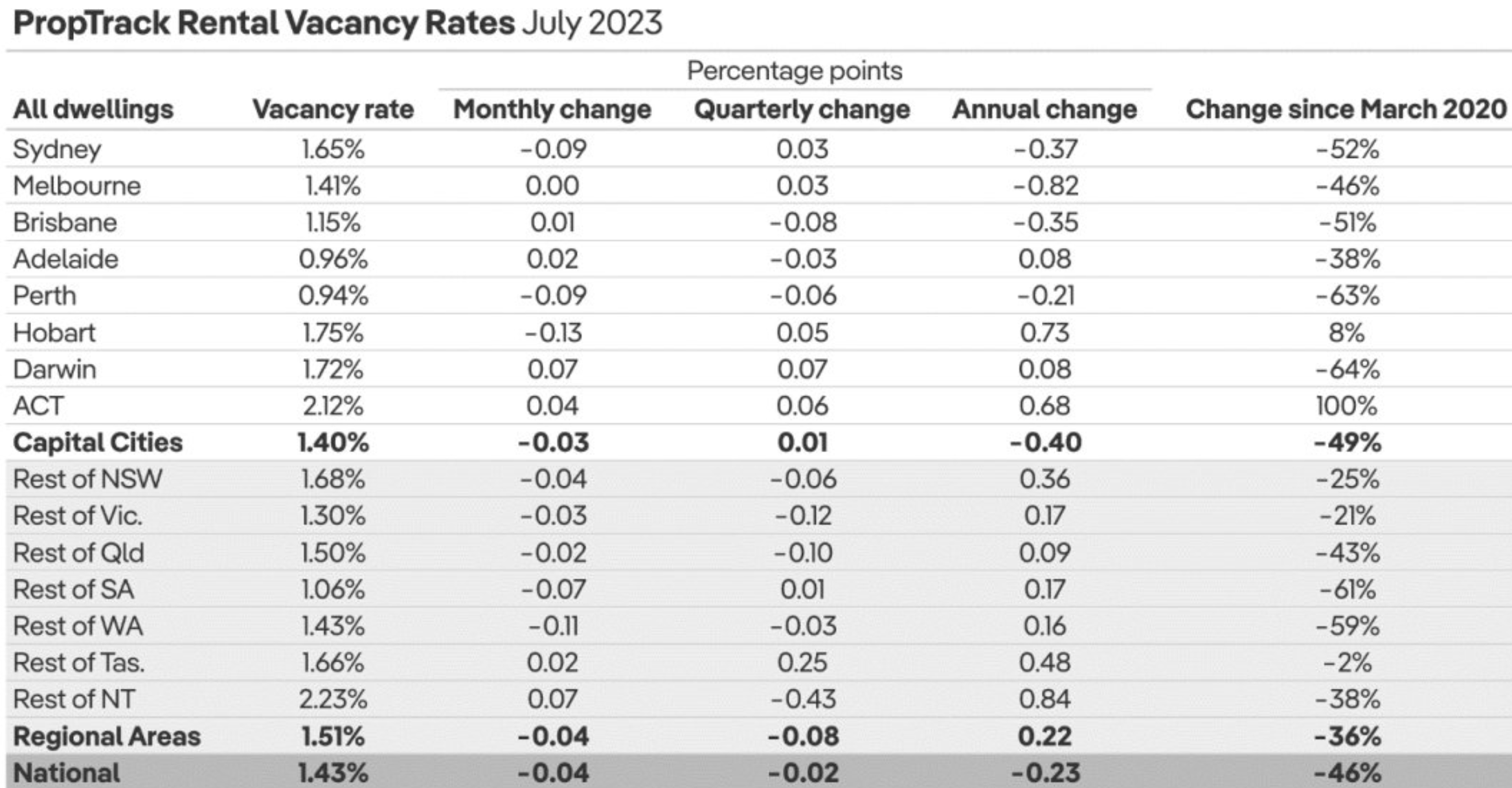

PropTrack has released data showing that residential vacancy rates are once again declining across the capital cities.

Despite more people turning to share housing and living back with mum & dad, the rental market simply cannot keep up with record immigration-fueled population growth.

According to PropTrack, the nation’s rental vacancy rate is “now close to half the level seen since she start of the pandemic”:

In turn, “the cost of renting is likely to increase further for Australia’s tenants in the months ahead, with the national vacancy rate falling in July”.

“Both capital cities and regional areas saw the supply of rental properties decrease over July”.

“Melbourne has seen the sharpest decline in rental vacancies of any market over the past 12 months. As Australia’s fastest growing capital city, vacancy is likely to fall further in Melbourne and lead to higher rents”.

“Pressure is unlikely to ease any time soon for tenants, with the number of vacant properties predicted to remain at extremely low levels over at least the next 12 months”, PropTrack warns.

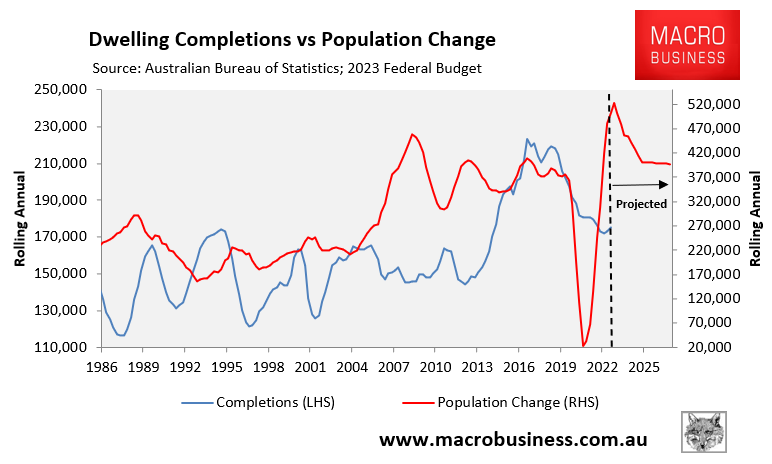

As we know, the 2023 federal budget forecast that Australia’s population would increase by 2.18 million people (the population of Perth) over the five years to 2026-27.

This extreme population growth will be driven by net overseas migration of 1.5 million (the population of Adelaide) over the same five year period.

At the same time, actual dwelling supply is falling, as illustrated clearly in the chart below:

The Albanese Government’s record immigration program is an unmitigated disaster for Australia’s tenant class and will ensure further financial hardship, crowding and homelessness for Australians.

The single best solution to Australia’s housing crisis is to moderate net overseas migration to levels commensurate with the nation’s ability to supply new housing and infrastructure.

Otherwise, Australia’s housing shortage will become a permanent feature of Australia.