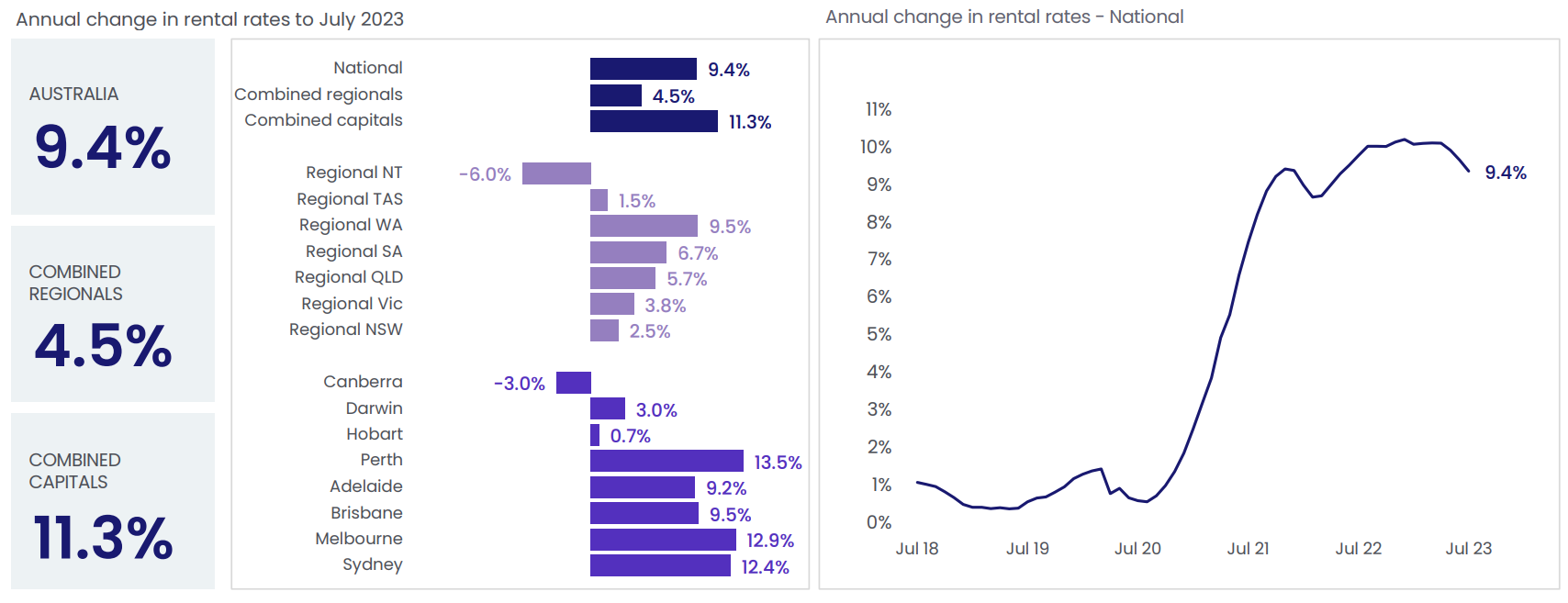

CoreLogic has released its monthly chart pack, which shows that annual national rental growth eased slightly to 9.4%; although it remains at a turbo-charged 11.3% across the combined capital cities:

Source: CoreLogic

As you can see, rental growth nationally is being driven by Perth (+13.5%), Melbourne (+12.9%), and Sydney (+12.4%).

