By Belinda Allen and Stephen Wu, economists at CBA:

Key Points:

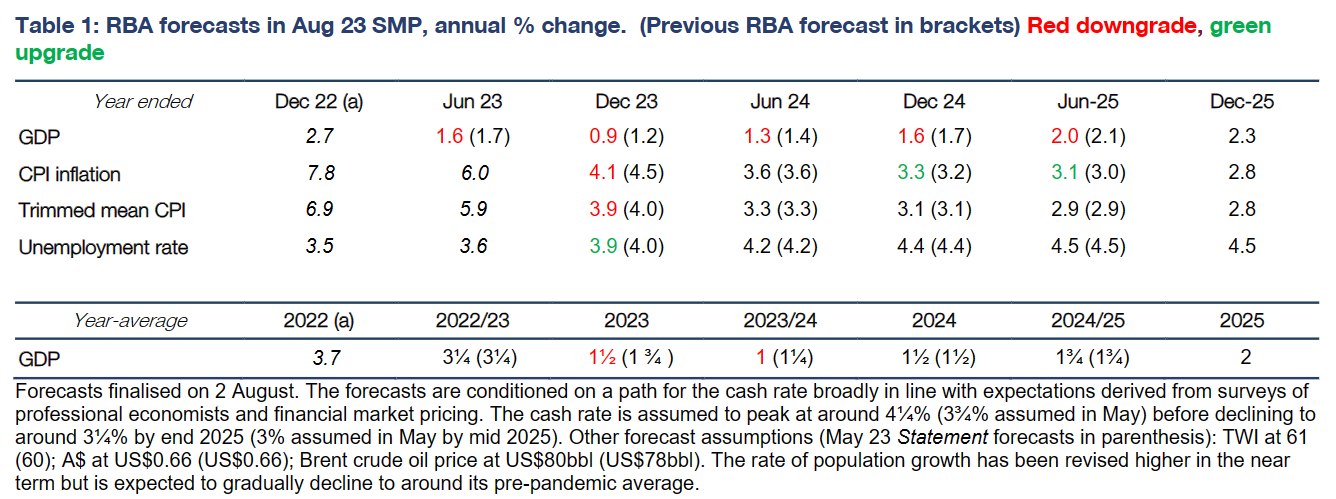

- The RBA has downwardly revised their December 2023 forecasts for inflation and GDP growth.

