The 2023 Intergenerational Report (IGR) that because of Australia’s compulsory superannuation system, the federal budget will spend less on aged pension despite doubling of retirees.

According to the IGR’s projections, Australia on track for pension payments to shrink from 2.3% of GDP to 2% by 2062-63 as superannuation balances grow from 116% of GDP today to 218%.

In 2062-63, approximately 9 million Australians will be aged 65 or older, although a smaller proportion will receive the aged pension or other income support, a 15% decrease from 2022-23.

Treasurer Jim Chalmers jumped on the findings claiming Labor’s genius compulsory superannuation system is saving the federal budget:

“Our population is ageing but our spending on the age pension will fall – that’s the intergenerational genius of super”.

“Super is delivering on its promise – providing a better retirement for more Australians and a better outcome for the budget over the next 40 years”.

“Labor built the super system and we’ve always worked to protect it and make it stronger.”

However, like always, Jim Chalmers is being loose with the truth.

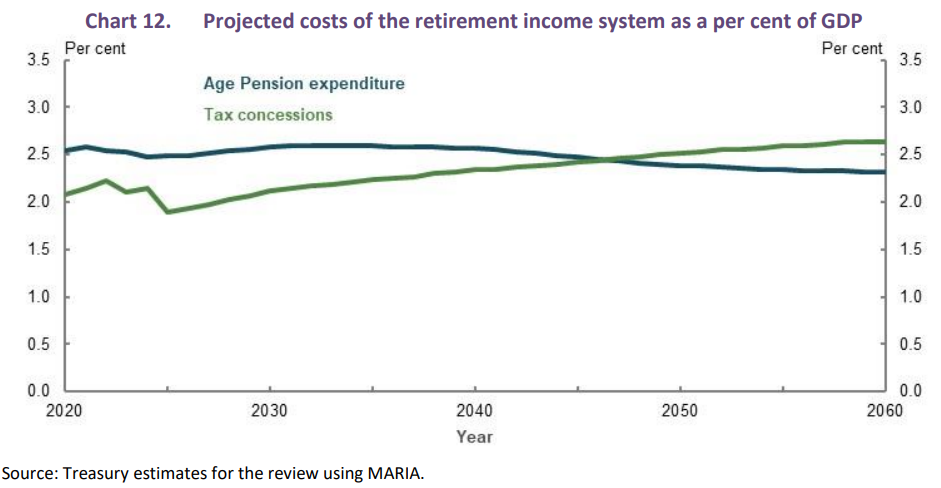

While spending on the aged pension will shrink by around 0.3% of GDP, the cost of superannuation concessions to the federal budget will balloon, overtaking the pension.

“Superannuation tax concessions as a proportion of GDP are projected to increase from around 1.9% in 2022–23 to 2.4% in 2062–63”, the IGR says, overtaking the aged pension in the 2040s.

The Australian Treasury’s 600-page Retirement Income Review Final Report likewise found that superannuation concessions would overtake the cost of the aged pension by around 2050:

