A new survey by Finder shows that a significant number of mortgage-stressed households are considering selling their homes.

This comes as 39% of Australian mortgage holders, or 1.3 million households, said they were struggling to repay their loans.

According to Finder, 40% of property investors are struggling to meet mortgage repayments and are concerned they will have to sell their investment property.

this equates to almost 900,000 investors that may be forced to sell due to rising mortgage repayments and cost of living.

Moreover, one in seven sole property owners, or 515,000 households, are concerned they may have to sell their family home.

“Borrowers are experiencing a huge financial shock after a relentless climb in interest rates over the past year and homeowners weren’t coping”, Finder home loans expert Richard Whitten said.

“Many borrowers have already pulled back on all non-essential spending — they have no money left to contribute to their mortgage”.

“They feel like they’ve got little choice but to sell up or lose their home”.

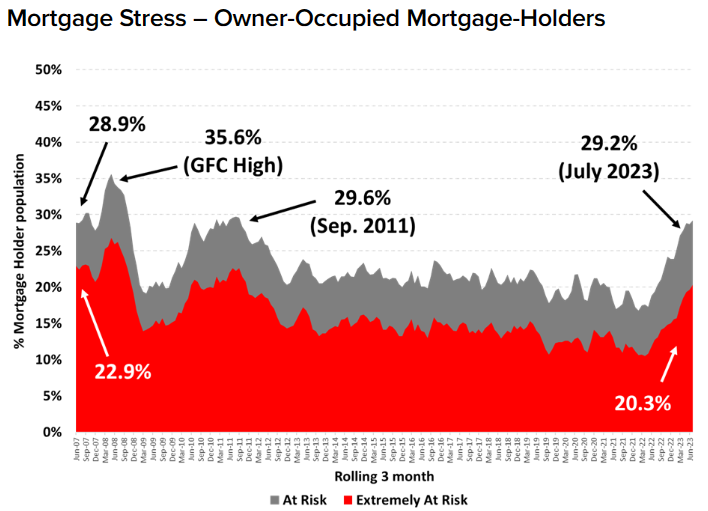

Finder’s results follow Roy Morgan’s latest data showing that 1.5 million households are now under stress:

Source: Roy Morgan

The situation could worsen even if the RBA keeps the official cash rate on hold.

First, Australia’s unemployment rate is expected to rise over the next 12 months owing to the slowing economy combined with strong labour supply growth (via record immigration).

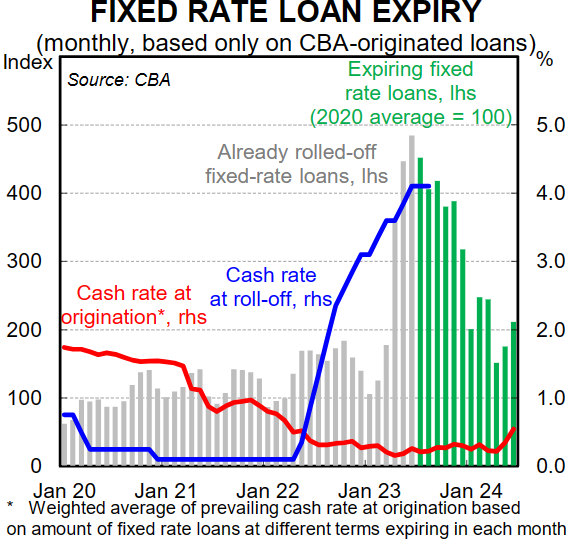

Second, only around two-thirds of the RBA’s rate hikes have been passed on to mortgage holders, according to CBA.

However, because of the fixed rate mortgage cliff, this figure will rise to around 85% by year’s end:

Source: CBA Economics

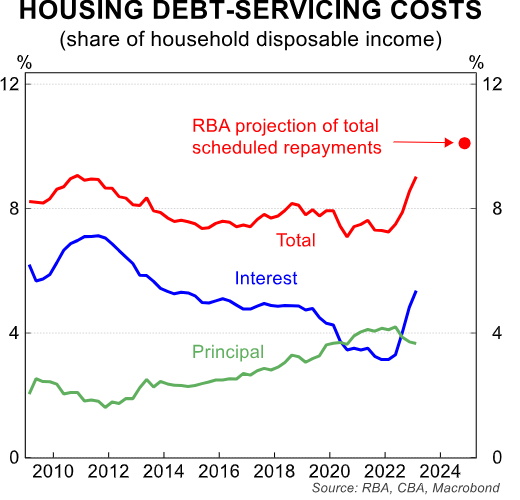

Moreover, by mid 2024, Australian households will be paying their highest share of income on debt repayments on record, according to CBA:

Therefore, mortgage stress will inevitably rise irrespective of what the RBA does with interest rates. And this should deliver an increase in forced property sales.