Australian house prices have recorded a miraculous rebound in the face of ongoing interest rate tightening from the Reserve Bank of Australia (RBA).

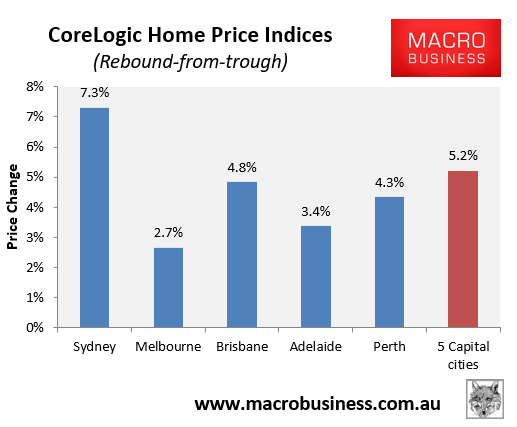

CoreLogic data shows that prices at the 5-city aggregate level have rebounded by 5.2% from their February 2023 trough, with all major capital city markets recording solid rebounds:

Yellow Brick Road chairman, Mark Bouris, believes the rebound will be short-lived.

He expects more homes to come onto the market in coming months, particularly as fixed-rate mortgages begin switching to variable rates.

In turn, Bouris tips that house prices to fall by another 5% by early 2024.

“This pause will not stop more homeowners from selling. In fact, I’m expecting more property to come into the market, particularly in spring, when many fixed mortgages are resetting to higher variable rates, and potentially drag prices lower”, Bouris said.

“We haven’t seen the full effect of the fixed rate reset, and I’m not talking about small percentages, it’s a huge portion of the market”.

“Around 40% of all new lending was fixed during late 2020 and early 2021, so these mortgages have started to reset in March and most will mature by the end of the year”.

“A lot of these borrowers will not be able to refinance, so some, not all, will have to sell, and this will likely occur during spring. This will exceed demand and likely push prices lower, although I’m not expecting a collapse in prices”, Bouris concluded.

AMP chief economist Shane Oliver also warned that “the impact of the rise in mortgage rates (with the risk of more to come) is still feeding through and unemployment is likely to rise significantly over the next year”.

Therefore, “if the economy were to slide into recession it’s likely that the government would cut the immigration intake, further reducing the underlying demand/supply imbalance”.

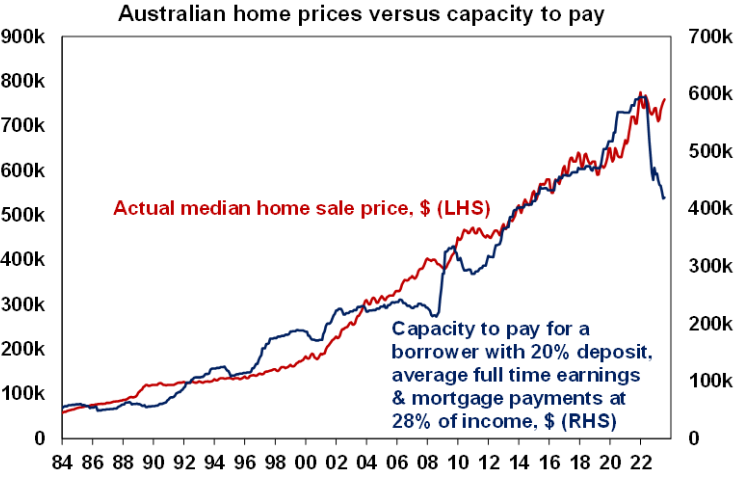

The rebound in Australian house prices has been highly unusual given it has occurred in the face of interest rate hikes, falling borrowing capacity, and amid falling sales volumes.

The next chart from Shane Oliver shows that borrowing capacity has fallen by nearly 30%, which should have been met with hefty price falls:

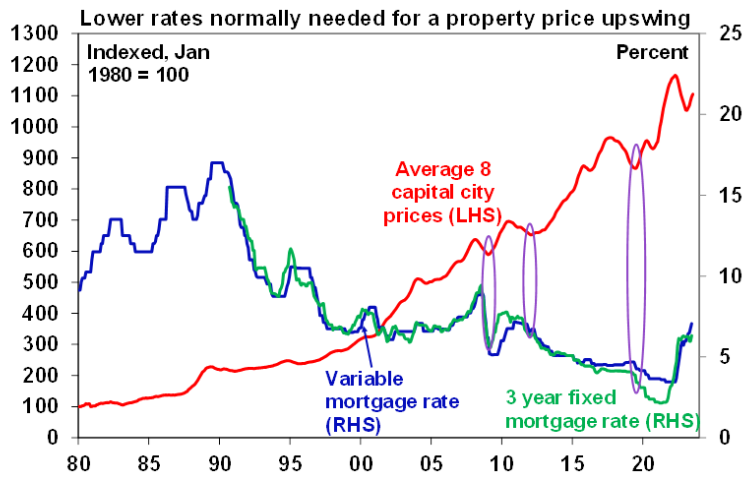

Oliver, therefore, believes “the rebound in home prices so far this year looks premature relative to the normal cyclical relationship with interest rates”:

My view is that house price growth will continue to slow (but not fall) before accelerating next year when the RBA begins cutting interest rates.

Record immigration, ongoing rental shortages and strong rent growth, and restricted supply will continue to support prices.

And when the RBA does start cutting, a match will be lit under the market.