Westpac’s latest Housing Pulse shows that Australians have become increasingly bullish on house prices even though they believe it is a bad time to buy a house (due to affordability concerns).

Westpac has also upgraded its Australian house price forecasts for 2023 and 2024.

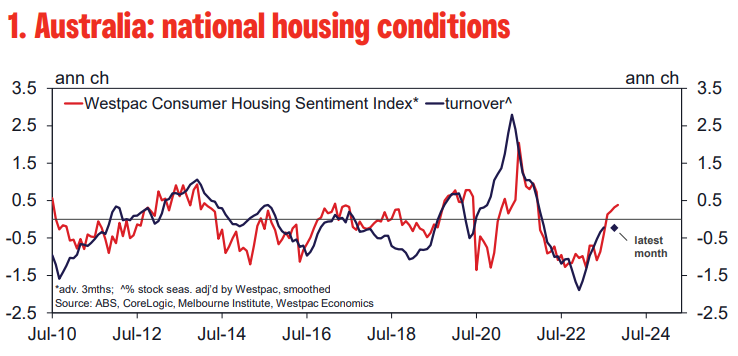

Australia’s housing recovery has continued to gain traction. Nationally, turnover has now risen 9% from its lows at the end of last year, but remains about 25% below the peak in late 2021.

Prices have also shown further gains, to be up 6% from their Feb low across the five major capital cities. While this is still very much a ‘price-led’ upturn, we are starting to see a more consistent positive picture emerge across prices, sales, and to some extent, sentiment.

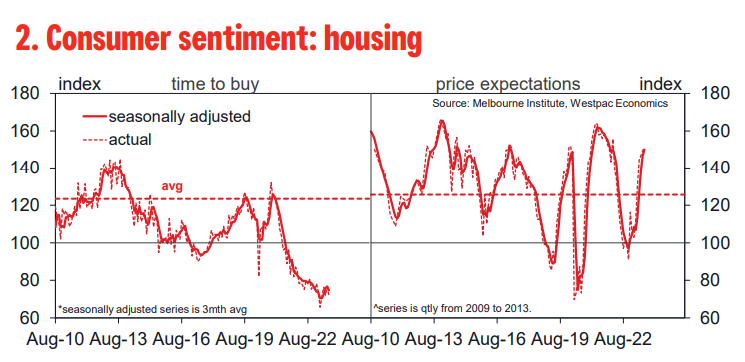

Housing–related sentiment has continued to improve, albeit with the mix still not particularly convincing. The main positives have continued to come from price expectations, which are now very bullish.

This is in stark contrast to ‘time to buy a dwelling’ assessments, which remain deeply pessimistic, consistent with still-stretched affordability, and extremely high levels of risk aversion.

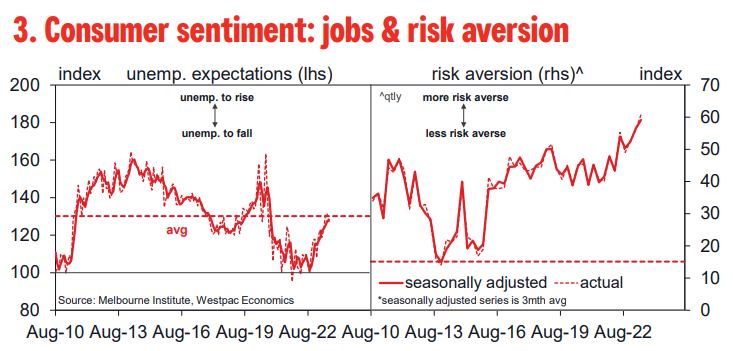

Confidence around jobs has been mixed, optimism having faded over the last year but with some tentative signs of stabilisation in recent months.

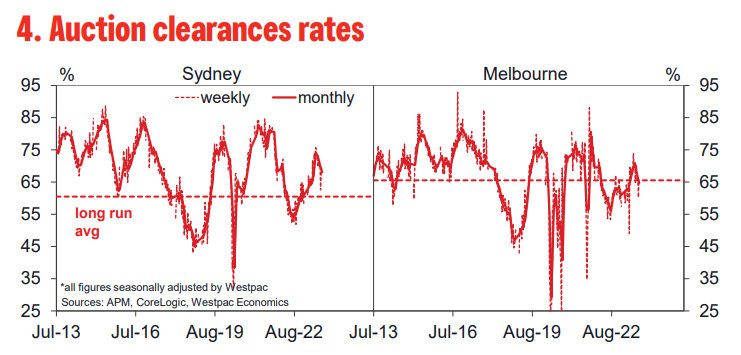

Auction markets also point to a sustained improvement in conditions on the ground, clearance rates holding around 70% in Sydney and in the 66-67% range in Melbourne, both readings typically associated with price gains.

