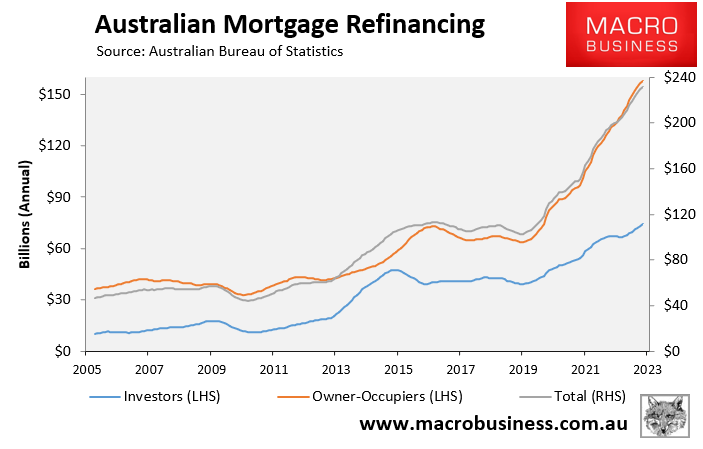

The Australian Bureau of Statistics (ABS) on Tuesday released housing finance data for June, which showed that the annual value of mortgage refinances hit a record high $232 billion.

That is nearly double the volume of refinances that took place before the pandemic:

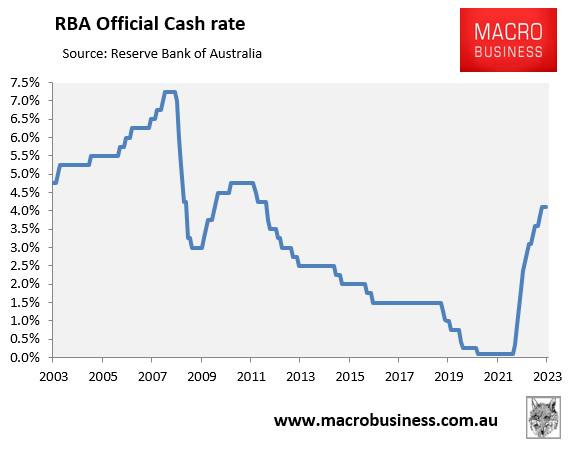

This surge in mortgage refinancing activity is being driven by the 4.0% of interest rate hikes from the Reserve Bank of Australia (RBA) since May 2022, which is the sharpest pace of monetary tightening on record:

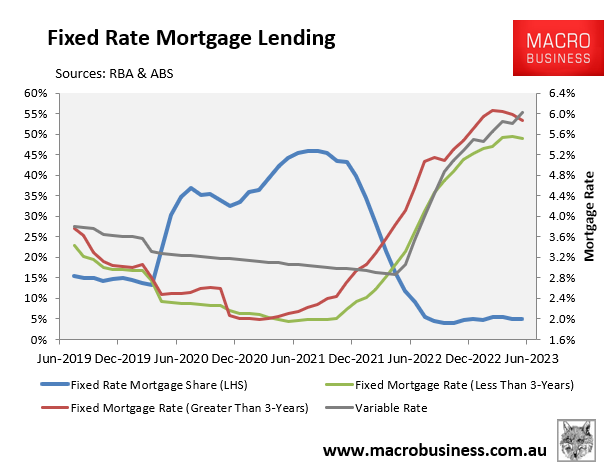

The refinancing is also being driven by the expiry of an abnormally large number of fixed rate mortgages.

As illustrated in the next chart, the share of new mortgages taken out at fixed rates lifted from around 15% pre-pandemic to around 40% between mid 2020 and late 2021:

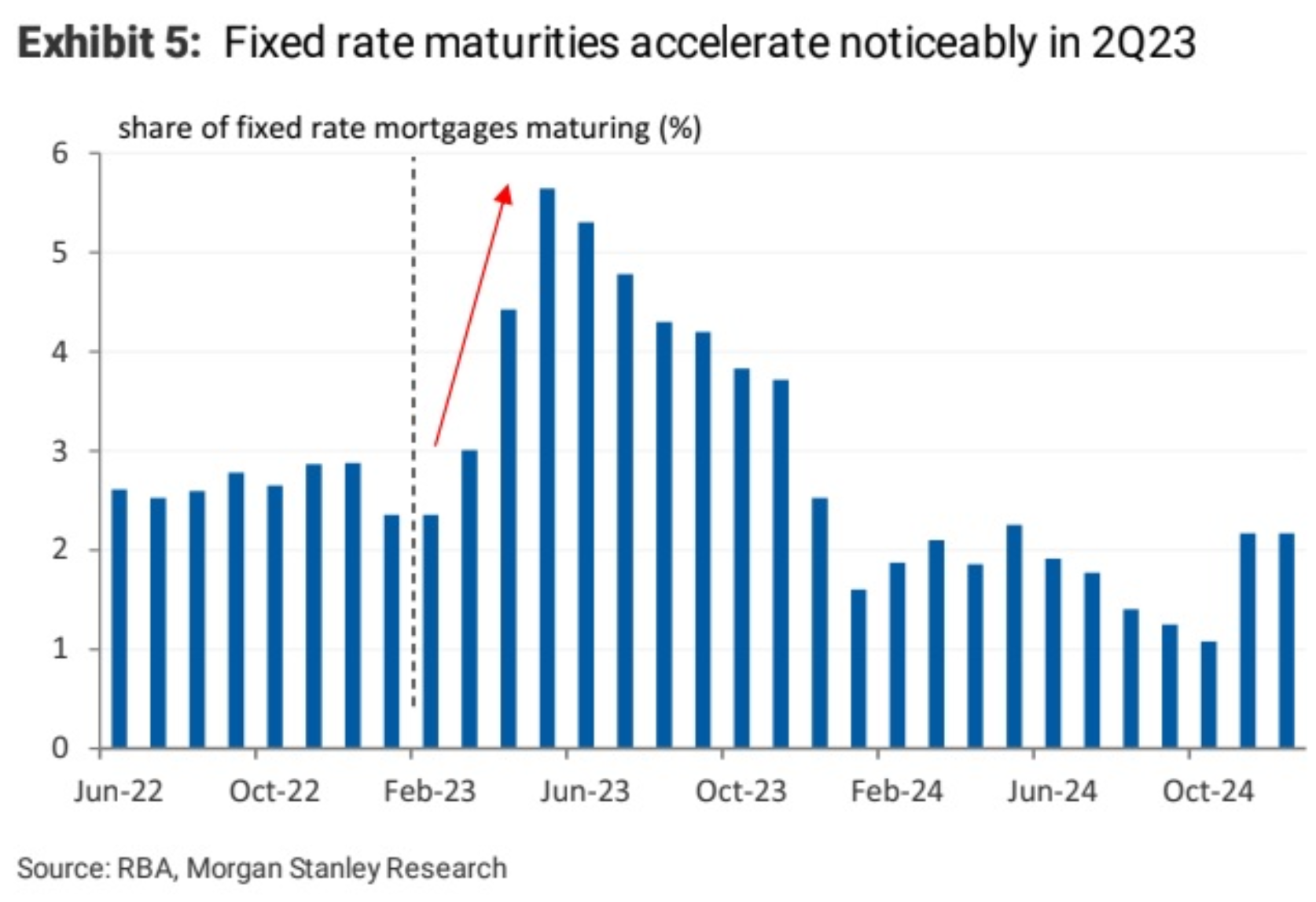

These mortgages are now expiring en masse, as illustrated in the next chart:

These borrowers are converting from cheap pandemic fixed rates of around 2% to variable rates above 6%.

As a result, the average monthly repayment on a $750,000 mortgage will soar from $3,180 to $4,830.

The financial pressure from rising mortgage repayments is forcing borrowers to search for a better deal.

Refinancing activity should also continue to boom given there are still huge volumes of fixed rate mortgages scheduled to expire over the remainder of this year.

If you are looking to save thousands of dollars in mortgage repayments, try the MB Compare n Save mortgage comparison tool. It takes less than a minute. And if you choose to refinance, Compare n Save will handle the process.