I noted on Monday how the June quarter wage price index (WPI) release from the Australian Bureau of Statistics (ABS), which is due out 11.30 am on Tuesday, will be critical in determining whether the Reserve Bank of Australia (RBA) hikes the official cash rate again next month.

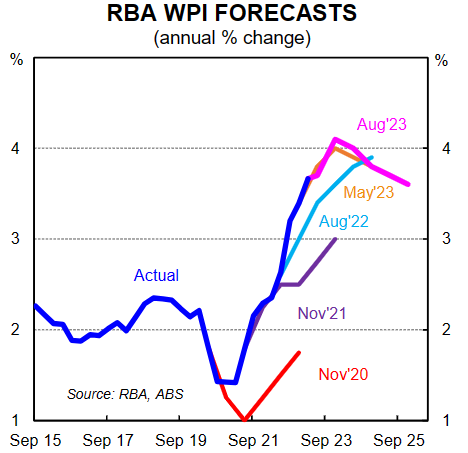

The August Statement on Monetary Policy (SMP) forecast that the WPI would peak at just over 4% annual growth in the September quarter:

Economists tip the WPI to grow by 1% the June quarter, which would take annual wage growth to 3.8%. But if it comes in significantly stronger, and annual wage growth pushes above 4%, then the RBA may be forced to hike (pending also the July labour force data coming out on Thursday).