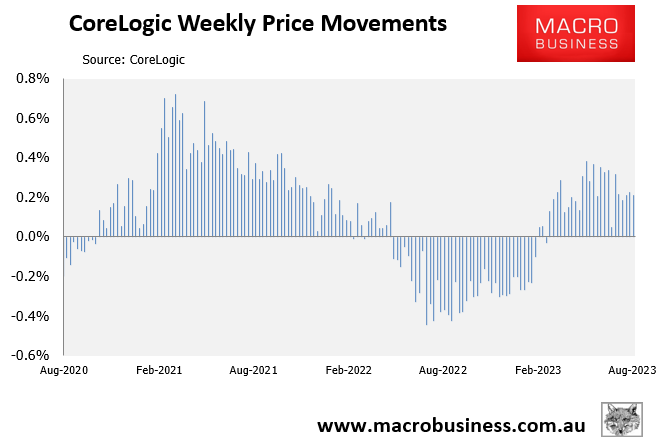

CoreLogic’s daily dwelling values index, which measures value changes across the five major capital city markets, increased by 0.21% in the week ended 17 August, representing the 24th consecutive weekly rise:

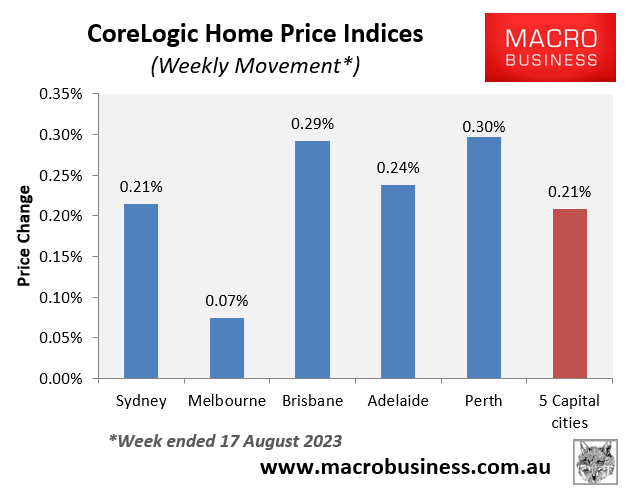

Perth (0.30%) and Brisbane (0.29%) led this week’s rise in values, although all major capital city markets recorded increases:

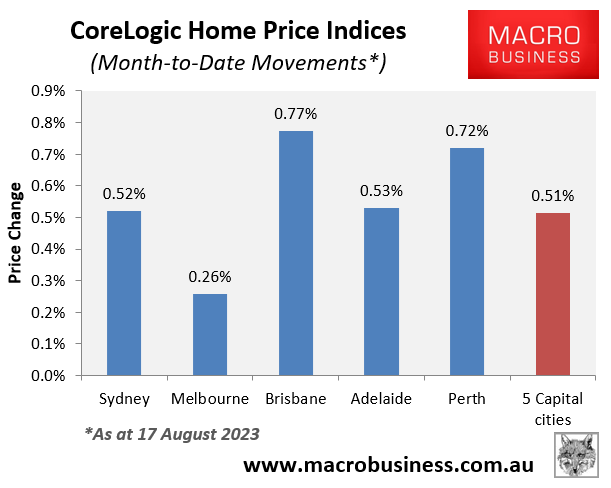

So far in August, home values have increased by 0.51% at the 5-city aggregate level, with Brisbane (0.77%) and Perth (0.72%) leading the way:

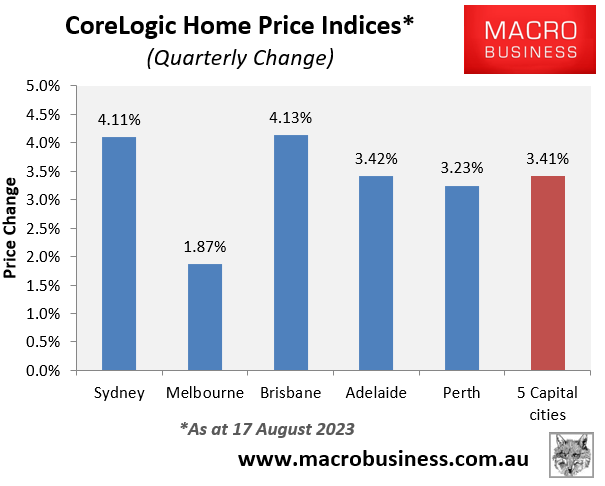

The quarterly growth rate in dwelling values has slowed to 3.4% at the 5-city aggregate level, with Brisbane and Sydney (both up 4.1%) leading the way:

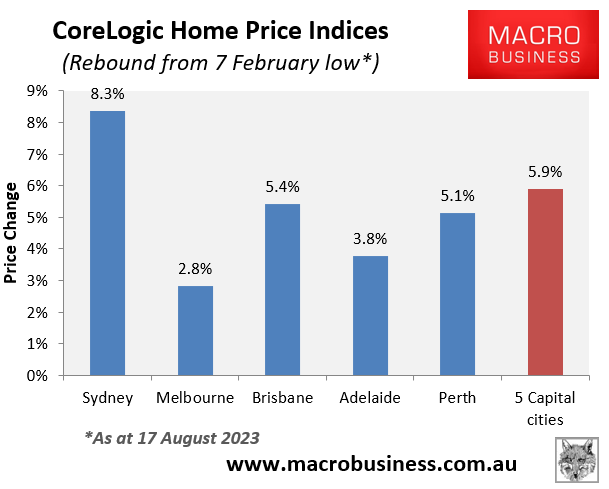

Since the daily dwelling values index bottomed on 7 February, values have rebounded by 5.9% at the 5-city aggregate level, led by Sydney (8.3%) followed by Brisbane (5.4%):

There is good reason to believe that Brisbane housing will outperform is capital city rivals over the medium to longer term.

According to Queensland’s new draft regional plan, which was published last month, an additional 2.2 million people will call south-east Queensland home by 2046, raising the region’s population to 6 million from 3.8 million now.

By 2046, about 500,000 people are predicted to relocate to the Brisbane City Council area alone, raising the population to 1,721,000.

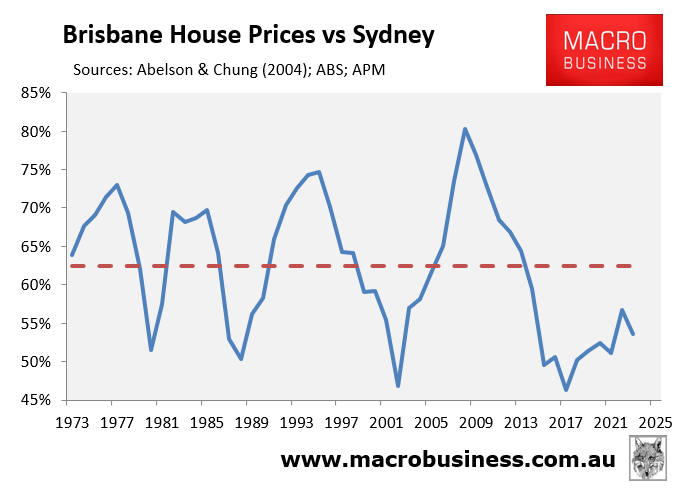

Domain data shows that the median house price in Brisbane is only 54% of the typical house price in Sydney:

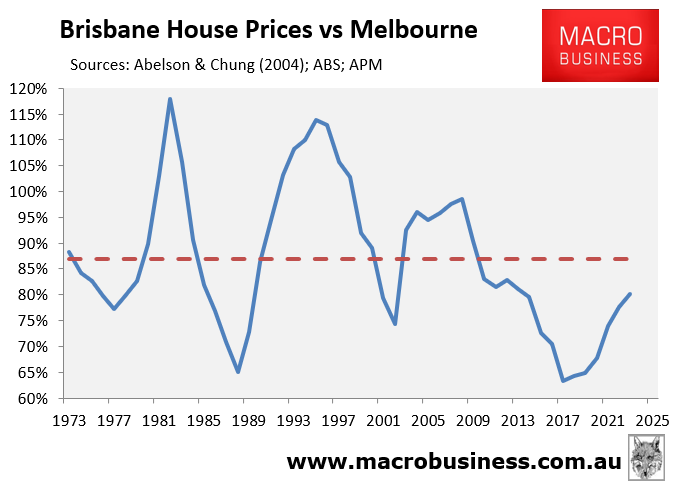

Brisbane’s median house price is also only 78% as expensive as Melbourne’s:

Therefore, Brisbane housing is relatively affordable compared to its larger east coast cousins, meaning that in the long-run, Brisbane house prices should grow faster.

The Olympics in 2032 will also spur infrastructure investment and strengthen Brisbane’s position as a global city, thereby increasing international buyer interest.

Simply put, the long-term ingredients are in place for Brisbane house prices to out perform.