There was lots of hoopla from economists over the weekend about whether Australia will experience a recession.

National Australia Bank CEO Ross McEwan says the domestic economy and the banking sector are in good shape and believes the nation will avoid a recession.

“There’s a resilience in this economy that you’re not seeing in other economies around the world. This is the luckiest country in the world” he said.

HSBC chief economist Paul Bloxham said it will be touch and go whether the economy enters a ‘technical recession’, although a per capita recession is guaranteed.

However, Bloxham played down the significance given unemployment remains low. Accordingly, “Australia might have a recession in name only”:

“Our central case is that growth will be close to stall speed, averaging 0.1% for the next four quarters, and the unemployment rate will rise by around 1 percentage point”.

“We expect per capita household consumption to fall. While the economy may feel very sluggish, we expect a recession to be avoided”.

“[But] the key criteria the International Monetary Fund uses for defining a global recession is when global GDP growth falls below that of population growth”.

“If per capita GDP is the most important metric, then Australia is now almost certainly in a recession. Australia would also have had a recession in 2000, 2006 and 2020”.

“If the aim is to judge whether living standards are improving, then per capita GDP is a better measure”.

“Even if a technical recession were to arrive in Australia in the second half of 2023, it would be debatable whether it was an actual recession, especially if the unemployment rate rose only modestly, as we expect”.

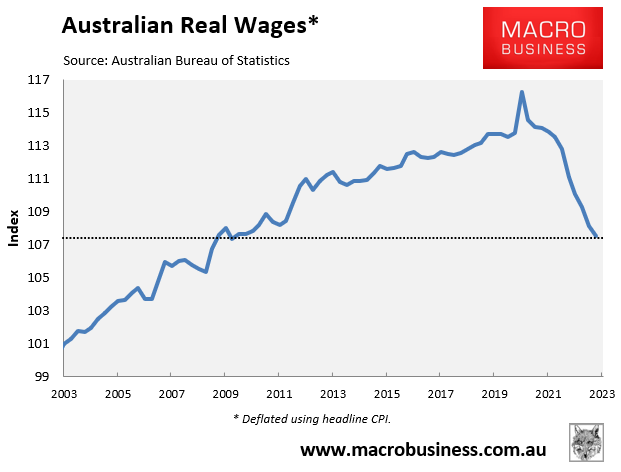

It is a bit rich to claim that Australia won’t experience an “actual recession” when per capita GDP growth is falling and real inflation-adjusted wages have fallen to March 2009 levels:

That’s 14 years of real wage rises gone, with further cuts inevitable as inflation outpaces wage growth.

The only thing keeping Australia from suffering a ‘technical recession’ is the Albanese Government’s unprecedented immigration program.

Quantitative peopling has ‘saved’ the Australian economy once more, at least in aggregate terms.

However, everyone’s slice of the economic pie is shrinking, and Australia’s expected 917,000 population increase over 2023 and 2024 will crush-load everything in sight and devastate living standards.

To be fair to the Albanese Government, this was also the Australian economic story last decade.

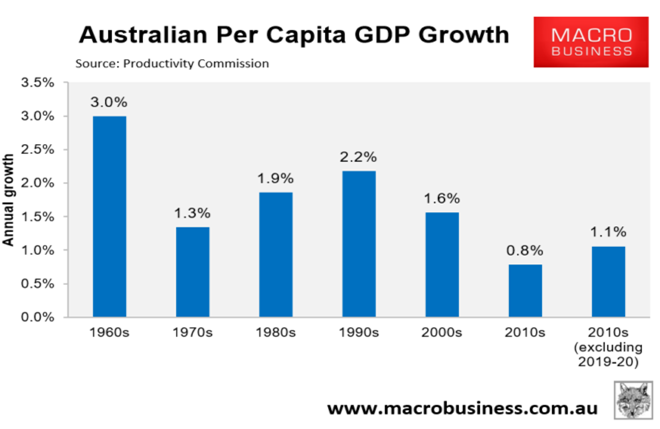

The Productivity Commission ranked the 2010s as the worst decade for real per capita GDP growth in 60 years of data, even excluding the impacts of the 2019-20 COVID-19 recession:

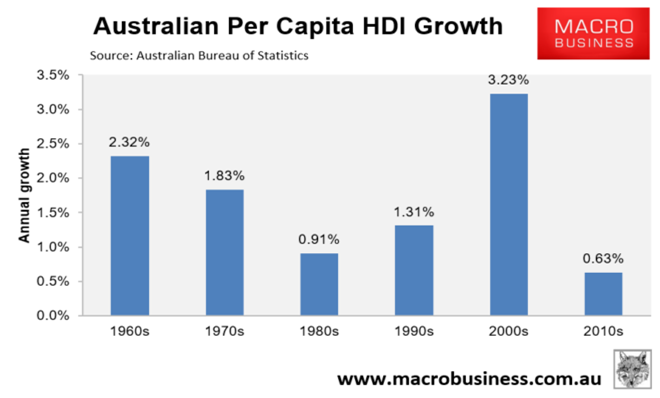

Real per capita HDI also recorded the weakest decade of growth in data dating back to the 1960s:

With the Albanese Government ramping immigration to fresh highs, Australia’s economy will become increasingly reliant on population growth.

Meanwhile, every genuine quality-of-life indicator will be further degraded by Labor’s extreme immigration policy.