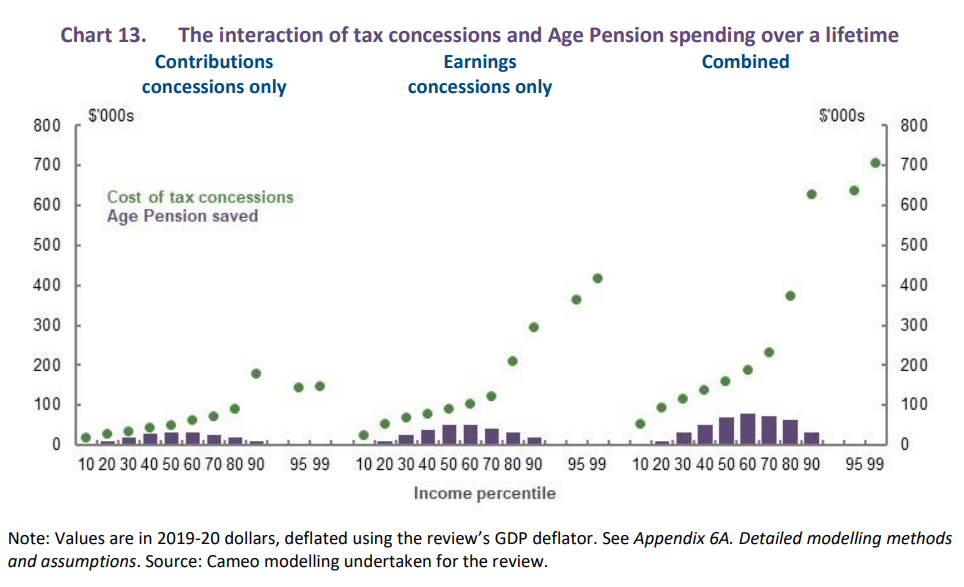

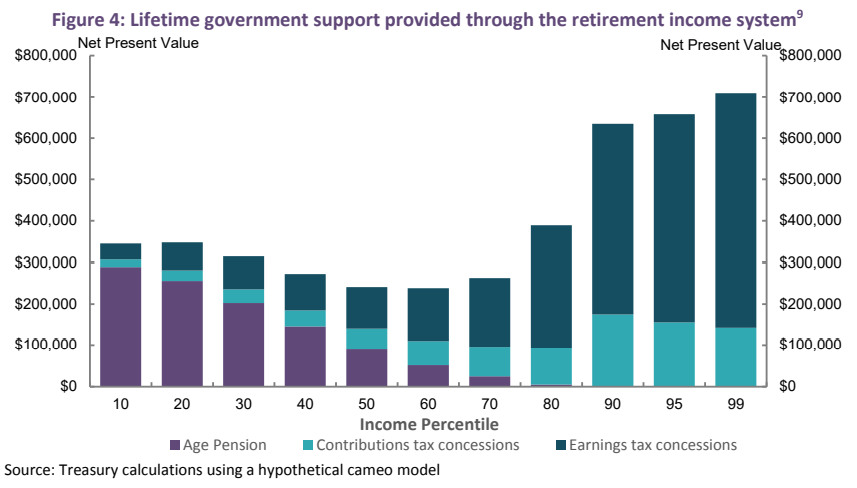

Worse, superannuation tax concessions are unequally distributed, overwhelmingly benefiting those on the highest incomes:

Indeed, the top 1% of taxpayers receive about 14 times as much in tax concessions as the bottom 10% of income earners, according to the Australian Treasury:

The reality is that superannuation has evolved into an expensive and inequitable tool for wealth building and inheritance, amplifying gaps in working-life wages into retirement.

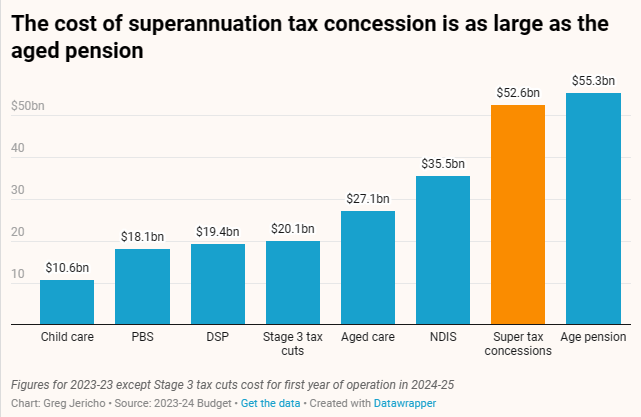

That’s why Jim Chalmers this year said that the government “can’t ignore the cost of these tax [superannuation] concessions with all of the other pressures which are on the budget”.

Because the cost of superannuation concessions is already almost as large as the aged pension and will soon overtake it:

The least Jim Chalmers can do is be honest about the situation.

Given the exorbitant cost, inefficiency, and poor targeting of superannuation concessions, good public policy necessitates unwinding these concessions and redirecting the savings into the aged pension, which is far more efficient and equitable.