Westpac with the note.

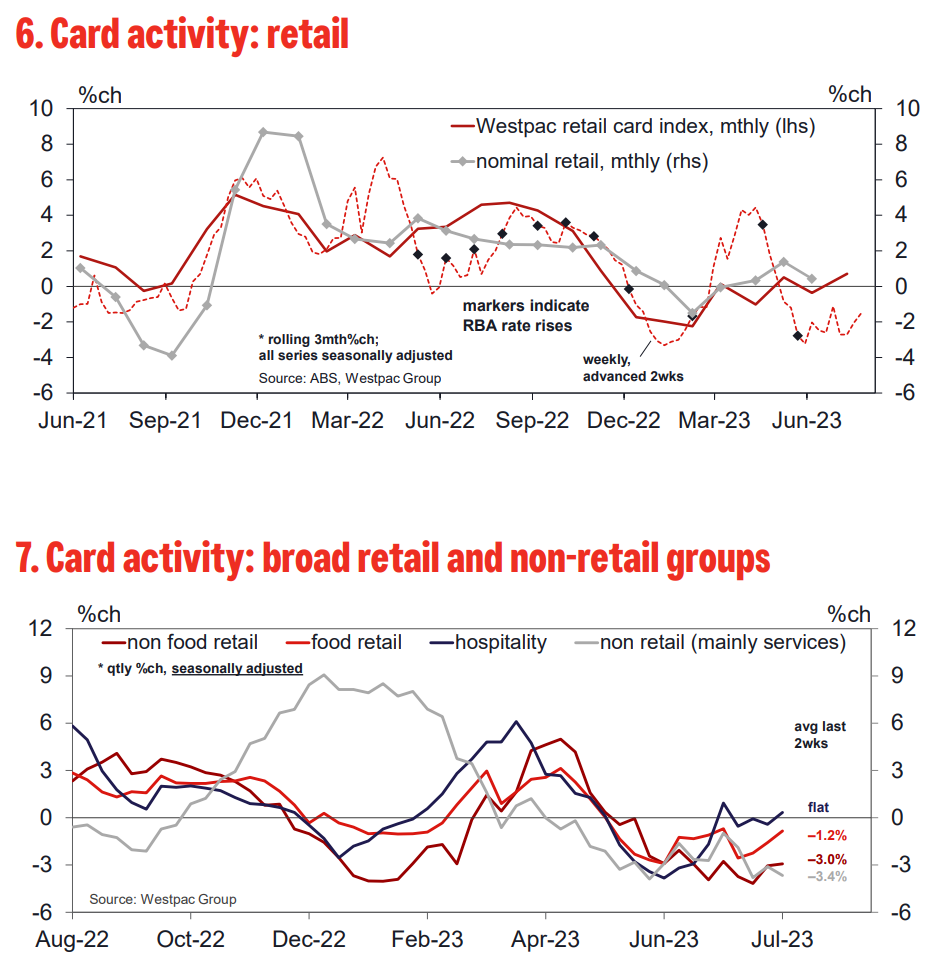

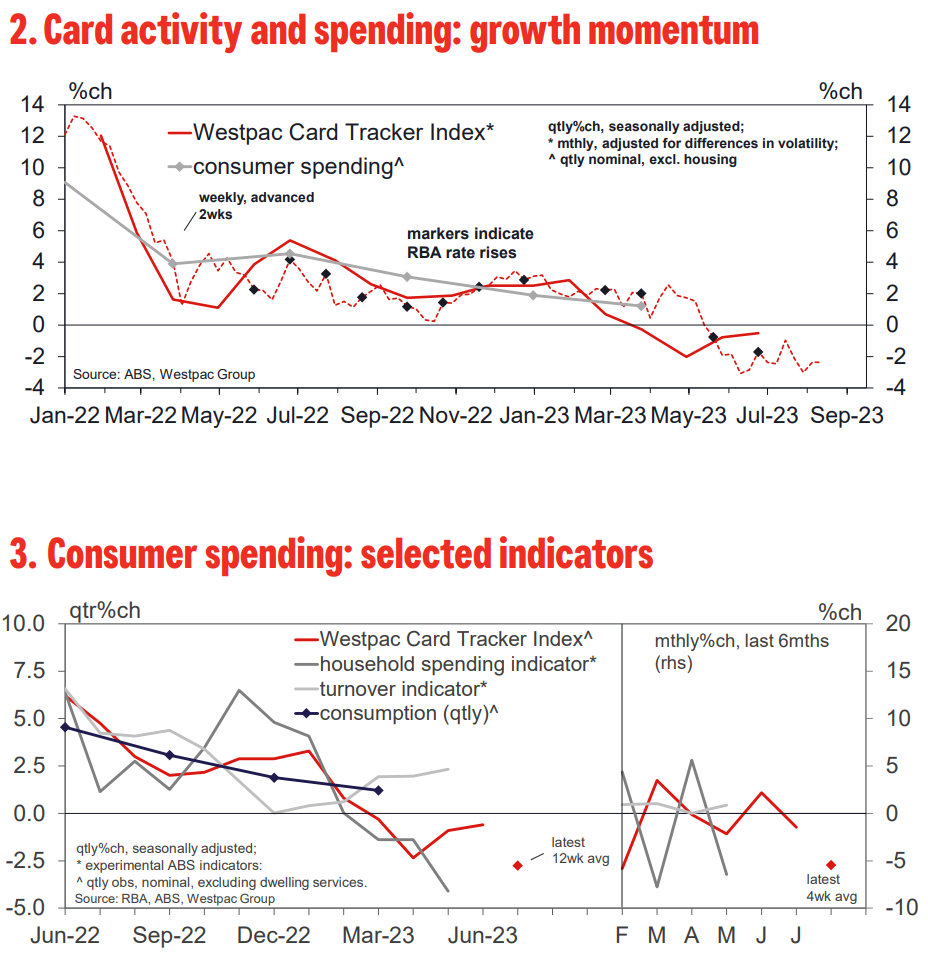

― The Westpac Card Tracker Index dipped slightly over the second half of July, moving 1pt lower to 127.9, to be roughly on a par with the levels seen this time last year – annual growth about flat and quarterly reads continuing to show a contraction.

― The picture from the category and state detail remains largely the same, weakness concentrated in goods and in the big eastern states, NSW and Vic. In annual growth terms, the last two weeks has seen some card activity for discretionary services but a renewed weakening for discretionary goods, momentum unchanged for essentials (firm for services, weak for goods). State performances have shown little or no change, NSW and Vic still seeing outright declines in per capita card activity on an annual basis.

― In this report we again take a closer look at activity by transaction size, this time focussing on cafes and restaurants. Predictably, the category has a very heavy clustering in the <$100 range, which accounts for 97% of all transactions by volume and 78% by value. Larger value transactions likely capture group meals, extending to venue higher for events, such as weddings, at the top end of the range. These segments show much bigger seasonal peaks in Dec, Christmas functions clearly a factor.

― COVID disruptions were much larger for medium and high value transactions. Growth-wise, all segments have retraced sharply over the nine months to Jun. For ‘event-related’ spend however this may be partly due to cycling a post-COVID catch-up phase.