CoreLogic in conjunction with the Housing Industry Association (HIA) has released its quarterly Residential Land Report, which provides disturbing data on residential land prices.

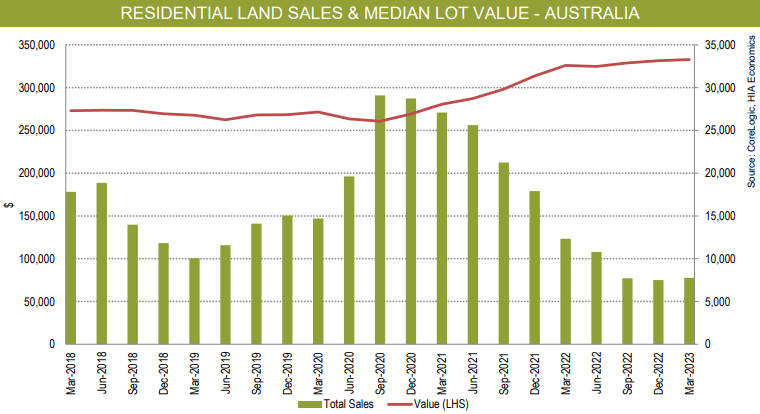

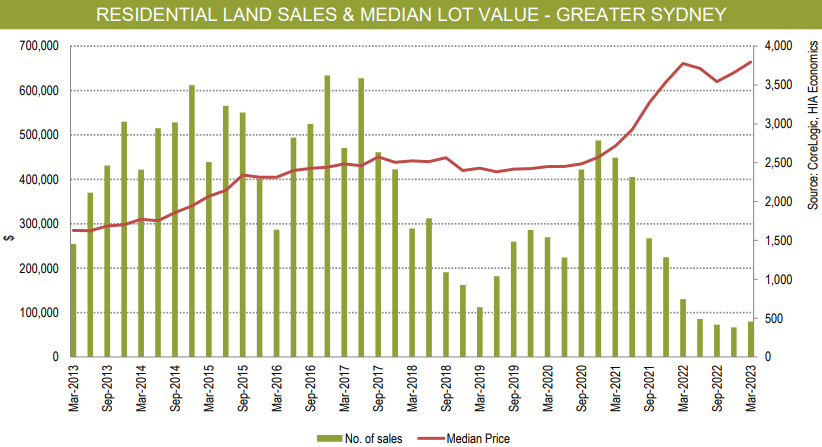

Despite record immigration-driven demand for housing, the volume of residential land sales fell by 37.2% in the March Quarter of 2023 compared to the same quarter the previous year. They also accounted for just half the number of lots sold in the March Quarter of 2013.

At the same time, the national median lot price rose to a record high $335,000:

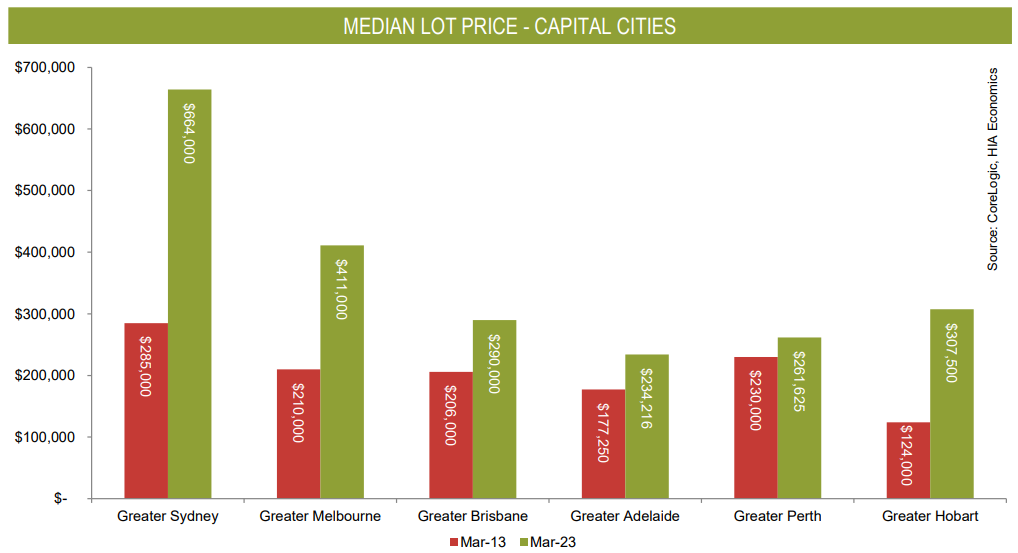

Over the decade to March 2023, median lot prices have soared across the capital cities, with Sydney and Melbourne experiencing the sharpest growth:

The rate of land cost inflation across the capitals was as follows over the decade:

- Sydney: +133%

- Melbourne: +96%

- Brisbane: +41%

- Adelaide: +32%

- Perth: +14%

- Hobart: +148%

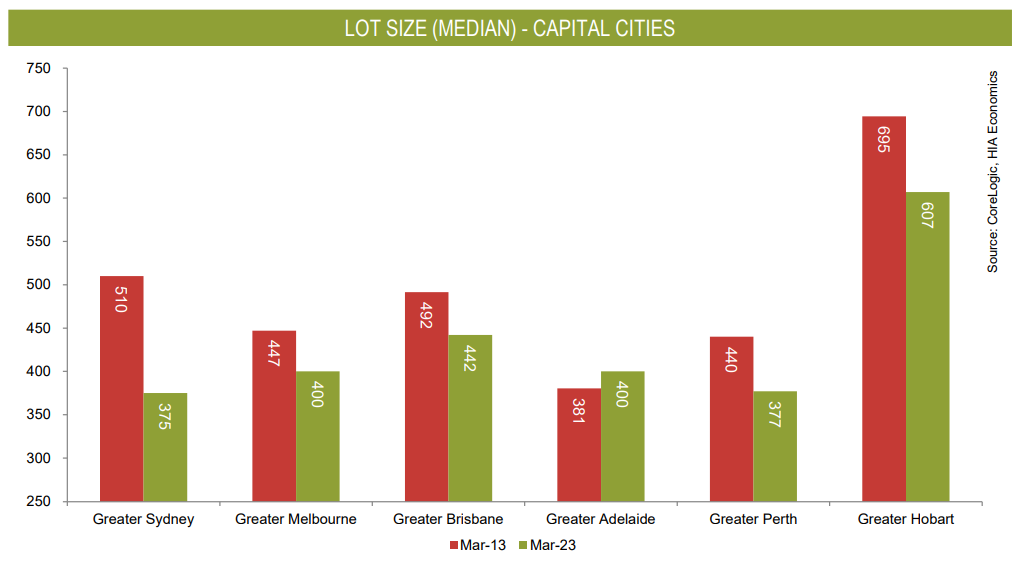

To add insult to injury, median lot sizes have shrunk across the capital cities, with Sydney leading the decline:

The shrinkage in lot sizes across the capitals was as follows over the decade:

- Sydney: -26%

- Melbourne: -11%

- Brisbane: -10%

- Adelaide: +5%

- Perth: -14%

- Hobart: -13%

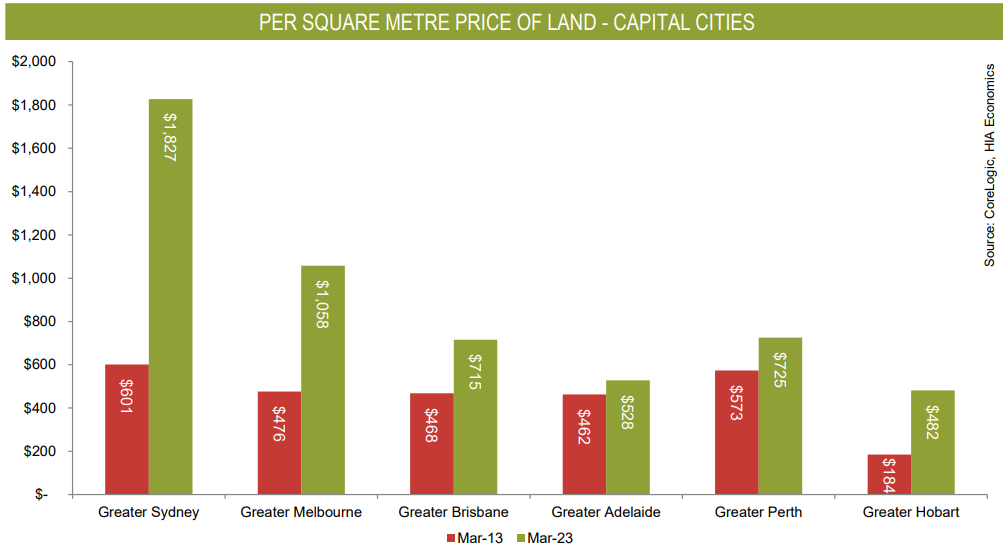

As a result, the cost per square metre has surged even higher across Australia’s capital cities, led by Sydney whose cost is now nearly twice the capital city average:

The inflation in land per square metre was as follows across the capitals over the decade:

- Sydney: +203%

- Melbourne: +122%

- Brisbane: +53%

- Adelaide: +14%

- Perth: +27%

- Hobart: +162%

The next chart on Sydney makes depressing reading. It shows median lot prices more than doubling over the decade as lot sales have collapsed:

Unfortunately, Australia has transformed into a country where housing options are being confined to an expensive shoebox apartment or an expensive tiny lot on the outskirts far from amenities.

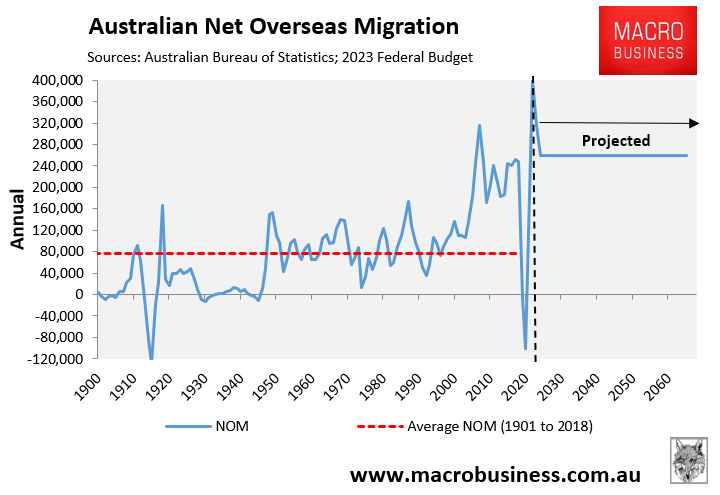

The situation will deteriorate further as the Albanese Government’s record immigration drives thousands more people to live inside the confined urban footprints of our main capital cities:

The only plausible outcome from the Albanese Government’s extreme immigration is higher land values and Australians living in smaller, more expensive housing, as well as on the streets.

It is as profound failing from a government that pretends to hold “affordable housing” as a key policy goal.