DXY is taking a breather:

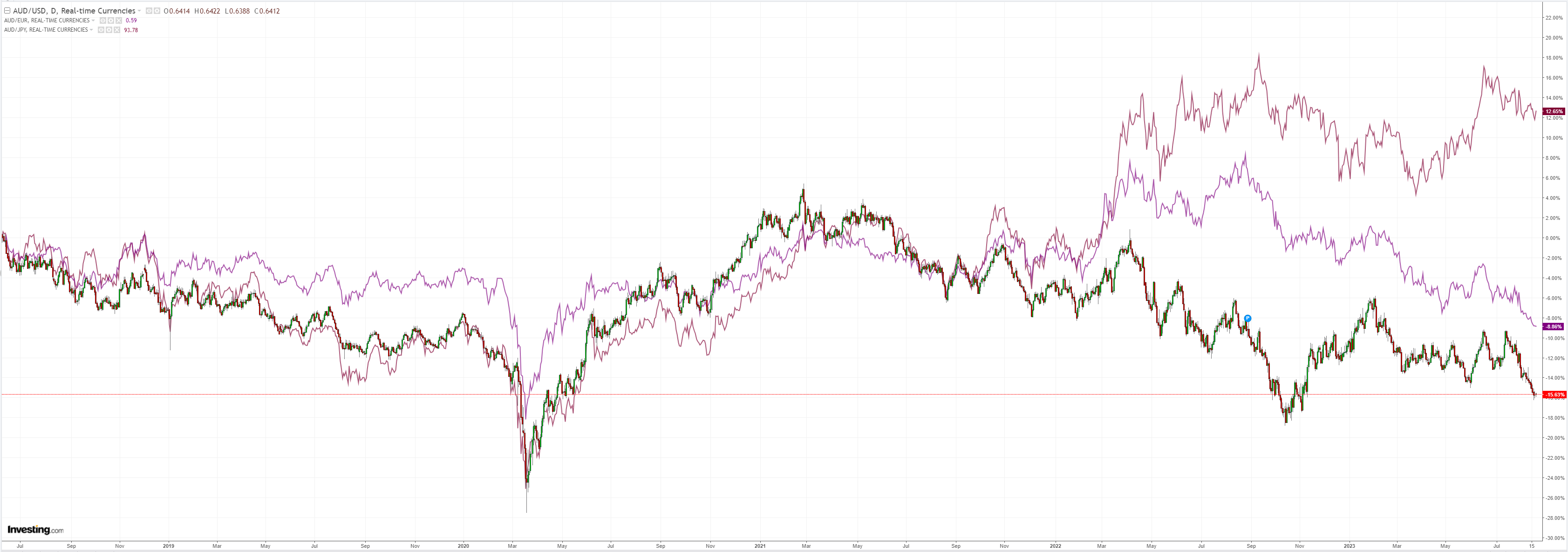

AUD went nowhere:

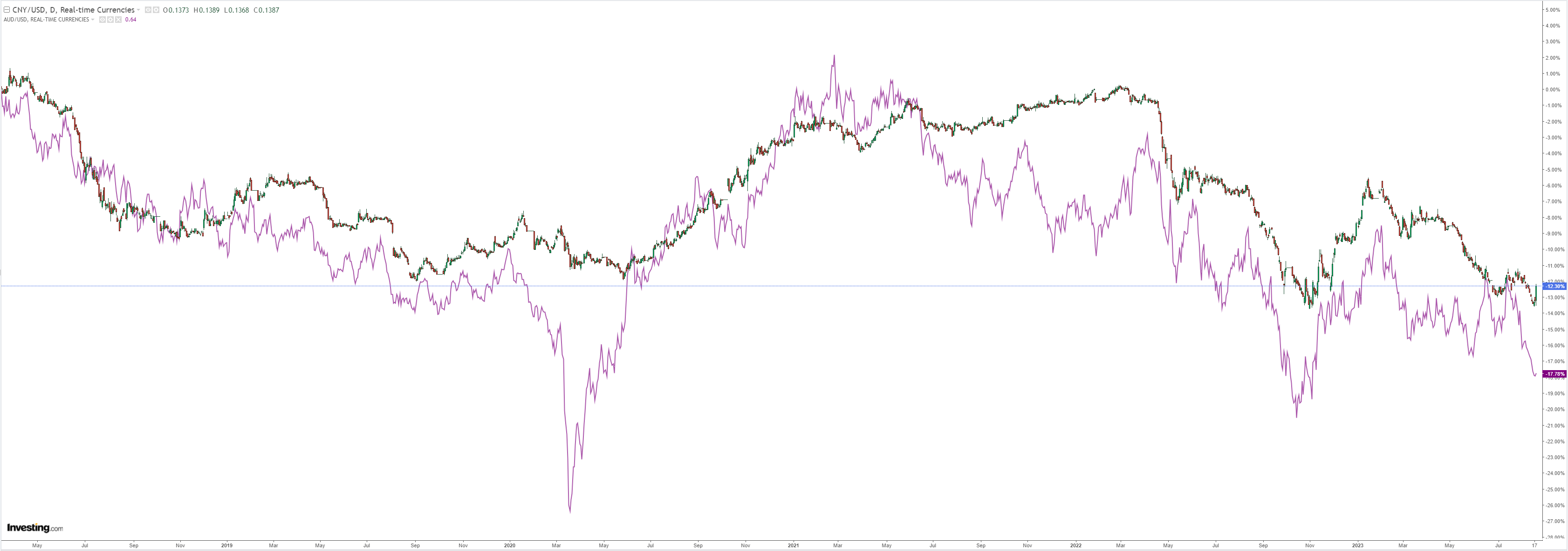

Even though CNY took off:

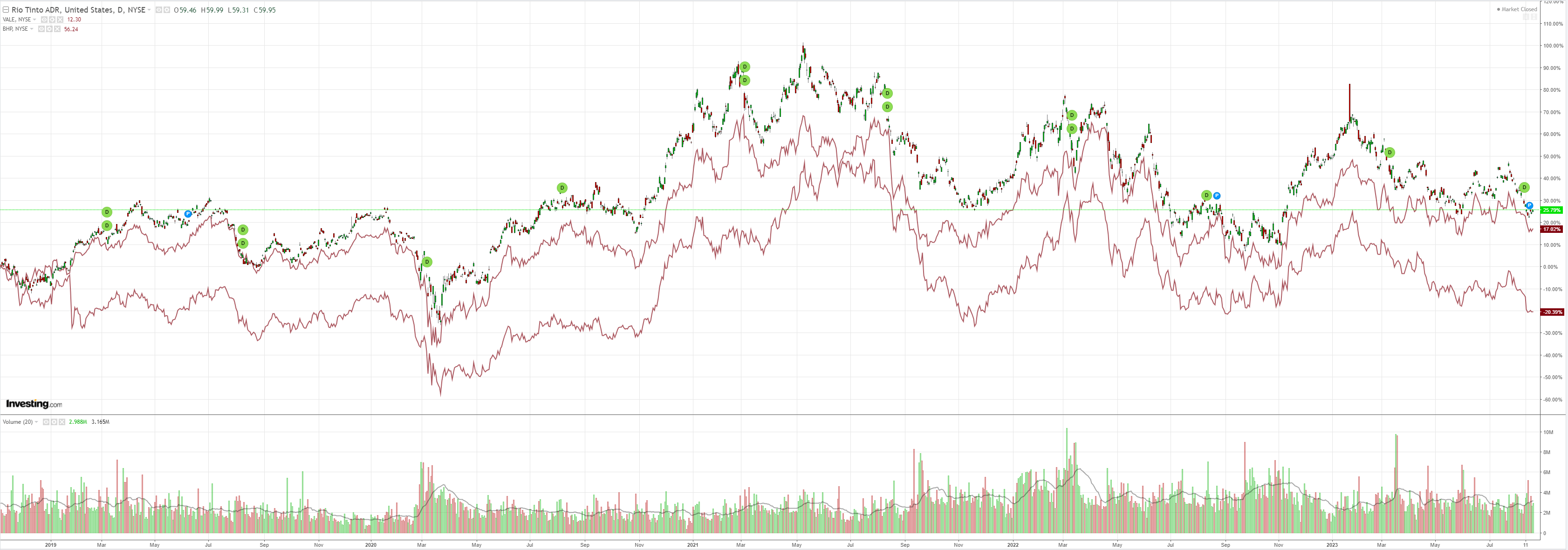

Commods relief rallied:

Miners not much:

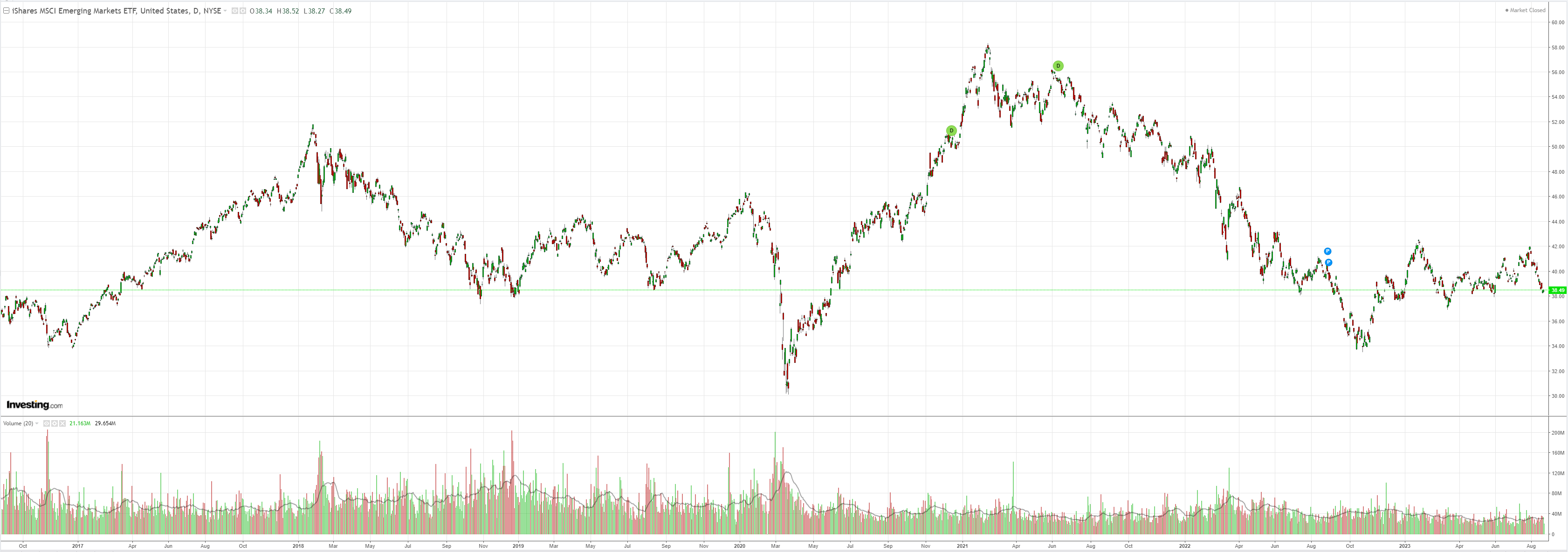

EM stocks not at all:

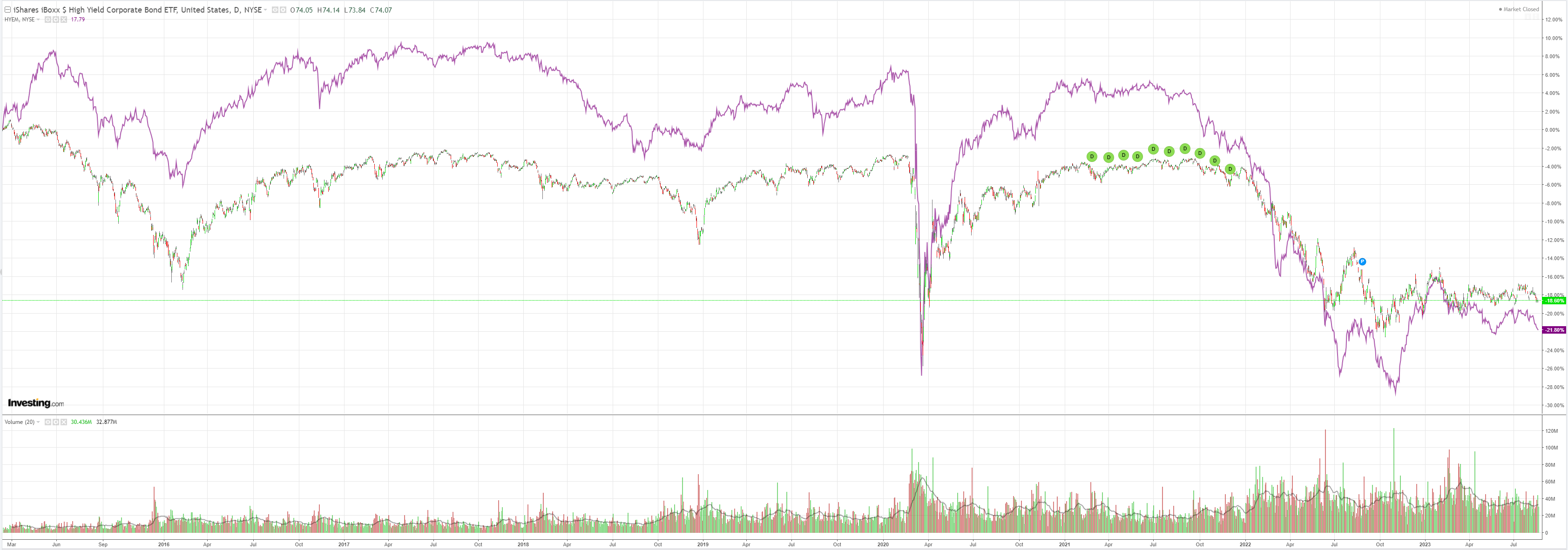

The junk screetch is building:

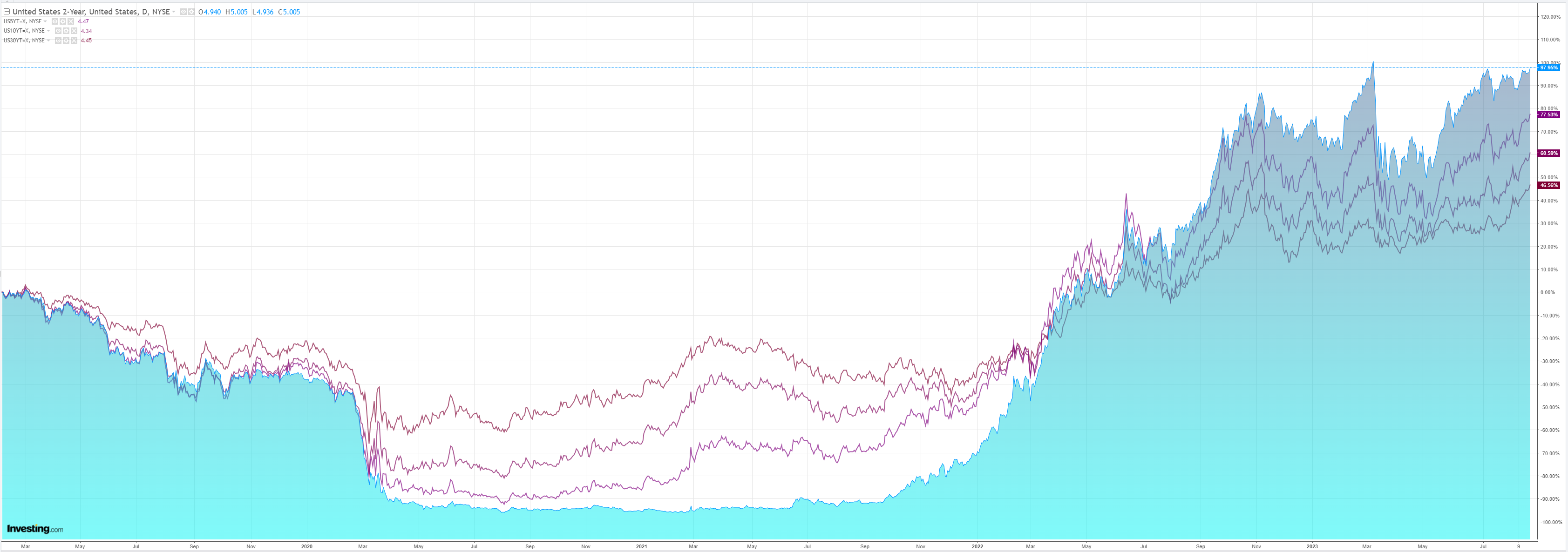

As yields pile higher:

Stocks found buyers:

China cut the five-year prime rate that prices mortgages by only 10bps, less than expected. This put a rocket under CNY and gave everything relief. It will take about five minutes before markets realise that this will make it worse as the Chinese property bust and the debt deflation are further entrenched.

Remember, the inverted GFC will probably play out more as a global growth shock than a global credit event. Refusing to aid the deleveraging swiftly enough, to protect CNY, is precisely the problem.

Credit Agricole has more on some of the unwind associated with this.

USD: a structural shift

Market focus this week will be on the central bank symposium in Jackson Hole as well as the US (and the European) PMIs for the month of August. This year’s Economic Policy Symposium hosted by the Kansas City Fed will take place between 24 and 26 August and will focus on the topic “Structural shifts in the global economy”. Ahead of the summit, we therefore expect the speeches to focus on: (1) the recent shift of global demand from goods to services that could continue to fuel services inflation but that could have ambiguous impact on growth depending on the structure of the economy; (2) the impact of developed countries’ aging populations on their labour supply, wage growth and inflation as well as growth outlook; and (3) the lingering geopolitical tensions that could encourage friend- and re-shoring in a boost to factor prices and inflation but maybe less so economic growth in developed economies. In short, we believe that the conclusion from the symposium could be that the Fed as well as other major central banks will have to remain hawkish for an extended period of time as they deal with the consequences of the structural shifts in the global economy. Coupled with more positive surprises out of the US this week, a potential hawkish surprise from the Jackson Hole symposium could push UST yields higher still and give the high-yielding, safe haven USD a boost.

USD: FX reserves and reservations

The USD rally took a breather in the latter half of last week in part because of Chinese officials’ latest efforts to stabilise the CNH. In addition, the latest TIC data releases yesterday suggested that the UST holdings of some of the biggest foreign investors declined to multi-year lows in June. This may have put the latest UST yield rally in a somewhat different light for FX investors and they may start to see the elevated yields as an indication that investors are starting to flee the USD rather than as a sign of its huge rate appeal. We believe, however, that there are other reasons for the drop in UST holdings than the worries about the quality of USD denominated assets. In particular, data from 91 central banks suggests that their FX reserves fell to USD10.2trn in June, down from USD10.4trn in March and USD10.6trn in January because of the recent weakness of global trade and the central banks’ efforts to stabilise their currencies vs the resurgent USD. If sustained, the downtrend could mean that the central banks may no longer be able to hold on to their USTs and other liquid foreign assets. Some clients are already speculating that sales by central banks may be behind the recent price action in developed economies’ bond markets and therefore the tightening of global financial conditions. They see that as the beginning of a vicious cycle where central banks’ efforts to stabilise their currencies through FX sales could add to the upside pressure on UST yields in a boost to the high-yielding, safe-haven USD. If this is the correct view, then the USD could remain supported, especially if higher yields lead to tighter financial conditions and thus to risk aversion in the coming days.

That is a recipe for a structurally lower Australian dollar.