CoreLogic’s daily dwelling values index, which tracks value changes across the five major capital city markets, rose 1.0% in August on a 5-city aggregate basis.

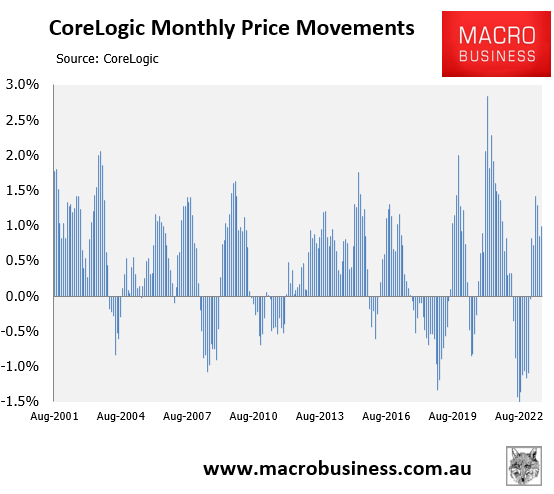

This was the sixth straight monthly increase in property prices, with values also accelerating from the 0.9% increase recorded in June:

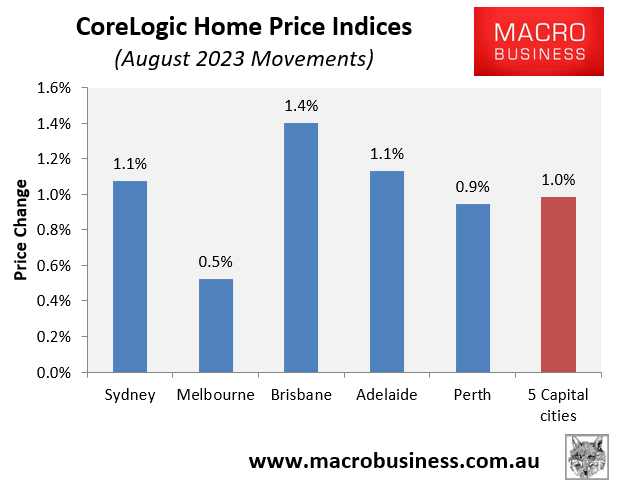

The next chart plots the monthly value changes across the five main capital city markets, with all positing growth:

Brisbane (+1.4%), Adelaide (+1.1%) and Sydney (1.1%) led price growth in August, whereas Melbourne (+0.5%) and Perth (+0.9%) recorded smaller increases.

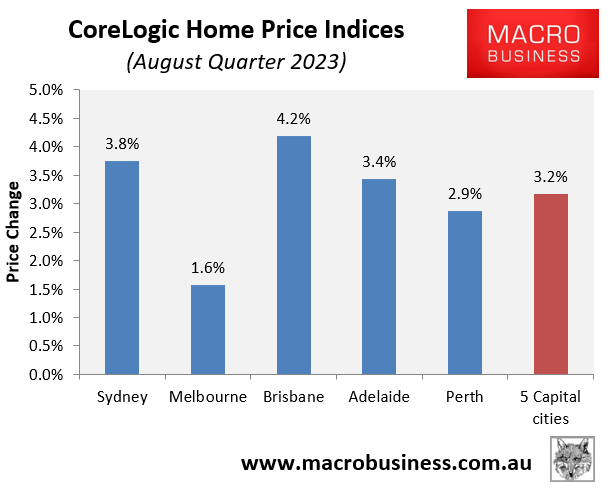

Over the August quarter, values rose by 3.2% at the 5-city aggregate level, with Brisbane (4.2%) becoming the price leader:

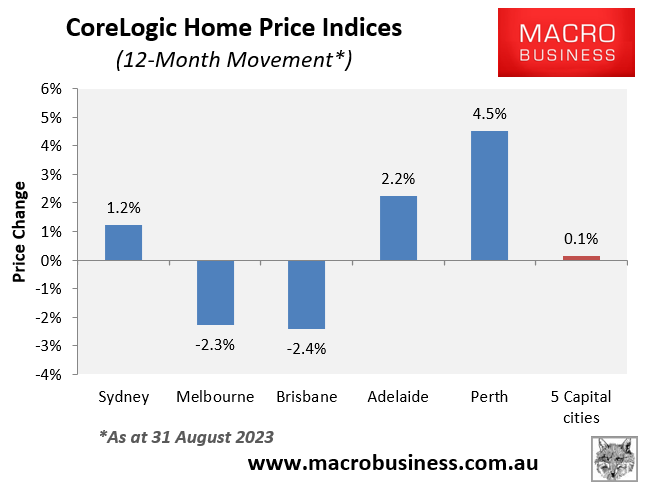

Home values have now risen by 0.1% at the 5-city aggregate level over the past year, led by Sydney (+1.2%), Adelaide (+2.2%) and Perth (+4.5%).

By contrast Melbourne (-2.3%) and Brisbane (-2.4%) recorded value declines over the year:

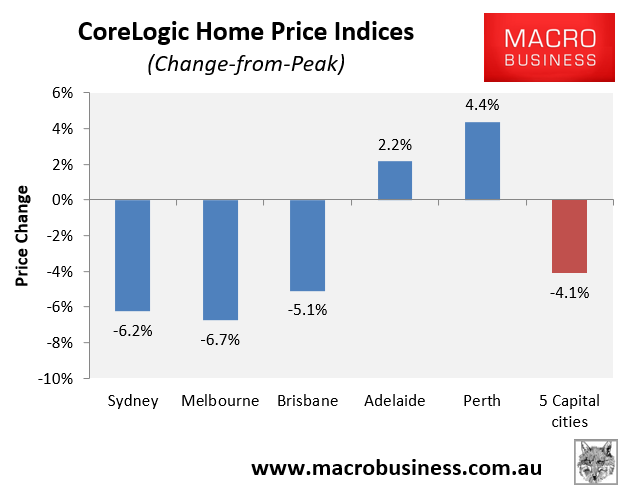

Finally, dwelling values are now 4.1% below their April 2022 peak at the 5-city aggregate level:

The three major east coast cities have all declined in value, whilst Adelaide and Perth have increased in value since the Reserve Bank of Australia (RBA) began raising interest rates in May last year.

This house price recovery has been particularly unusual because it has occurred in the face of continued RBA monetary tightening, reduced borrowing capacity, and low sales volumes.

The positive effects of the Albanese government’s record net overseas migration, skyrocketing rents, and a scarcity of available stock continues to offset the RBA’s historic monetary tightening and the one-third reduction in borrowing capacity.

As the RBA begins to lower interest rates next year, house price momentum should accelerate.