A new survey from Finder shows that home ownership is becoming increasingly out of reach for many Australians, with 31% of non-homeowners surveyed believing they will never be able to purchase a home.

The figure shows a 10% increase in since the question was posed in 2020:

This comes as a report from the National Housing Finance & Investment Corporation (NHFIC) and the Commonwealth Bank highlights the growing cost of entering the housing market.

The report shows that the average gross household income for first-home buyers with the CBA was about $117,000 in early 2023, while the average purchase price was almost $629,000.

Meanwhile, the average deposit for first-home buyers was $159,000. This compares with just $108,400 at the start of 2020.

SQM Research MD Louis Christopher says the figures suggest that many people are getting financial help from their parents to buy their first home. This in turn means that people who cannot rely on the so-called ‘bank of mum and dad’ are being locked out of the housing market.

“The average first-home buyer, even a couple, on the average household income, would likely take up to 10 years to save a $159,000 deposit”, Christopher said, noting that the figures would be worse for Sydney and Melbourne.

Richard Whitten, home loans specialist at comparison website Finder, said many first-time buyers cannot afford such high deposits.

“Wage growth over the past few decades simply hasn’t kept up with skyrocketing property prices”, he said.

Soaring rental costs are also eroding young Australians’ ability to save a deposit.

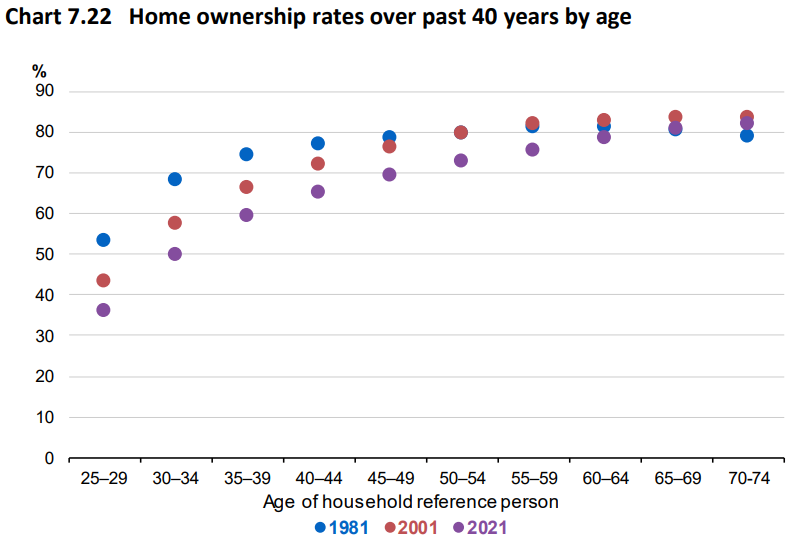

The latest Intergenerational Report (IGR), released last week, showed that the rate of home ownership fell by 18 percentage points from 1981 to 2021 for those aged between 30 and 34, and 17 percentage points for those aged 25 to 29:

The true situation is actually worse given Australians are increasingly being show-horned into high-rise apartments and granny flats:

As a result, the type, quality and cost of housing has worsened for younger Australians relative to prior generations.

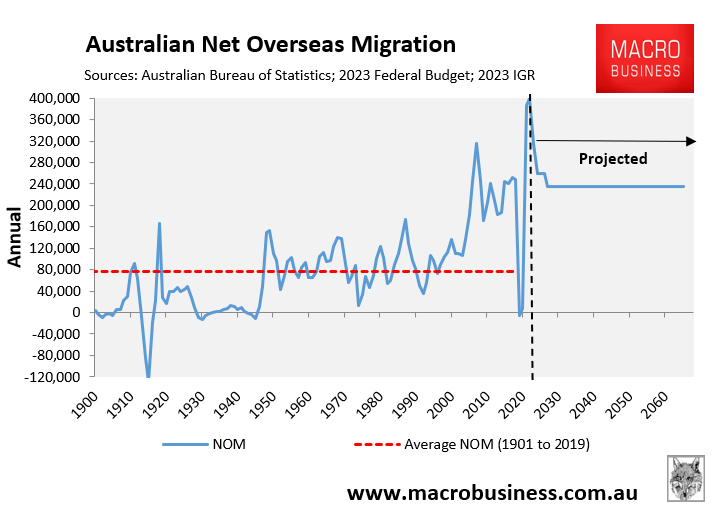

The federal government’s ‘Big Australia’ immigration policy will ensure that home ownership rates continue to fall in the future.

According to the 2023 IGR, Australia’s population will grow by 14.2 million people over the next 40 years to 2062-63 due to unprecedented levels of net overseas migration:

This 14.2 million projected population rise is equivalent to adding a combined population of Sydney, Melbourne, Brisbane, and Adelaide to Australia’s existing population in only 40 years.

Few policies are more harmful to young Australians seeking a place to live than forcing them to compete for housing with hundreds of thousands of new migrants each year.

Future Australians will have to make do with cramped high-rise shoebox dwellings owned by the landlord class and corporations.

You will rent and be happy.