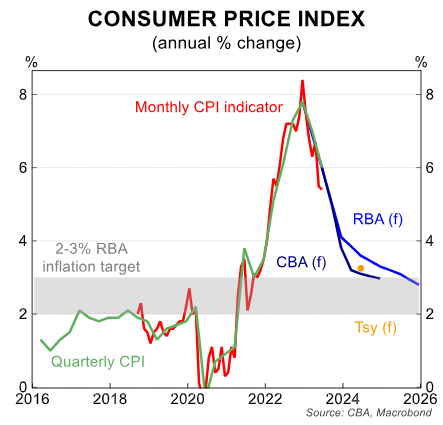

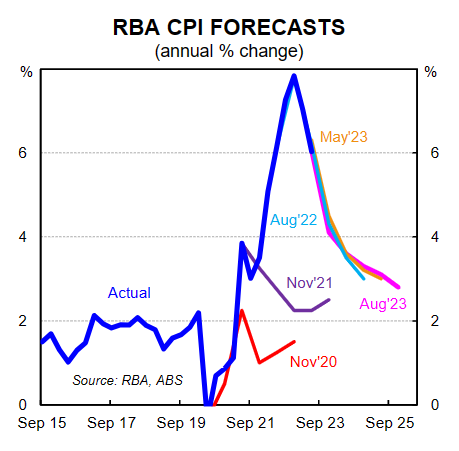

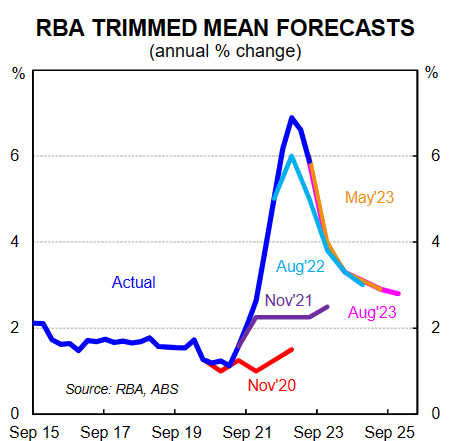

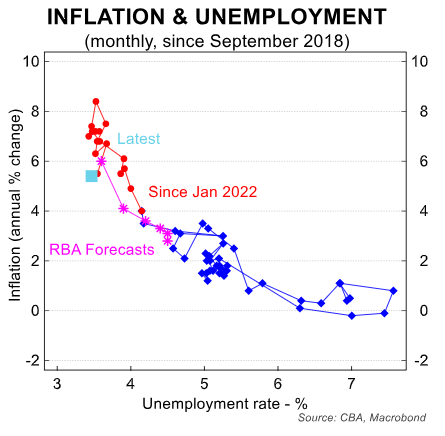

- The RBA now expects headline inflation to be 4.1% in Q4 23 and 3.3% in Q4 24. We expect inflation at 3.0% in Q4 24.

- The RBA expects inflation to be within the target band by the end of 2025, later than our expectation.

- The RBA now expects GDP growth to be 0.9%/yr in Q4 23 before recovering to 1.6%/yr in Q4 24. We expect 0.7% and 1.9% respectively.

- The labour market is also expected to be in a slightly better position by the RBA at year-end with the unemployment rate at 3.9% before drifting higher next year and peaking at 4½% in 2025. We expect the unemployment rate to be 4.2% in Q4 23.

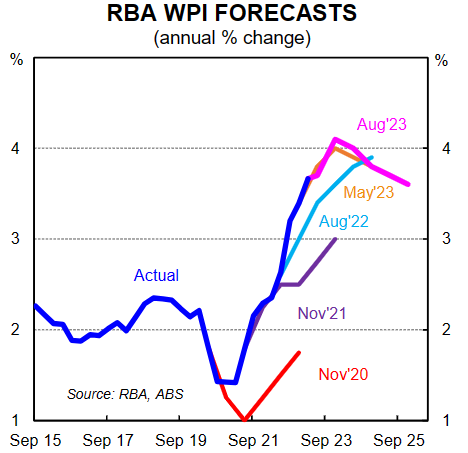

- The RBA also made some slight upward revisions to annual wages growth over the next year to peak at 4.1% in Q4 23.

- The RBA’s forecasts assume a peak in the cash rate at 4¼% (current cash rate is 4.10%), higher than assumed in May.

- We expect 4.1% to be the peak in the cash rate this cycle. The hurdle to hike again is high.

- We expect an easing cycle to commence in Q1 24, but the resilient labour market could push this start date later.

The RBA’s updated forecasts reinforce that 4.10% is the peak in the cash rate:

The RBA’s August Statement on Monetary Policy (SMP) comes after the RBA left the cash rate on hold at 4.10% in August, the second consecutive on-hold decision.

We see the cash rate on hold at 4.10% until Q1 24 before an easing cycle commences.

The cash rate where it stands now is working to bring inflation back down, slow economic activity whilst preserving some of the gains made in the labour market.

The refreshed RBA forecasts released on Friday reflect this shift in the economic environment over the past three months.

In short, both GDP and headline CPI forecasts for December 2023 have been lowered, as has the unemployment rate. Longer term forecasts for each of these indicators though are little changed.

The even keel the RBA has been aiming for seems closer to reality. We had expected one last rate hike at the August meeting, based on lingering concerns around upside risks to wages and inflation and a still strong labour market. It seems the RBA now feels the rate hikes in May and June counteracted those risks that were evident back in May.

The SMP noted “The Board raised interest rates by 25 basis points at the May and June meetings, to provide greater confidence that inflation would return to target over the forecast horizon”.

The RBA appear more comfortable inflation is coming back down, particularly given there is still a large amount of pass-through from the hiking cycle still to come. The SMP noted “The Board’s current assessment is that the risks around the inflation outlook are broadly balanced”.

