DXY came off last night:

AUD firmed:

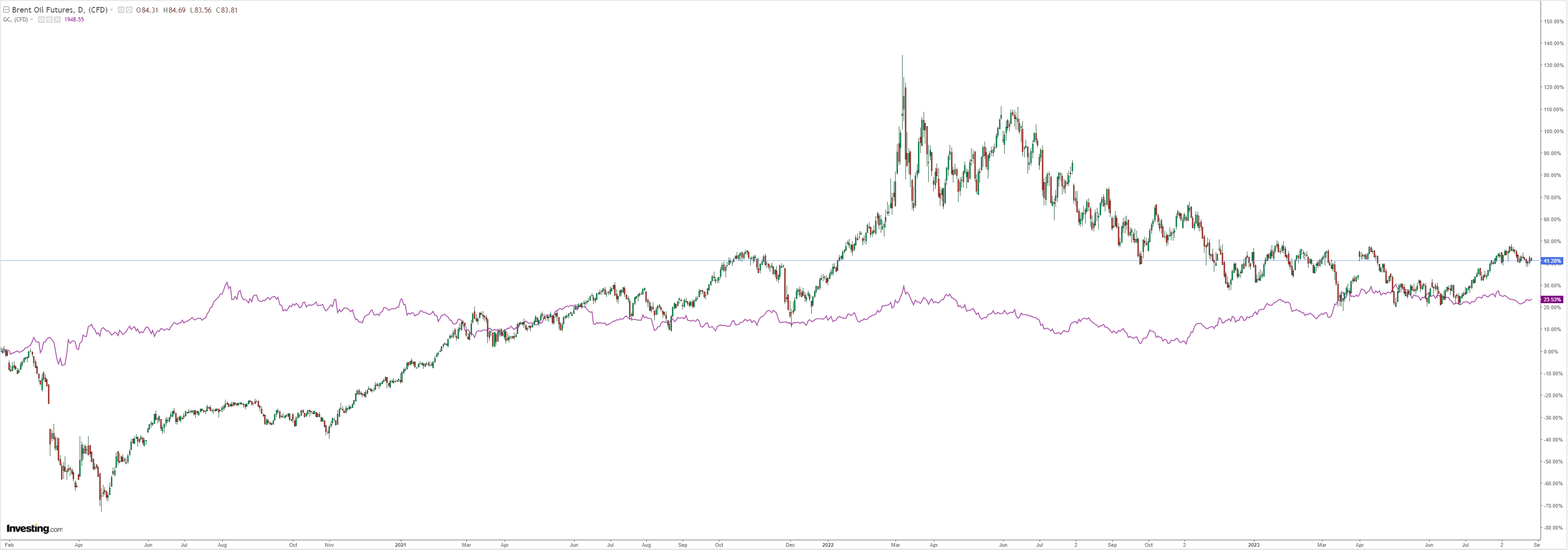

Commodities bounced:

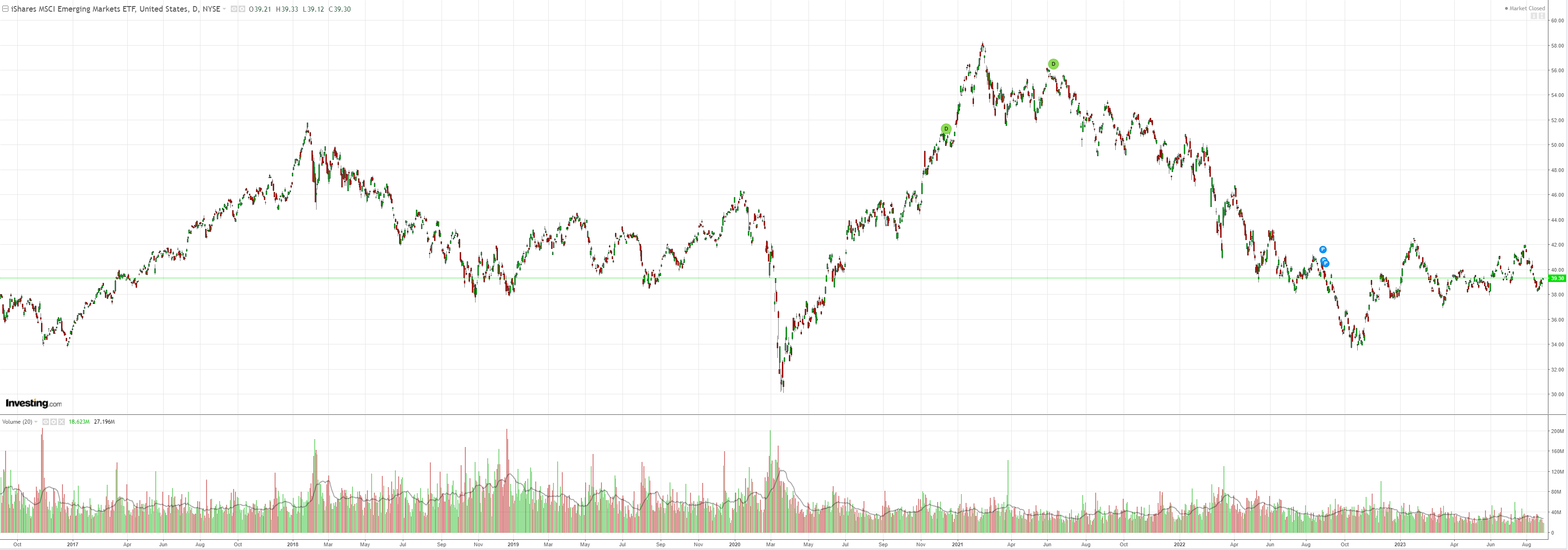

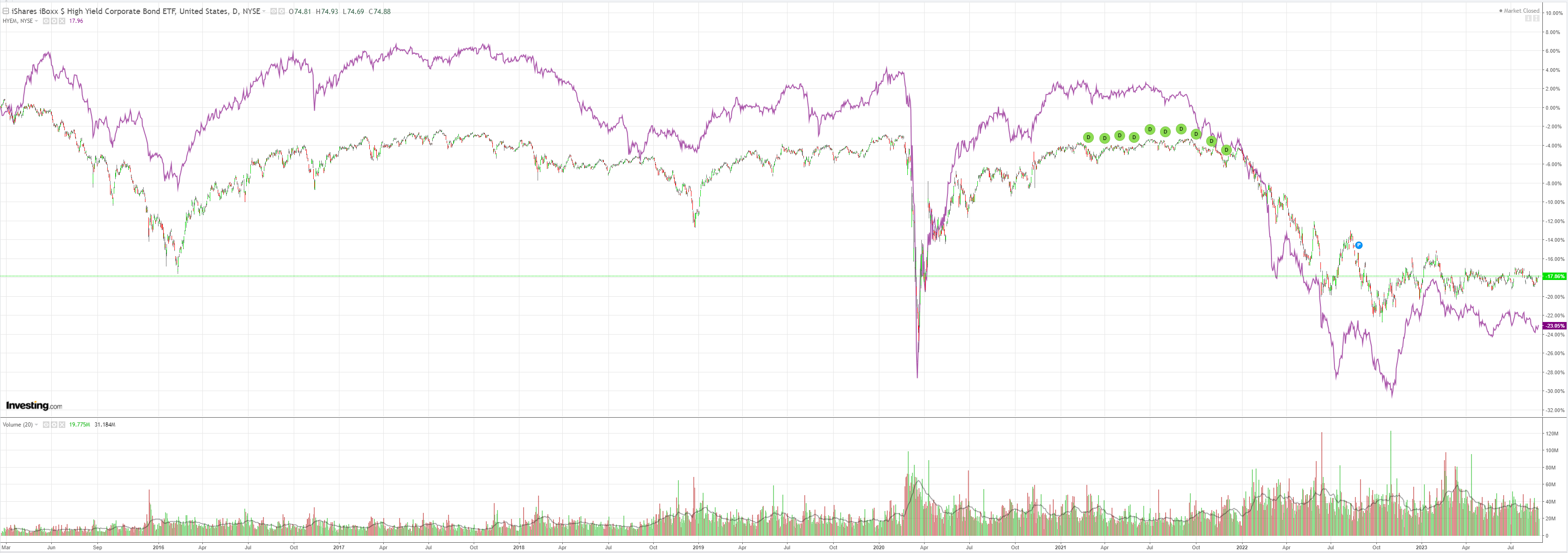

Trash too:

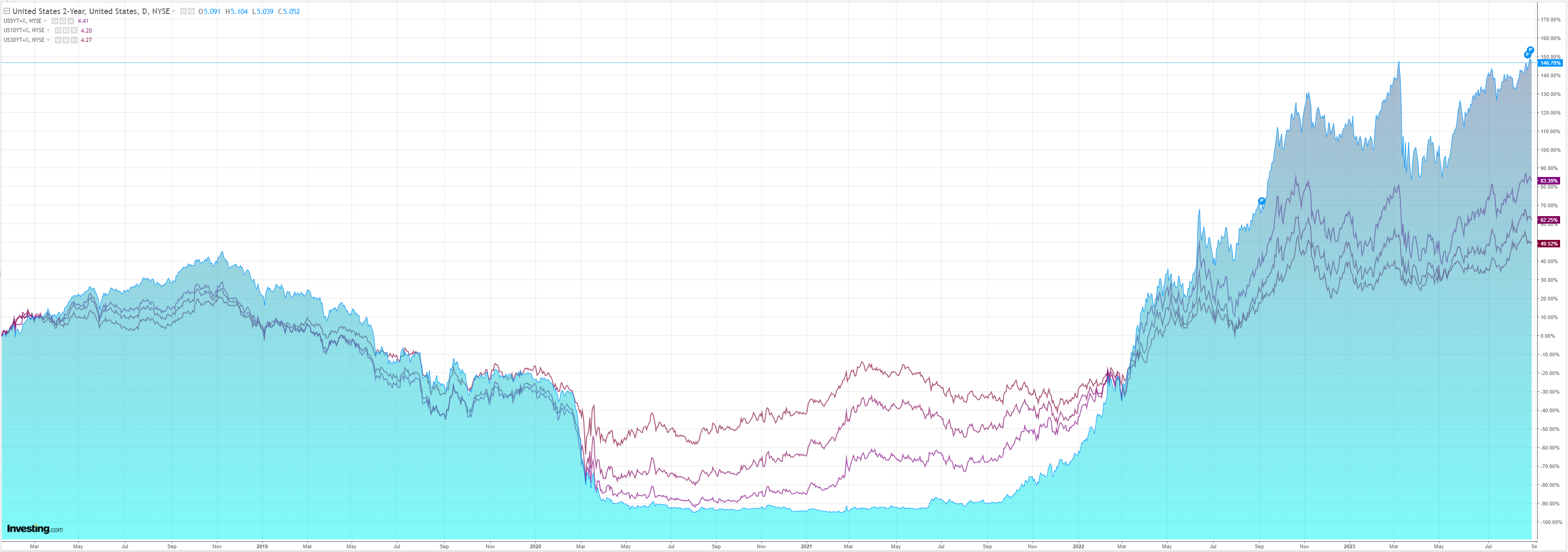

The curve is flattening again:

And the robots are buying stocks again:

BofA sees a brief pause only for DXY.

Markets move towards our forecast

We remain comfortable with our call for one more 25bp hike in November and 75bp of cuts next year, starting in June and proceeding at a quarterly cadence. Markets moved toward our forecast after Powell’s speech. At the time of this writing, they are pricing about a 70% chance of a hike by November, compared to 60% before his remarks. Pricing of cuts in 2024 has decreased by 5bp to around 110bp.

Rates: balance of risks = higher for longer

Powell was not definitive on whether or when the Fed will hike rates again, sending a less hawkish signal than we anticipated. FOMC overnight indexed swap (OIS) in mid-2024 has been most volatile, consistent with a higher for longer message. Powell was focused on the risks around the inflation outlook, leading the market to contemplate timing of cuts in 2024. Rather than just the inflation data near term, the broader suite of data will need to indicate more balanced risks around the inflation outlook. We continue to think that fading cuts in 2024 is the best way to trade frontend. Cuts by mid-2024 have been priced out by around 6bps. The market has also shifted the peak in policy rate from November to December, opening door for adjustments at a later meeting.

FX–initial USD weakness but quick reversal

Into the Jackson Hole event, the month-to-date USD rally had been quite persistent. Relative to the market’s expectation of a hawkish tone, Chair Powell’s speech turned out to be more balanced, causing an initial knee-jerk move lower for the USD. However, the USD weakness quickly reversed by end of the speech. As we discussed in the report,FX implications of a Fed September hold and November hike last week, market expectation converging to a near-term Fed rate hold decision for September would likely alleviate some pressure for the market. As a result, the USD could see some short-term pullback towards the 200-day simple moving average (SMA) after having had a good run in August. For rest of the year, we maintain a cautious view on FX and continue to see EURUSD at 1.05 as the year-end forecast.

That sounds about right, though I think the timing is more at risk from China than the Fed. If it blows up, then so will DXY. There was nothing new yesterday to change the downwards direction of the Chinese economy.

The Pacfiic peso is back.