Morgan Stanley with the note.

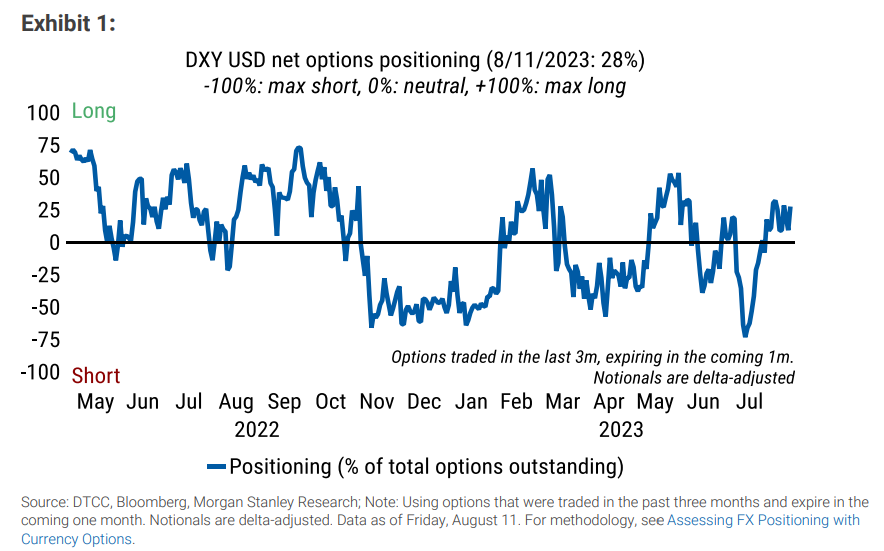

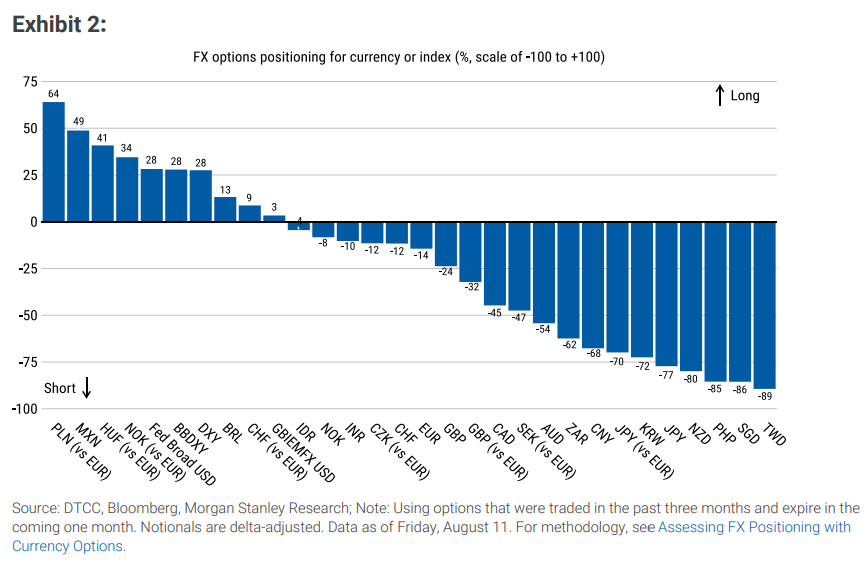

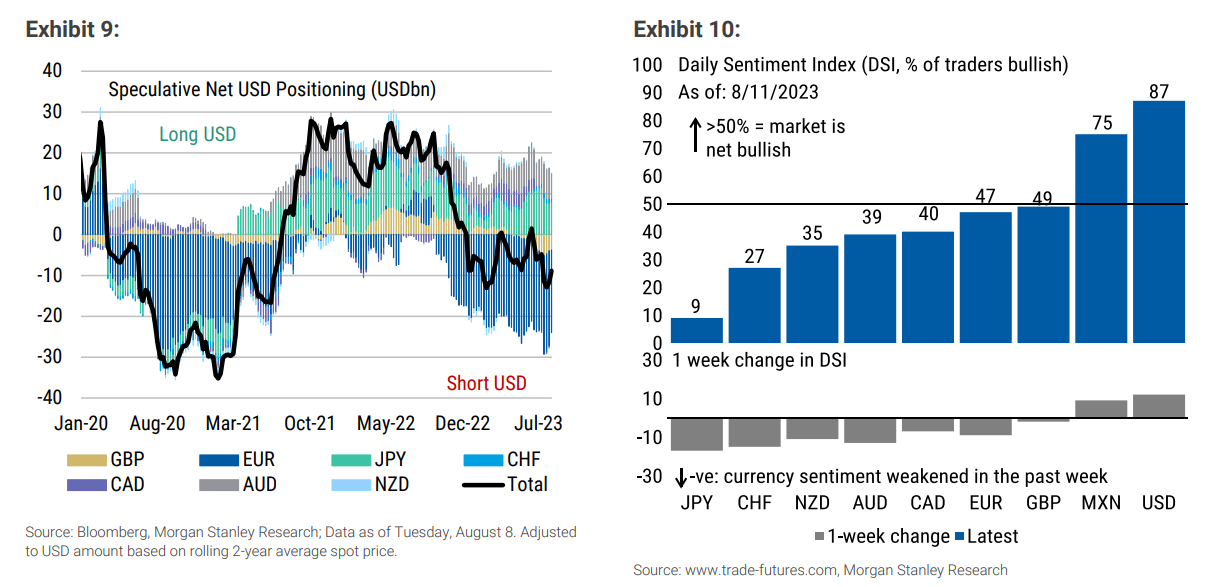

In the week ending Friday, August 11, options pricing data indicate that investors added long USD (DXY) positions, and increased short NOK (vs. EUR) and JPY positions. In the futures market, NZD and CAD shorts against USD were added, while investors bought CHF in the week ending Tuesday, August 8. Overall, options data suggest that tactical investors are most long NOK (vs. EUR), while being short NZD and JPY. Positioning in the futures market is long EUR and GBP, and most short USD (DXY) and AUD. Options data show that USD (DXY) positioning is slightly long, while data from the futures market point to net USD short positions.

Plenty of room for DXY to run higher there. Especially since it usually specs that set the price. That EUR long looks like a deer in the headlights.