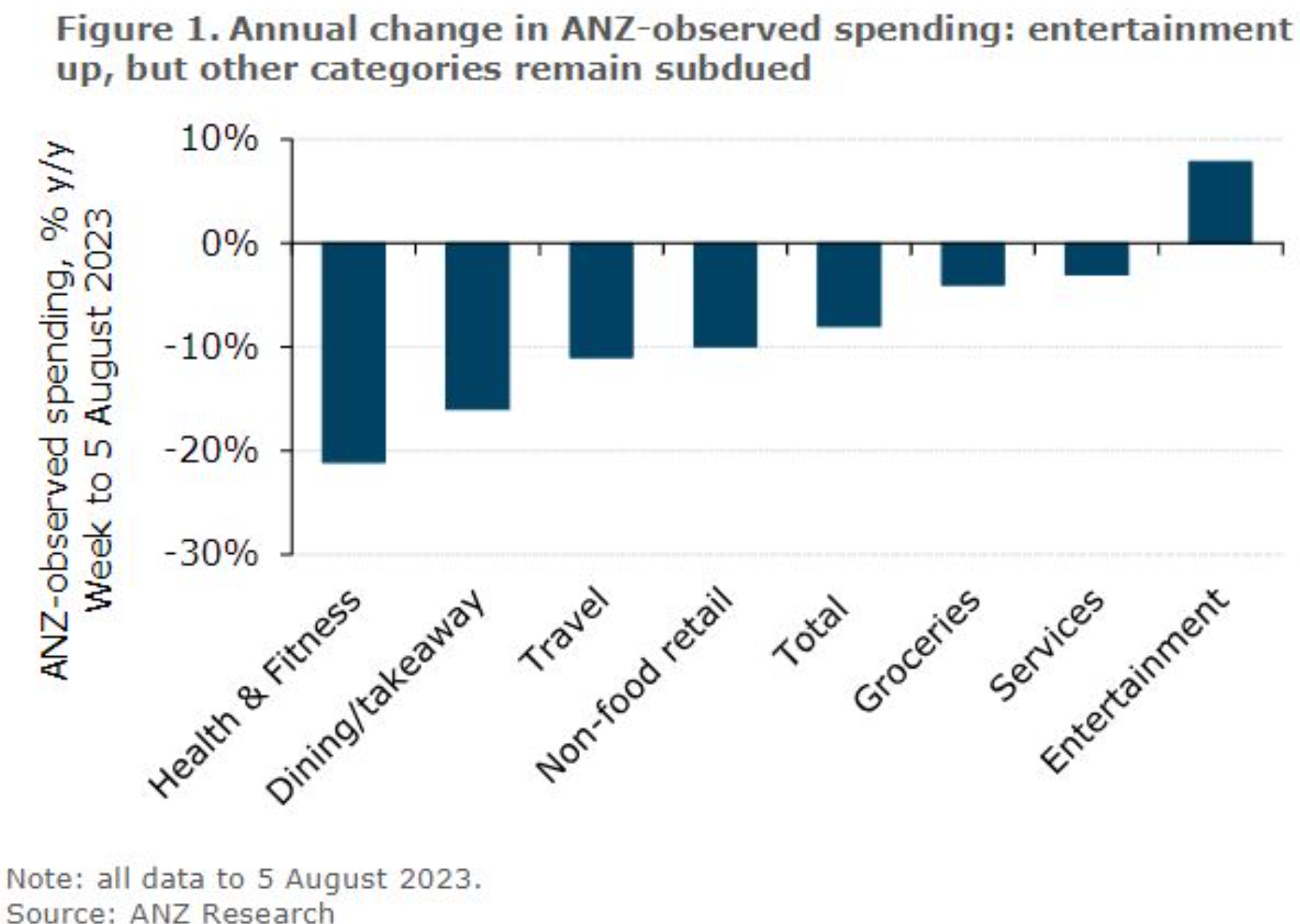

Meanwhile, ANZ’s observed spending survey fell by 8.0% over the year to 5 August 2023, with entertainment spending the only segment to rise (presumably driven by the Barbie movie):

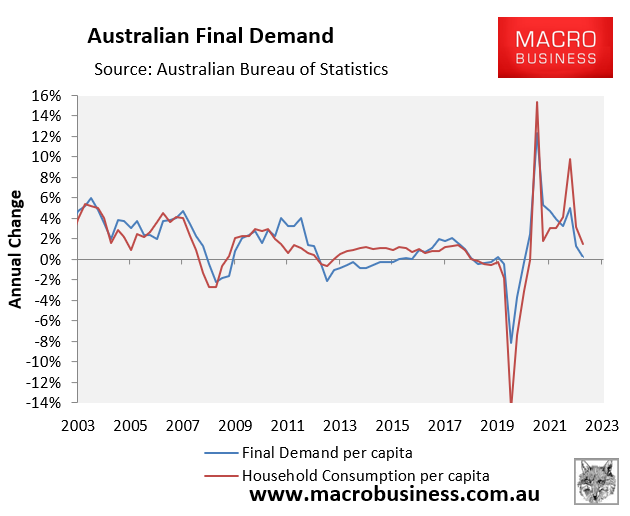

Household consumption is the key driver of the Australian economy, comprising around 55% of final demand on average.

Therefore, where household consumption goes, the economy usually follows.

This relationship between real household consumption and final demand is illustrated in the next chart from the March quarter national accounts (the June quarter national accounts will be released early next month):

Based on the above, it is easy to see why the Australian economy is expecting a severe per capita recession, with a “technical recession” of two consecutive quarters of negative aggregate GDP growth also a real possibility.

The only thing that will prevent Australia from experiencing a “technical recession” is the Albanese Government’s extreme immigration policy, which is forecast to grow Australia’s population by around 2% this year.

Even if a “technical recession” can be narrowly avoided, and Australia’s economy grows slightly, everybody’s slice of the economic pie will shrink.

So too will their broader living standards as extreme levels of immigration crush-load everything in sight, most notably Australia’s rental market.