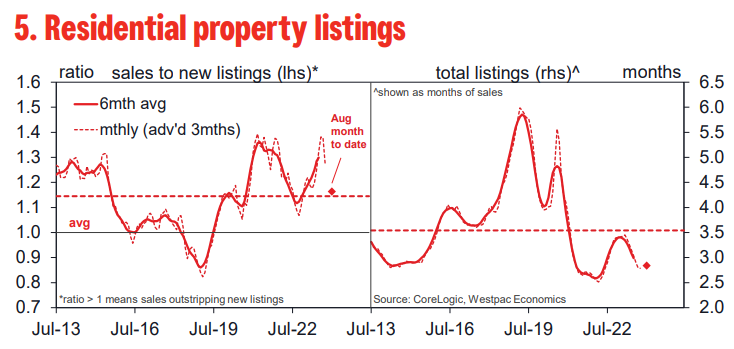

‘On–market’ supply remains tight for now but a lift in new listings, which are starting to track more in line with sales, suggests the balance is shifting. Stock on-market is still just under 3 months of sales, well below the long run average of 3.75. While most are some variation of tight, on-market supply does differ across cities and sub-markets.

Nationally, the Westpac Melbourne Institute ‘time to buy a dwelling’ index fell 5.6% over the 3mths to Aug, unwinding all of the modest gain over the previous 3mths. At 72.1 the index remains near extreme cyclical lows, the long run average being 121.6.

The duration of weakness is particularly notable. July marked the 26th consecutive sub-100 read on buyer sentiment. That is much longer than any previous run of weak reads.

The next longest, during the deep recession of the early 1990s, only saw 18 consecutive months of sub-100 reads by comparison.

The Westpac–MI Consumer House Price Expectations Index rose a further 4.8% over the 3mths to Aug, having soared 40% between Feb and May. At 151.2, the Index is at a new cycle high in strongly optimistic territory, broadly consistent with annual price growth of around 10%.

A larger outright majority of consumers (74%) expect prices to continue rising over the next 12mths, with half of this group expecting double digit price gains. Another 16% expect prices to hold flat while only 10% of consumers expect to see prices to decline.

Consumers continue to show a gradual loss of confidence around jobs. The Westpac Melbourne Institute Unemployment Expectations Index lifted a further 3.2% over the 3mths to Aug, after similar rise over the previous 3mths (recall that higher reads mean more consumers expect unemployment to rise in the year ahead).

At 127.2, the Index is now slightly below the long run average of 129.2. Readings are broadly consistent with flattening labour market conditions rather than a sharp spike in job-loss fears.

Risk aversion has continued to escalate, the Westpac Consumer Risk Aversion Index rising a further 4.7pts to 60.8, a new record high on estimates going back to the mid-1970s.

Over a quarter of consumers now favour ‘pay down debt’ as the ‘wisest place for savings’ with the proportion favouring ‘shares’ and ‘real estate’ continue to hold near historic lows.

Australia’s housing market recovery appears to be on a much firmer footing. The lift since the start of the year has maintained momentum despite further interest rate rises, with surging migration continuing to be an important driver.

The near-term outlook also looks more positive, Westpac assessing that interest rates have now peaked and that the economic slowdown will be somewhat milder than previously forecast.

While conditions will remain challenging near term – with interest rates still high, growth weak and a rise in unemployment still to come – the housing upturn is now likely to be sustained.

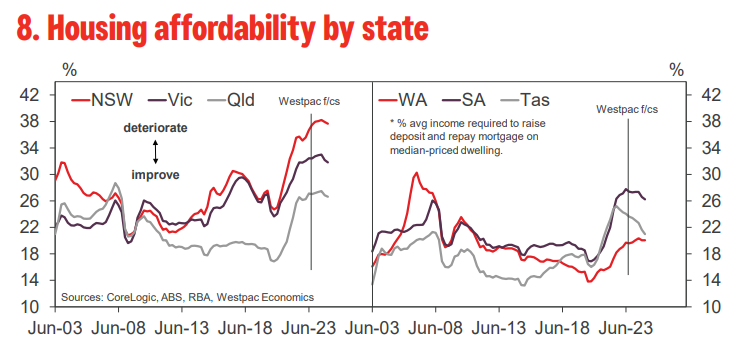

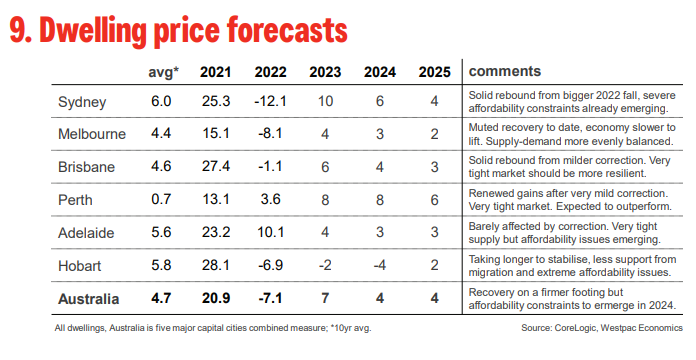

Westpac expects dwelling prices to rise 7% in 2023 and by a further 4% in 2024. Stretched affordability is quickly becoming the dominant issue for markets.

