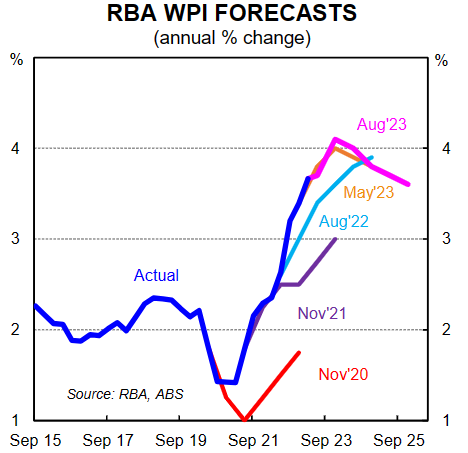

The Reserve Bank of Australia’s (RBA) August Statement on Monetary Policy (SMP) made some slight upward revisions to annual wages growth over the next year to peak at 4.1% in Q4 23:

Source: CBA Economics

On Tuesday, the Australian Bureau of Statistics (ABS) will release the Q2 23 Wage Price Index (WPI), which will be a critical input that will determine whether the RBA hikes the official cash rate next month.

The CBA’s economics team forecasts a 0.9%/qtr gain, taking annual wage growth to 3.7% (from 3.6% in the year to March).

But if wage growth comes in significantly above expectations, then the RBA could be forced to hike rates further next month.

CBA’s internal data on wages points to continued strong pace in annual growth, but no material acceleration as yet.

Given this, CBA forecasts WPI growth to peak below 4.0%, which is below the RBA’s forecast.

CBA also forecasts that Q1 24 will be the first quarter in which workers will experience annual real wages growth since March 2021.

According to the August Melbourne Institute consumer survey, workers reported a pick up in actual wages growth (black line below):

Source: Macquarie Macro Strategy

Those reporting a pay rise also picked up:

Source: Macquarie Macro Strategy

However, both remain low versus the pre-2014 period.

More importantly, expected wage inflation fell back after a (minimum wage announcement effect) spike in July:

Source: Macquarie Macro Strategy

The correlations in the above charts suggest wage growth will soon peak.

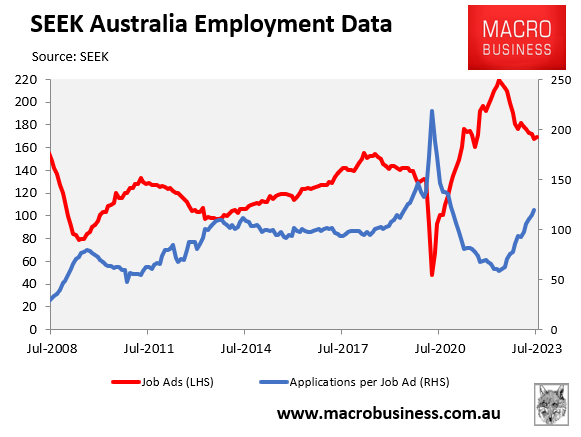

This makes sense given partial data shows that Australia’s labour market is loosening as supply (via record immigration) expands ahead of labour demand.

Applications per job ad are now above the worst of the mining crash low-flation period of 2015-2020:

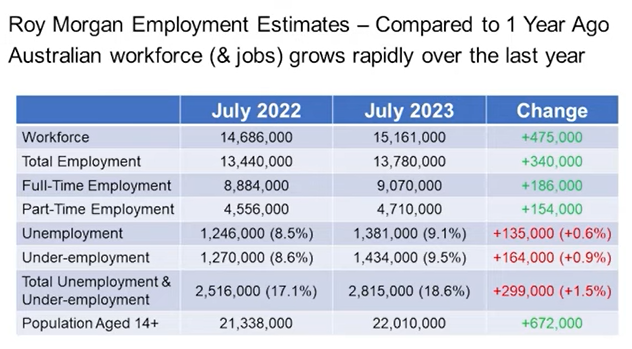

Roy Morgan’s data shows the labour force is growing much faster than the jobs market:

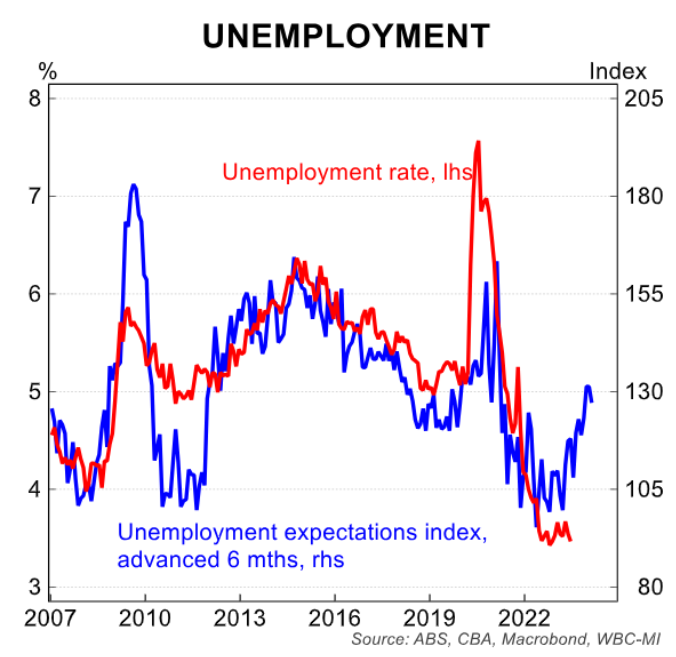

In turn, the unemployment rate will soon rise:

Record growth in labour supply in the face of a slowing economy will inevitably drive up unemployment and stifle wage growth.