One month is a long time in the world of property.

Just last month we witnessed multiple reports proclaiming that investors were fleeing Australia’s property market en masse, especially across Sydney and Melbourne:

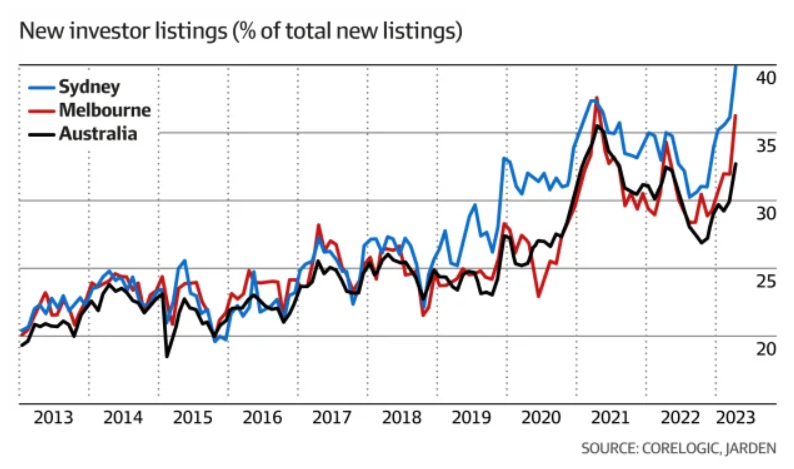

Last month’s CoreLogic chart pack also showed that nearly one-third of new for-sale listings were being added by investors, up from the decade average of one-quarter:

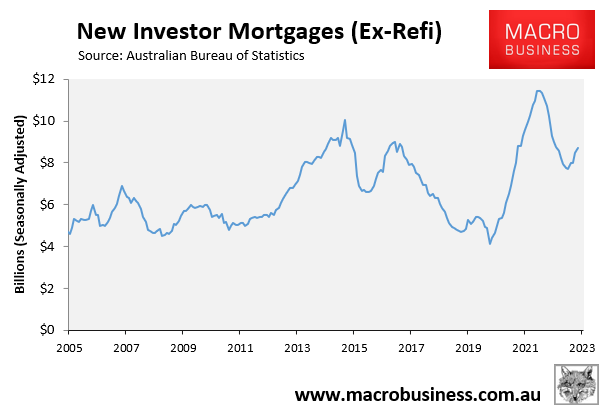

This narrative flipped last week when mortgage origination data from the Australian Bureau of Statistics (ABS) showed that new investor mortgage commitments are returning and approaching their 2015 and 2017 peaks:

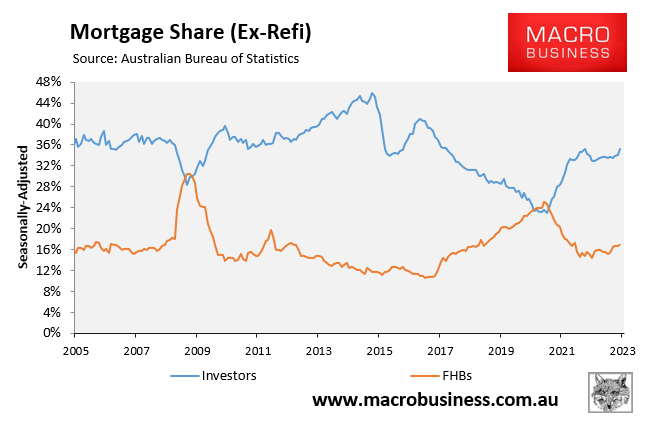

Furthermore, the proportion of new mortgages going to investors has grown to 35.3%, the highest since 2017, at the expense of first-home buyer demand:

REA Group economist Angus Moore told Sky News host Ross Greenwood that investor demand is clearly picking up, especially across Sydney:

“We are actually seeing a bit more in terms of investors in the market at the moment. If we look at ABS data, the share of mortgages going to investors [is] sitting a little bit above a third at the moment nationally. It’s as high as about 40% in New South Wales”.

“What we’re seeing at the moment is just the fact that rental markets are really attractive for investors”.

“Vacancy rates across the country are extremely low – as low as one and a half percent in most capital cities or even lower in places like Adelaide and Perth where they’re sub one percent”.

“[This] means you just have very low risk of your property sitting vacant, so that’s quite attractive to investors”.

“At the same time, we’re seeing very brisk rent growth right across the country including increasingly in Sydney and Melbourne, which really wasn’t the case over the past few years”.

“To put that in some perspective, over the last year median rents for units in Sydney and Melbourne are up nearly 20%. That’s that’s very brisk and that’s probably attractive to investors at the moment”.

“You’ve still got migration rising in Australia. You’ve still got the lack of building taking place. So, the equation is rents are rising, they’ll continue to rise which again will tick the odds in favour of these investors who are obviously smelling the breeze”.

“The fact that interest rates look like we might have reached the peak, that’s going to start to make that a bit more attractive”.

Investors are not quitting Australia’s housing market.

Rather, we are seeing a significant level of churn, in which investors sell to other investors.

Given that interest rates are at or near their peak and rents are rapidly rising, demand from property investors should increase as we approach 2024.