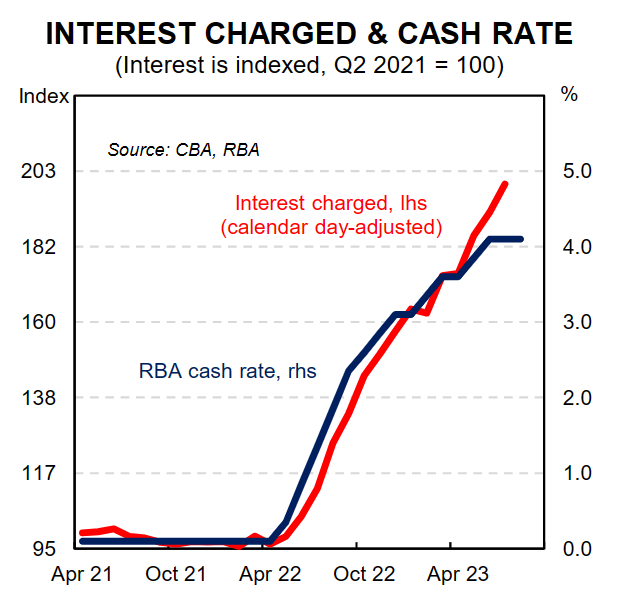

CBA economist, Stephen Wu, has released data showing that the amount of interest charged on CBA bank accounts rose further in July, despite the Reserve Bank of Australia (RBA) last increasing the cash rate in June.

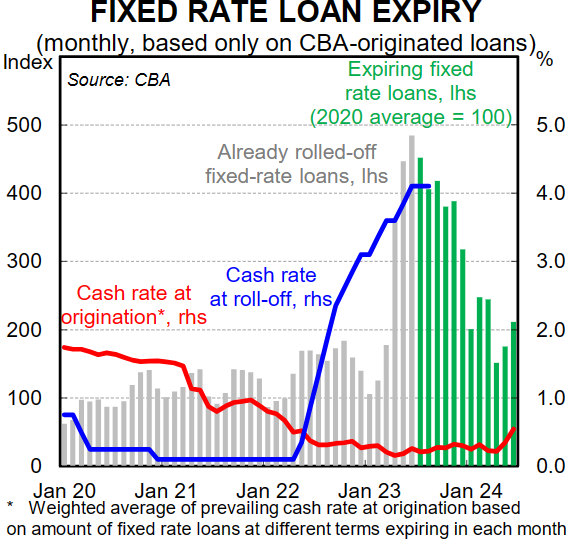

The latest increase in interest charged reflects the expiry of fixed-rate loans. $34 billion worth of fixed-rate mortgages expired over the six months to June 2023, with a further $52 billion expiring in the 6 months to December 2023:

Only two-thirds of the current cash rate increase has been felt by borrowers, according to Wu.

A separate report from CBA senior economist, Belinda Allen, noted that “generally, there is a three month lag between RBA rate rises and higher mortgage repayments, as well as between switching from a fixed rate loan to variable rate loan”.

Accordingly, by year’s end, around 85% of the RBA’s rate hikes will be felt by borrowers.

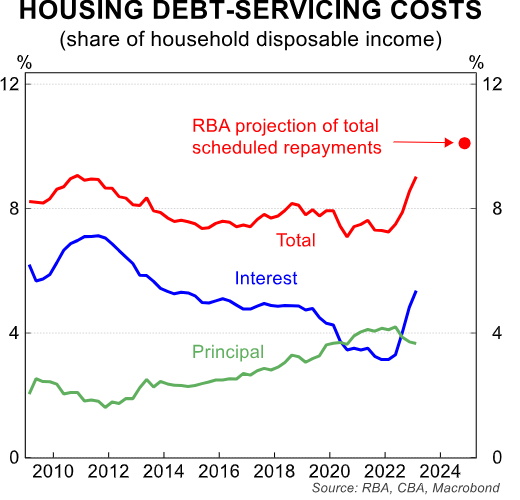

Moreover, by mid next year, Australian households will be paying their highest share of their income on debt repayments on record:

In turn, the economy faces a further contraction in household spending “due to the lagged impact of rate hikes and the ongoing fixed rate roll off”.