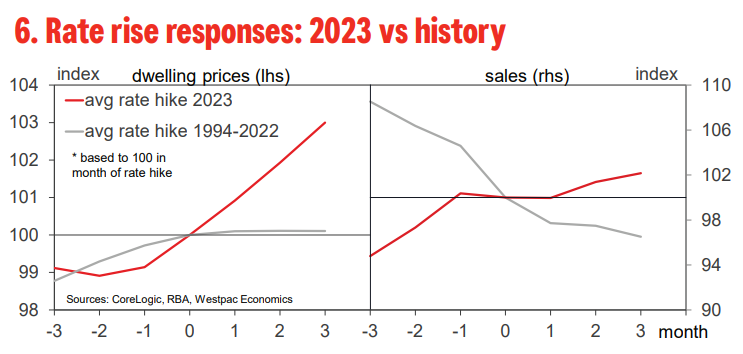

Across the five major capital cities, dwelling prices have now risen 4% over the year to date – a 5.2% rebound from Feb’s low retracing just over half of the 9.7% fall over the previous ten months. Most notably, gains have been well-sustained despite further rate hikes from the RBA in Feb, Mar, May and Jun.

The consistent picture is of a broadening recovery, albeit one that is being led by prices with the volume of activity and demand still relatively subdued.

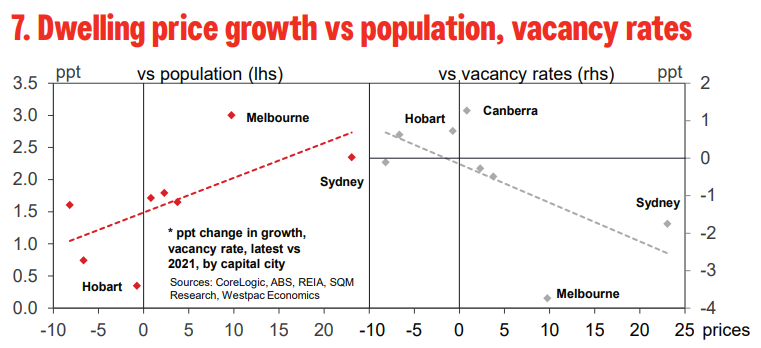

As noted previously, the impetus for gains looks to be mainly coming from a sharp acceleration in migration inflows and an associated tightening in rental markets, all against a backdrop of low levels of ‘on-market’ supply.

The turnaround in price growth has been strongest for markets where population growth has seen the sharpest pick-up and much more muted in markets that have seen a less pronounced shift.

The same pattern is evident when we look at changes in rental vacancy rates and rental yields, and, to a lesser extent, when comparing shifts in on-market listings.

Previously, we had expected further rate rises and a material weakening in the economy to drive a significant loss of momentum for housing near term.

That outlook now looks less challenging with interest rates now expected to remain on hold for an extended period and the growth outlook a little less threatening – labour market conditions holding up better than expected in 2023 and rate rises now expected to deliver a milder hit in 2024.

GDP growth is still forecast to be weak, running at just 1% in 2023 and 1.4% in 2024, but not quite as weak as the sub-1% average that had been forecast previously. Most importantly for housing markets, the associated rise in the unemployment rate is now expected to come through later and be milder, with a peak of 4.8% vs 5.5% previously.

This is an unusually ‘front-loaded’ price upturn. Housing recoveries in the past have only tended to flow through to prices once the RBA is cutting rates or clearly poised to do so, with a lift in prices typically following a sustained lift in turnover.

This ‘front-loading’ points to a more stretched situation in terms of affordability, key measures likely to deteriorate past historical extremes in most markets by late 2023 (Brisbane and Perth notable exceptions). This will become a major constraint for price growth in 2024 and 2025.

Overall, Westpac expects current momentum to be better sustained with prices rising 7% over calendar 2023 but with growth slowing as affordability constraints emerge, prices forecast to rise 4% in 2024 and 2025 despite rate cuts.

Near term, the main uncertainty surrounds the extent to which a lift in ‘on-market’ supply slows price gains.

Over the medium term however, the outlook depends on how tensions between a physical undersupply of housing and stretched affordability plays out, with investors and high income households being key wildcards.