However, the forces at play over the past three months have evolved differently than expected back in May. Stronger growth in unit labour costs and higher rent inflation has been offset by weaker-than-expected goods inflation and downgrades to the activity outlook.

Despite the balanced inflation outlook a tightening bias does remain in place. The forward guidance in the SMP is the same as in the August Board post-meeting statement “Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon the data and the evolving assessment of risks”.

Our take on this forward guidance is that the Board is willing to raise the cash rate again in this cycle, but only if needed. As we noted on Tuesday after the decision, the hurdle to hike again is high. The onus is on the economic data to prove the case.

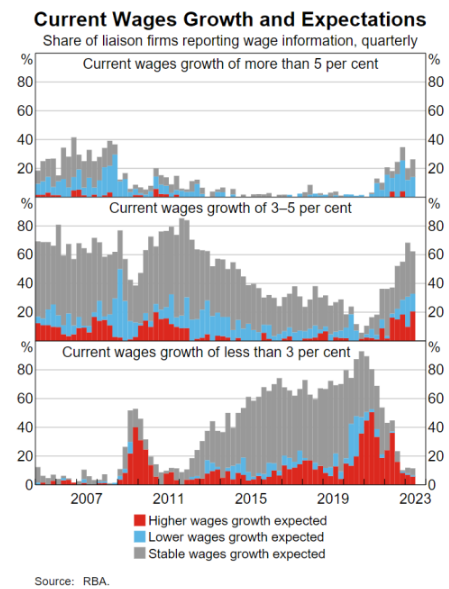

The main pressure point will likely come in the form of Q3 23 annual wages growth printing higher than expected (data due November). We expect by this time the activity side of the economy has cooled enough that another rate hike is off the cards.

We think it is unlikely for an upside surprise in wages occurring earlier given the partial data for wages seen for Q2 23 (data due 14/8).

Put another way, we do not think the RBA will lift the cash rate again if the economic data print in line or weaker than their forecasts.

RBA and CBA forecasts are converging

We continue to expect the economy to slow more quickly than the RBA does from here, but our forecasts and the RBA’s forecasts are converging.

The RBA forecasts GDP growth to be 0.9%/yr in Q4 23 (was 1.2%/yr). In contrast we see GDP growth at 0.7%/yr in Q4 23.

Both the CBA and RBA forecasts for GDP in 2023 imply a per capita recession given population growth is near 2.5%/yr.

Our expectation for growth to be softer than the RBA means we forecast the unemployment rate to rise a little more quickly. We expect the unemployment rate to lift to 4.2% by December 23.

The RBA lowered its forecast a little to 3.9% (was 4.0%). The RBA then forecast the unemployment rate to lift to 4.2% in June 2024 (we expect 4.6%).

A resilient for longer labour market is a clear risk for our call of rate cuts starting in Q1 24. If we see the labour market remain resilient for longer, in other words more in line with the RBA’s forecasts, it is unlikely we will see rate cuts as early as we expect.

A slower growth profile, and less optimistic labour market profile also leads us to expect inflation to recede more quickly than the RBA. We expect it to print at 3.8% in December 2023, and the RBA now expects 4.1% (a big revision down from 4.5% in May).

Part of this shift lower in the inflation profile can be explained by energy and other government policies, goods disinflation and a better balance between supply and demand.

We also forecast wages growth, as measured by the wage price index (WPI), to peak at 3.8%/yr, compared with the RBA’s forecast of a peak in wages growth of 4.1%/yr (upgraded from 4.0% in May, but down from the 4.2% expected in February).

Part of this upgrade to the RBA’s wage forecasts relate to developments in government wages policies in several states, the annual minimum and award wage decision by the FairWork Commission and the 15% lift in wages for ages care workers.

The outlook for the cash rate:

From a monetary policy perspective we think that the RBA will not hike the cash rate again in this cycle. This is simply based on our take of the Board’s reaction function from here.

As we noted above the economic data will need to print stronger than the RBA’s updated forecasts for them to increase the cash rate again. And that is not our base case.

As we note above though the risks still sit with another hike, given a resilient labour market, sticky services inflation and the recovering housing market possibly boosting consumption. The hurdle though is high.

