AMP Capital chief economist, Shane Oliver, has raised the probability of Australia entering a technical recession – i.e. two consecutive quarters of negative GDP growth – to 50%:

“Recession can still be avoided. But it’s a high risk with the lagged impact of rate hikes still feeding through – particularly in Australia where we put the risk of recession at 50% given the vulnerability of the household sector. Weak growth in China is also adding to the risks of recession”.

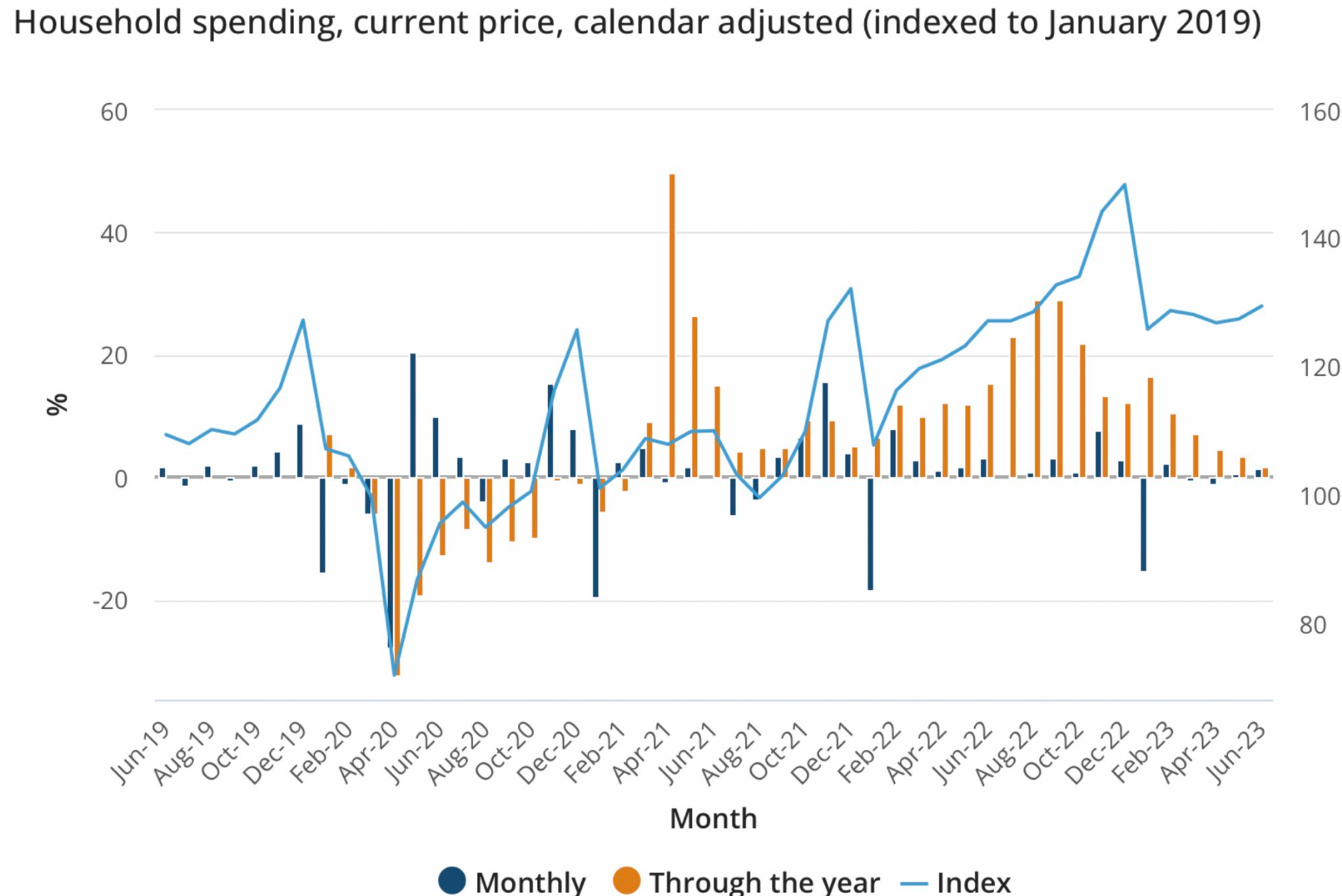

Separately on Twitter, Oliver noted that “ABS Australian household spending growth slowed to just 1.8% yoy in June (brown line in chart)”:

“Given rising prices, this implies real consumer spending is now falling as rate hikes and cost pressures hit. This is consistent with a high risk of recession – which we put at 50%”.

Oliver also notes that Australia would already be in recession if not for the nation’s record immigration-driven population growth:

“Strong population growth boosts demand and hence GDP growth and could enable a recession as defined as a fall in GDP to be avoided”.

“In this regard it’s notable that while both the Australian Government and RBA are forecasting positive GDP growth this financial year on a year average basis at 1.5% and 1% respectively, this is expected to be below the rate of population growth at around 1.7% or more which means that both are forecasting a per capita (or per person) recession, but this is masked by strong population growth”.

“Of course, what matters for living standards is per capita GDP growth but arguably for investors overall growth is more important as this is what will drive company profits”.

The primary driver of Australia’s economic growth is household consumption. And the economy generally follows where household spending goes.

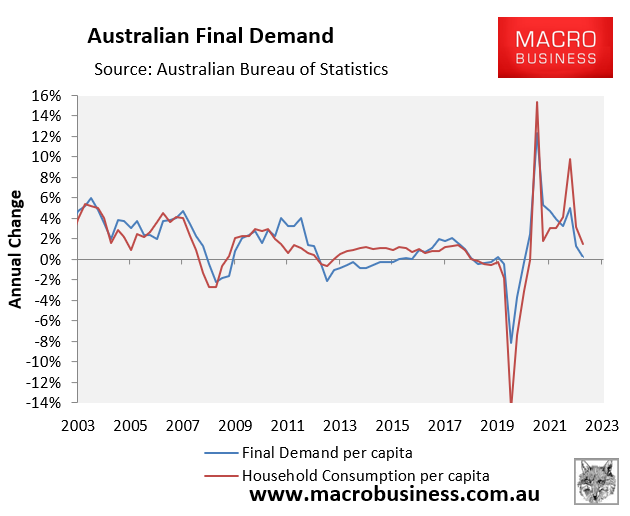

This link is clearly illustrated in the following chart from the March quarter national accounts.

Therefore, the collapse in real household spending points to falling GDP growth ahead.

The Albanese Government’s record immigration program is the only thing keeping the Australian economy from entering a deep technical recession.

The overall economic pie is still growing slowly, but everyone’s piece of the economic pie is shrinking, as are earnings and living standards.