John McGrath, CEO of McGrath Estate Agents, is the latest vested interest to vomit fake solutions to Australia’s housing crisis.

Joining an unprecendented chorus of denial, McGrath has denied that the federal government’s unprecedented immigration program, which is projected to see 1.5 million net overseas migrants land in Australia by 2026-27 (equivalent to an Adelaide’s worth of people), is driving the shortage of homes.

Rather, it is because 67% of Australians choose to live in capital cities rather than the regions:

“The biggest demand issue I see is not immigration or population growth, it’s that 67% of Australians choose to live in one of just eight capital cities, according to the 2021 Census”.

“That sort of population concentration is a key factor exacerbating demand in those eight locations”.

“We need an influx of skilled labour given so many businesses can’t find enough staff”.

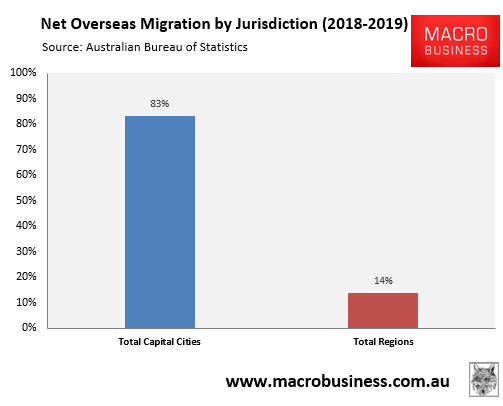

This line of argument makes zero sense given immigration is driving Australia’s population increase and demand for housing. Worse, overseas migrants are far more likely to live in the capital cities (especially Sydney and Melbourne) than the Australian-born population:

The Productivity Commission’s Migrant Intake into Australia report revealed that 86% of immigrants lived in the major cities of Australia in 2011 (mostly Sydney and Melbourne), whereas only 65% of the Australian-born population did:

The 2016 Census revealed identical results, with 86% of new migrants (1.11 million) in the five years to 2016 settling in Australia’s cities, versus just 14% (187,000) that settled in Australia regional areas over the same period.

“In 2016, Sydney had the highest overseas-born population of all capital cities (1,773,496), followed by Melbourne (1,520,253) and Perth (702,545)”, noted the ABS.

“The 2016 Census also reveals that those born overseas were more likely to live in a capital city (83%), a much higher percentage than people born in Australia”.

In the financial year before COVID hit, 83% of migrants landed in the capital cities versus just 14% in the regions:

Settlement data for the Albanese Government’s record immigration is not yet available. However, you can bet your bottom dollar that they would have gone to the major cities.

Thus, if McGrath truly believes that the problem is too many people choosing to settle in the capital cities, then the best solution is to cut immigration. The data is clear.

Moving on to ‘solutions’. Rather than reducing demand to sustainable levels by cutting immigration, McGrath has chosen the non-solution of magically increasing supply via easier planning, reduced developer taxes, blah, blah, blah:

“My solution would revolve around the release of more land, plus reducing the statutory costs associated with development, and a swifter development approval process”.

“If governments provided more cost-effective, expedient development opportunities for developers to build, and conducted a sensible review of rezoning opportunities in areas that would cope with higher density living, we could improve supply significantly”.

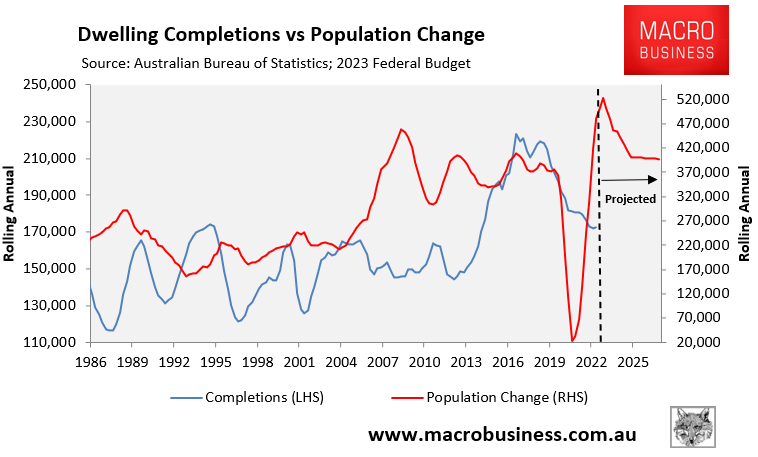

Except that Australia lifted supply to record levels last decade. The problem was that it still wasn’t enough to keep pace with the massive rise in immigration from 2005:

As shown directly above, Australia’s population is officially projected to balloon by 2.18 million people in the five years to 2026-27 – equivalent to a Perth’s worth of people – driven by record 1.5 million net overseas migration over the same period.

No amount of “planning” can ever cope with such a massive population deluge in such a short period of time.

The reality is that running a mass immigration policy means that our major cities will forever be crush-loaded, placing extreme further pressure on infrastructure and housing, and destroying living standards for incumbent residents.

We are all McGrathmageddon now.