The Australian Bureau of Statistics (ABS) has released its Household Spending Indicator for June, which reported household spending was 1.8% higher compared to June last year:

Through the year, household spending increased for services (+4.6%) but fell for goods (-1.2%).

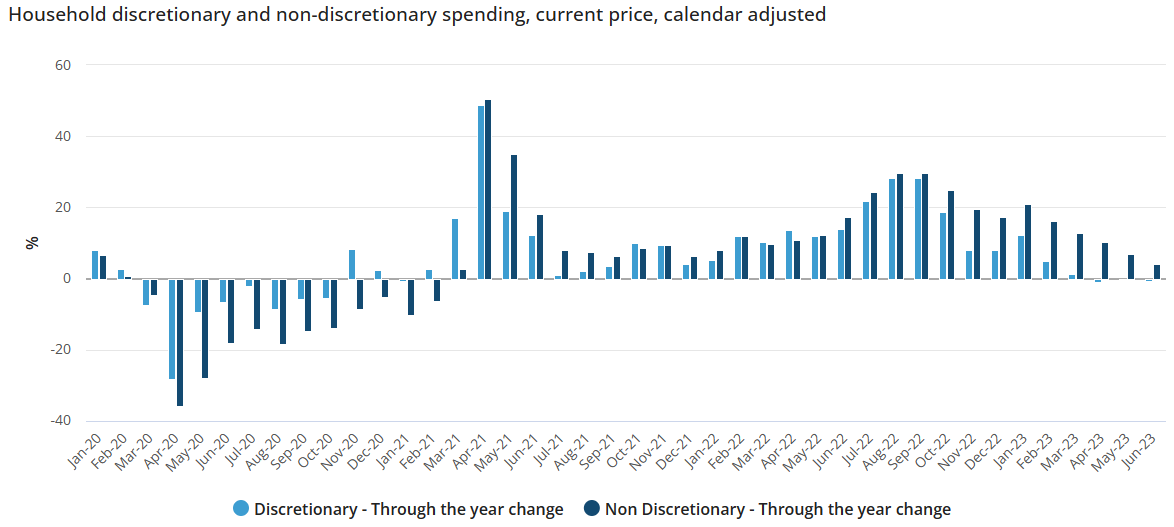

Through the year, household spending increased for non-discretionary (+4.2%) but fell for discretionary (-0.7%).

Ben Dorber, ABS head of business indicators, said: “This was the smallest growth in household spending since February 2021.

“Spending on discretionary goods and services was down for the third straight month, falling 0.7% over the year, as households adjust to cost of living pressures.

“Non-discretionary spending rose 4.2%, however the growth rate has been slowing since January, when it reached 21.0%”.

Given that Australia’s inflation rate was 6.0% in the 2022-23 financial year and Australia’s population grew by 2.0% over the same period, real per capita household spending would have fallen sharply.

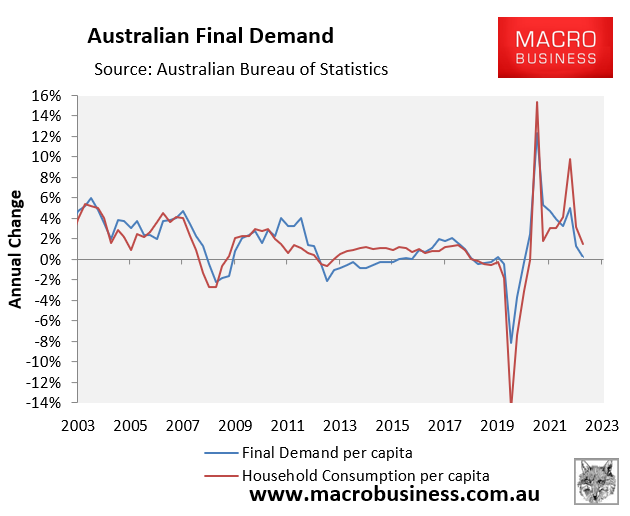

Household spending is the main driver of Australia’s economic growth. And where household spending goes, the economy generally follows.

This relationship is shown clearly in the next chart from the March quarter national accounts:

Therefore, the collapse in real household spending points to falling GDP growth.

Australia’s economy is already experiencing a deep per capita recession.

Based on this data, there is a decent chance of Australia experiencing a ‘technical recession’ of two consecutive quarters of negative aggregate GDP growth.

The only think currently preventing the Australian economy from diving into a deep technical recession is the Albanese Government’s record immigration program.

The overall economy has been growing modestly, but everybody’s share of the economic pie has shrunk, alongside their wages and living standards.