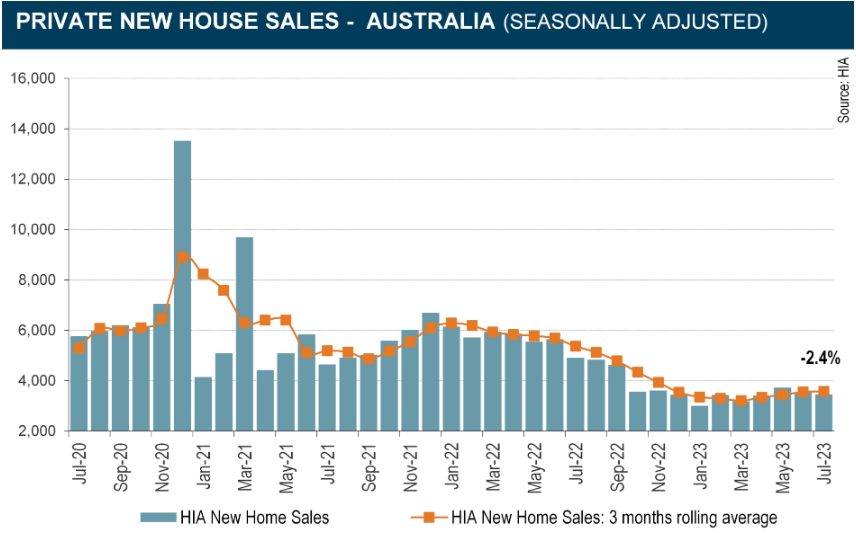

The Albanese Government’s supply-side housing reforms got another dose of reality yesterday when the Housing Industry Association (HIA) reported that new home sales had declined by 2.4% in July, with the HIA also forecasting a weak 2024:

“This month’s decline leaves sales in the three months to July 2023 down by 33.4% compared to the same period in 2022”, noted HIA Senior Economist Tom Devitt.

“Weak new home sales, together with an elevated number of previous sales being cancelled, reinforce the expectation that Australia will see a decade-low level of home building next year”.

“Even a cut to the cash rate now would not produce a recovery in new house commencements until the second half of 2024”.

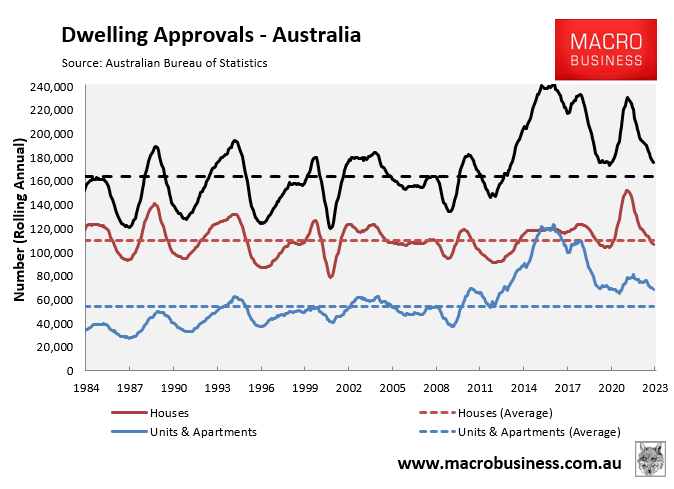

The collapse in new home sales follows a similar sharp decline in dwelling approvals:

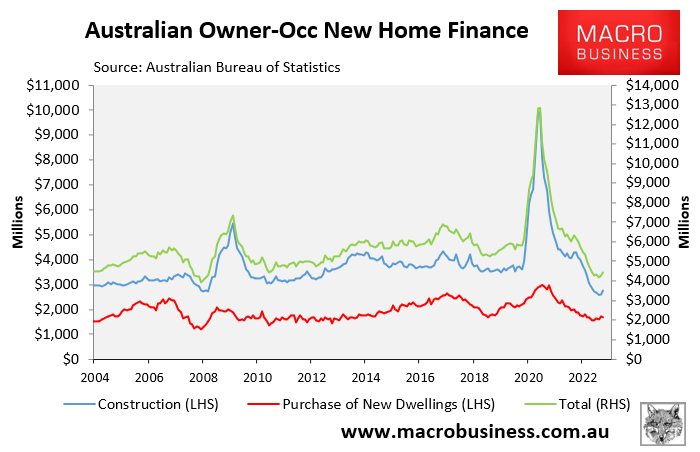

The value of owner-occupier finance commitments to build or buy a new home have also collapsed:

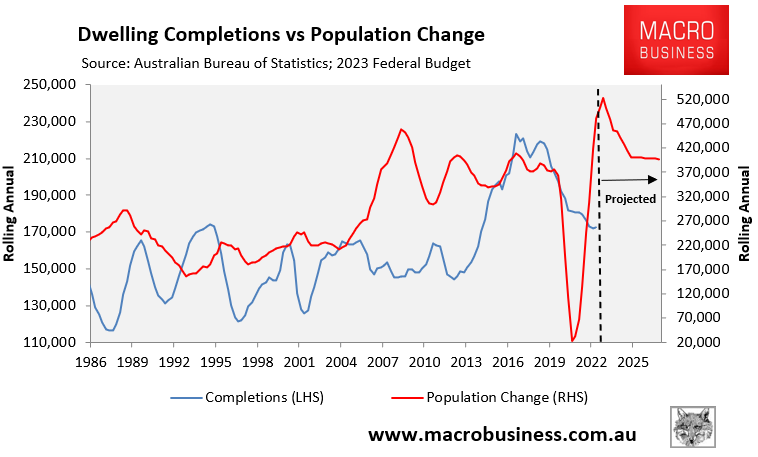

Therefore, all the major leading indicators are pointing to lower levels of housing construction over the next few years.

Indeed, Treasury Secretary Steven Kennedy recently told a Senate Estimates Economics Committee that investment in new homes is forecast to decline by 2.5% in 2022-23, 3.5% in 2023-24, and then by 1.5% in 2024-25.

Oxford Economics Australia also forecast that overall dwelling construction activity would shrink by 21% over the three years to 2024-25.

Rob Nicholls, a University of New South Wales construction industry regulation researcher, also warned that insolvency risk will weigh on new home construction going forward:

“In an environment where we need a million new homes in the next five years and we need several hundred thousand of them right now to address our increasing population, the fact that there is an insolvency risk deters people from building homes and that is problematic at a national level.”

Let’s get real: the Albanese Government’s promise to build 1.2 million homes over five years is built on quicksand.

Australia has only ever built more than 220,000 homes in a year once (i.e. 223,000 in 2017). So the notion of building 240,000 for five years straight with high materials and financing costs and labour shortages is delusional.

The solution to Australia’s housing shortage is obvious: reduce net overseas migration to a level commensurate with the nation’s ability to supply new housing and infrastructure, and in accordance with environmental carrying capacity.

It’s the demand-side, stupid!