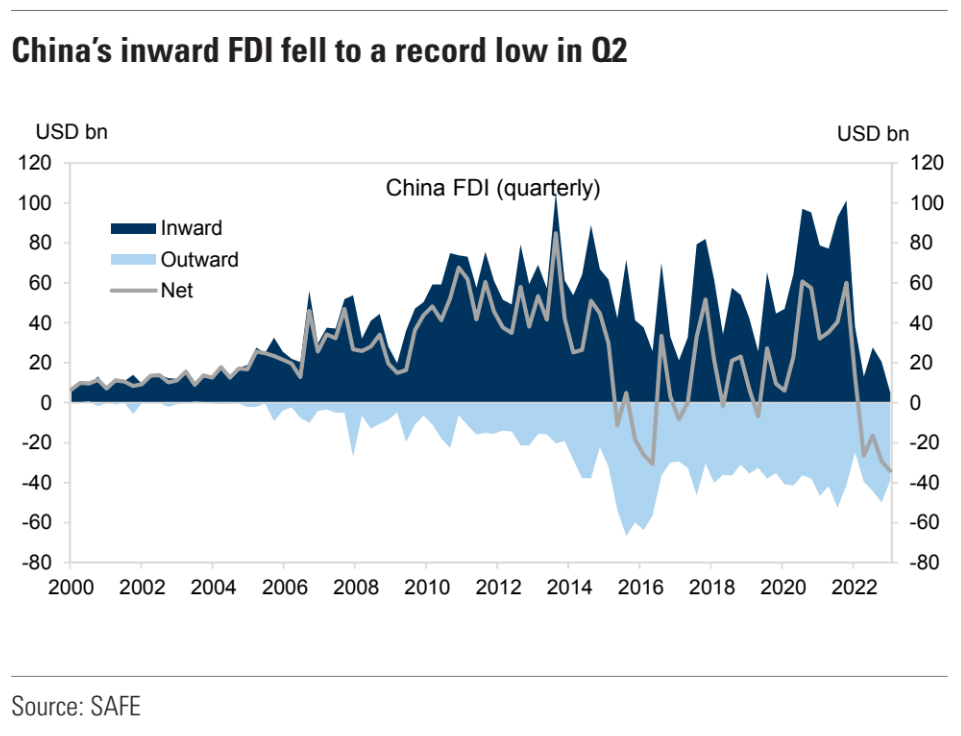

Chinese foreign direct investment is a good proxy for global supply chains investing in China.

It is at the lowest level in recorded history. Basically zero, far below even pre-WTO accession

This is a structural shift. No sane nation is today expanding its dependence upon Chinese trade for obvious reasons:

- Policy risk stemming from Emperor Xi.

- Geostrategic risk as the liberal world awakes to the CCP threat.

- Plague risk.

- Economic risk as China goes ex-growth.

All play a role in making China uninvestable. So, globalised FDI is either staying at home or heading for friendlier shores.

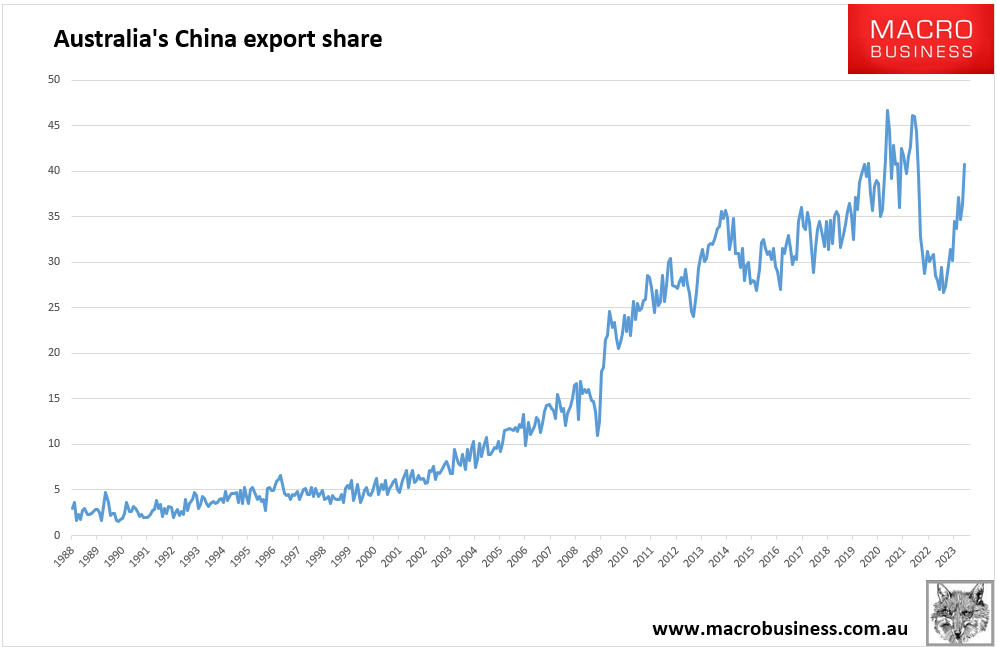

Except For Australia. The one nation that was actually on the receiving end of all of the above risks in action is now grovelling its way back into Chinese dependence:

You might recall that throughout China’s economic war on Australia, Albo defended Beijing over the Australian national interest. Now he is putting those ‘values’ into action.

This is indefensible in strategic terms:

- If you trust the US to defend Asian liberalism, then the risk of conflict makes it stupid.

- If you don’t trust the US to defend Asian liberalism, increased China dependence is the last thing you want.

Albo and the ALP are captured by the CCP and risking the freedom of every Australian child for fun and money.