Looking further ahead our base case sees the RBA commence an easing cycle in Q1 24, with the 18-19 March meeting our favoured meeting under the new schedule.

This will see a 9 month difference between the last hike and the first cut. There is though a real risk that the first easing occurs later than our expectation, particularly if the labour market performs more in line with the RBA’s forecast.

The timing of rate cuts in Australia aligns with our timings for rate cuts in other major central banks, particularly the US FOMC.

We expect the FOMC to begin to ease monetary policy in Q1 24 as well, as the US economy slows and inflation moderates.

Our working assumption is that the annual rate of inflation does not need to return to target before the RBA cuts the cash rate. Rather we think a six month annualised pace of inflation that is close to target would be sufficient for the Board to ease policy given inflation is a lagging indicator.

Overall we are looking for 100bp of policy easing by end-2024 that would take the cash rate to 3.10%. We believe this is a more neutral cash rate and should see the economy begin to recover over the second half of 2024.

The global backdrop matters

The RBA’s re-assessment of the global backdrop in many ways mirrors their views of the domestic economy.

While the RBA judges the outlook for global growth to have deteriorated, inflation outcomes have improved, and in some cases been better than expected.

Growth in Australia’s major trading partners (MTP) has been downgraded. MTP growth is now expected at 3.7%/yr in Q4 23 and just 3.0%/yr in Q4 24, downwardly revised from forecasts in May of 4.0%/yr and 3.5%/yr respectively.

A re-weighting of trading partner weights partly contributed to the downgrade. The RBA does not produce their own forecasts for most other economies; instead it simply takes the consensus of market economists’ forecasts.

It does, however, produce in-house forecasts for China –our largest trading partner –so it’s worth exploring how their assessment on China has shifted.

The RBA has downwardly revised their forecast for China’s economic growth. In May the RBA forecast growth to ‘comfortably exceed’ the Chinese authorities’ growth target of around 5%, but now see growth as ‘consistent’ with that target.

The outlook for the Chinese economy is also now a key risk factor for the Australian outlook. This replaced previous concerns around financial stability risks emanating from the US banking system as one of the key sources of uncertainty or risks for Australia.

The weak Chinese economy and uncertainty around the outlook is affecting demand and prices for Australia’s key exports. This includes bulk commodities, but also education and tourism services too.

However, if large scale and broad policy stimulus around the Chinese property sector is announced, that would have the effect of increasing prices of bulk commodities and support Australia’s key exports and terms of trade.

RBA business liaison insights

Since November last year, the RBA has released a summary of insights derived from their business liaison program in each of their quarterly Statements. The key takeaways from the ~230 contacts interviewed each quarter (70-80 a month) are:

1) The pressure on household budgets is seeing continued deterioration in spending. Households, particularly those on lower incomes, are trading down to cheaper products and purchasing fewer items. Some household goods and clothing retailers are reporting ‘large falls’ in sales in recent months. Three months ago contacts were noting that domestic tourism demand remained strong, but this has changed. Domestic tourism demand has declined, more notably so in regional areas. That said, discretionary services spending (such as major events) are reportedly still strong.

2) Business investment intentions have continued to pare back, but have still been fairly resilient. Higher interest costs, deteriorating business conditions, and an expected slowing in the economy have been major factors in the pullback. Non-mining investment remains supported by projects in renewable energy and infrastructure. Resource investment will be supported by bulk commodities and battery minerals.

3) Expectations for wages growth over the year ahead remained steady at around 4%/yr. Wages growth for workers covered by individual agreements is expected to moderate over the period ahead. Firms are citing the Fair Work Commission’s decision to increase award wages by 5.75% from July this year as not likely to have a larger spillover effect than in the past, although the wage outcome was higher than some firms had expected. Wages growth more broadly is expected to slow as staff turnover falls, labour competition declines, and business conditions deteriorate.

4) Businesses’ input cost increases have continued to moderate, in line with the return of shipping costs to pre-pandemic levels, declining global demand and improving global supply. Declining demand and large excess inventories have seen some retailers discount prices. Firms are now ‘being cautious about the detrimental effects that large price rises might have on demand’.