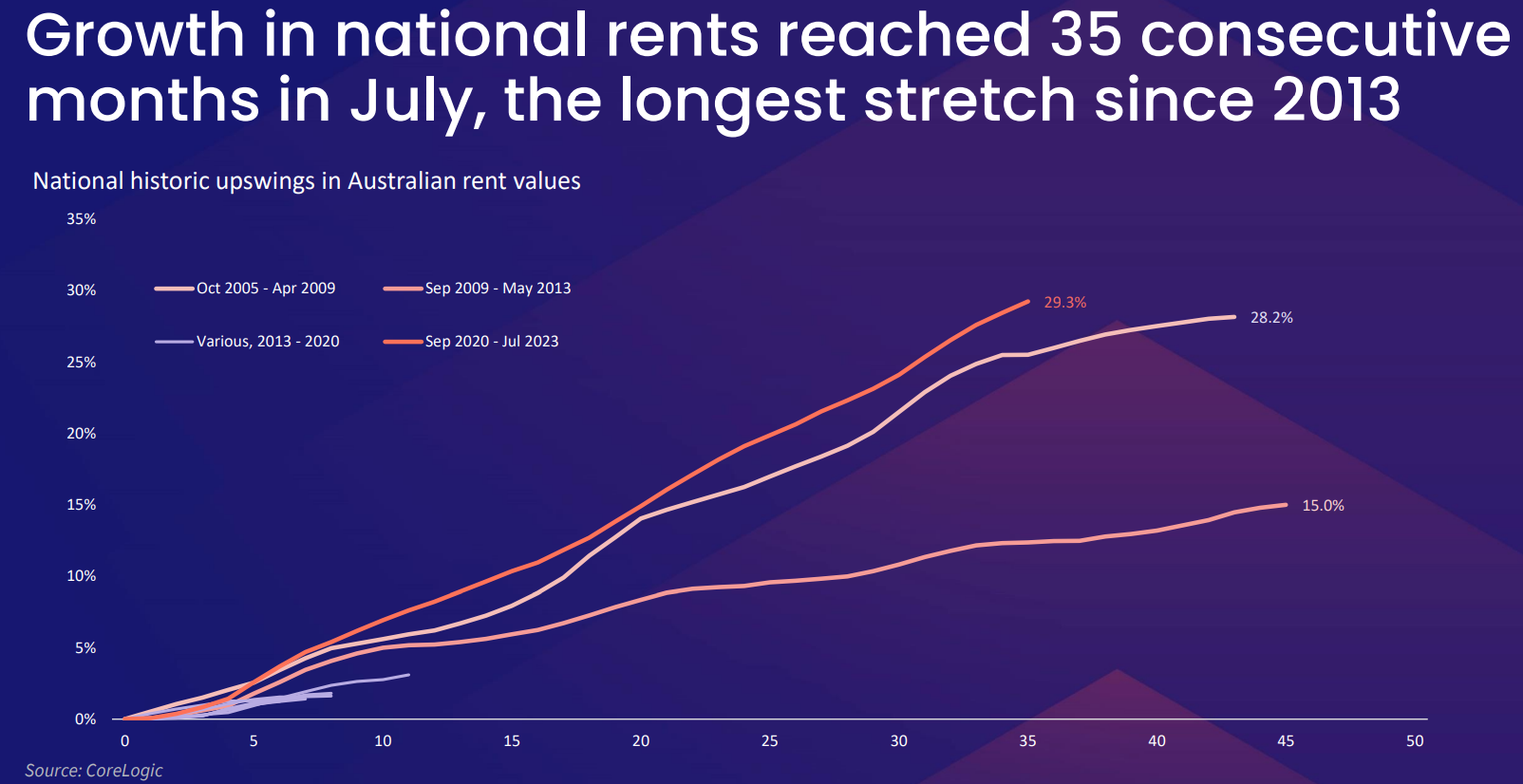

While the slight easing in Australia’s rental growth is encouraging, CoreLogic has also provided the below chart showing that Australia has recorded the strongest upswing in rents on record – i.e. 29.3% growth between September 2020 and July 2023.

It is also the longest stretch of consecutive rental growth (35 months) since 2013 – a record that will certainly be broken as rents across the nation continue to climb:

Source: CoreLogic

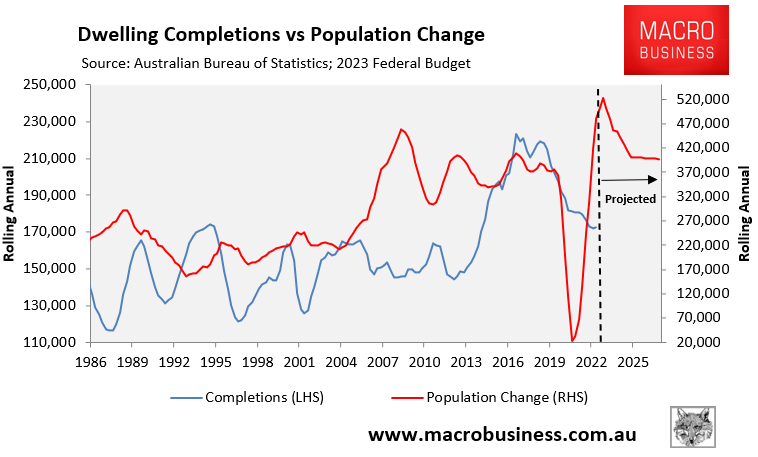

As noted last week by Maree Kilroy of Oxford Economics, the demand and supply for housing are moving in opposite directions, which will cause worsening housing shortages:

“Demand and supply for housing are moving in opposite directions. This will sustain a sizeable dwelling deficiency over the coming years”.

“It’s not until late 2024 that we anticipate market pressure will guide dwelling approvals back to growth”.

The Housing Industry Association (HIA) likewise warned that the “lack of new work entering the pipeline threatens to worsen the affordability crisis”:

“Australia has a structural undersupply of housing, with rental vacancy rates around the country at record lows, driving rents and dwelling prices to new heights”.

“The return of overseas workers and students, without an equivalent boost to housing supply, will exacerbate the situation”.

“The volume of houses commencing construction [is] expected to reach decade lows in 2024”.

The Albanese Government has foolishly opted to run the nation’s largest ever immigration program at the same time as actual housing construction is declining due to multiple construction firm failures and high material and financing prices:

As illustrated in the chart above, Australia’s population was projected in the federal budget to grow by 2.18 million people over the five years to 2026-27, equivalent to five Canberra’s, driven by a record 1.5 million net overseas migration over the same period.

Importing a record number of people while the housing industry is on its knees and infrastructural projects are being shelved is insane.

The Albanese Government has virtually declared that housing shortages and rising rents will become permanent features of the Australian economy.