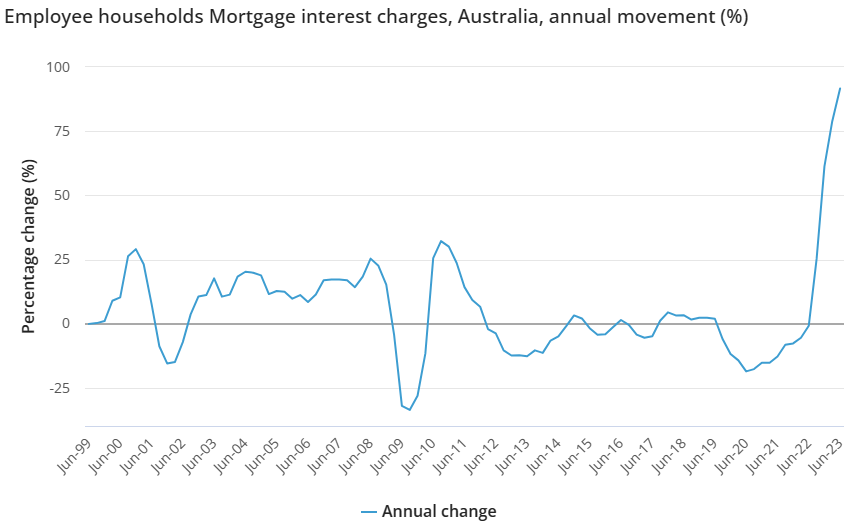

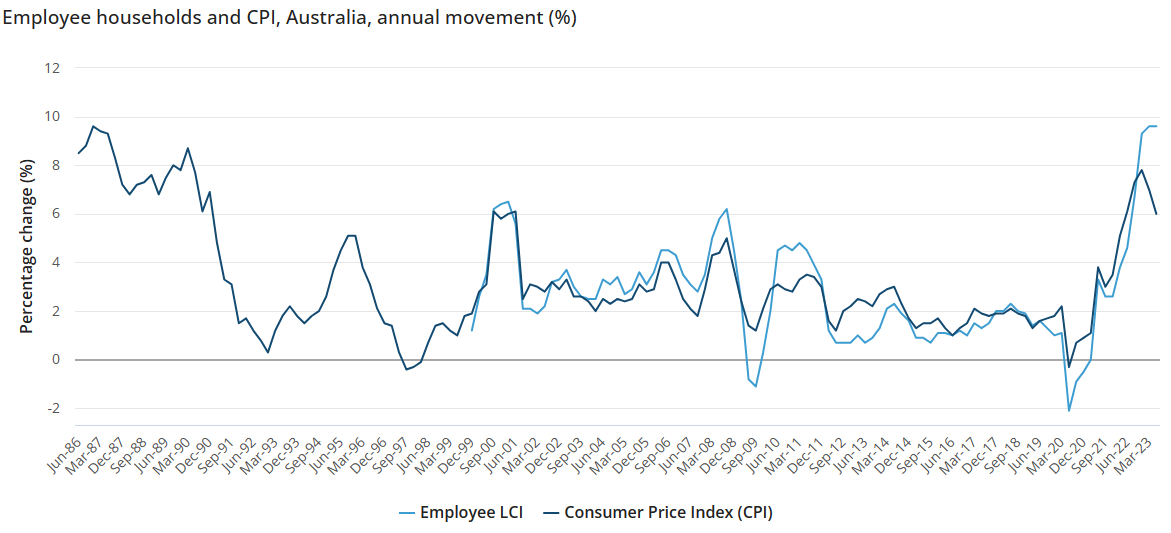

The 4.0% of interest rate hikes from the Reserve Bank of Australia (RBA) has delivered a record rise in cost of living for employee households:

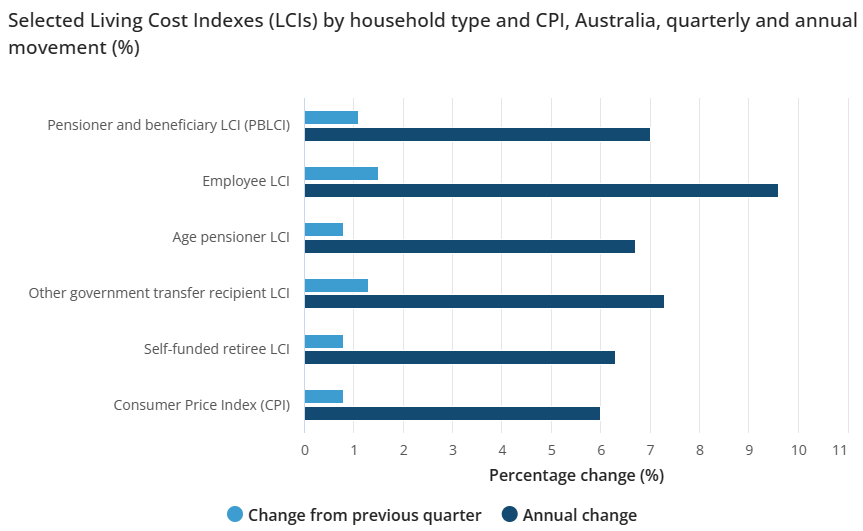

All five Living Cost Indexes (LCIs) rose between 0.8% to 1.5% in the June 2023 quarter.

Over the twelve months to the June 2023 quarter, all LCIs rose by between 6.3% and 9.6%.

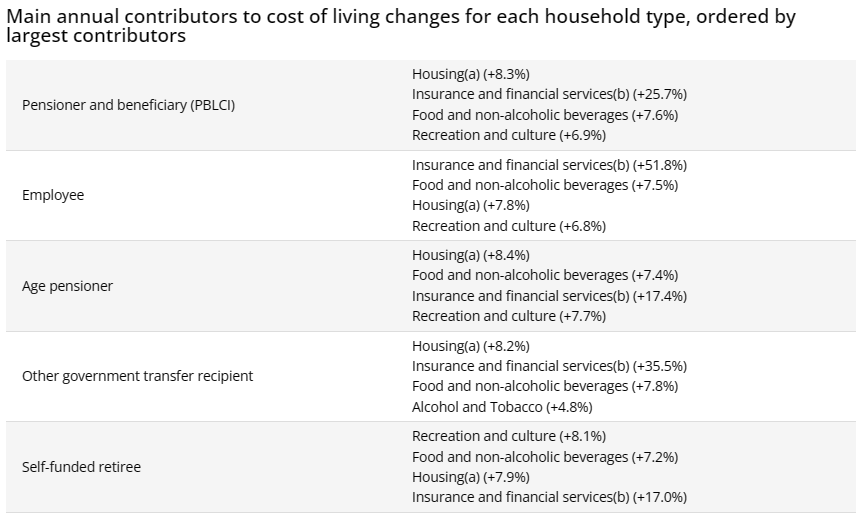

However, employee households recorded the strongest quarterly and annual rises due mostly to surging mortgage interest charges, as well as rents:

According to the ABS:

“The Insurance and Financial services group recorded the strongest rise across all LCIs this quarter. This was due to increases in Mortgage interest charges and Insurance”.

“Mortgage interest charges rose as banks passed on the Reserve Bank of Australia’s (RBA’s) cash rate rises to home loan interest rates”:

“Housing was another main contributor for the household types where Rents make up a higher proportion of expenditure. Rental prices continued to rise this quarter reflecting strong demand amid low vacancy rates”.

“The rise in annual living costs for employee households is the largest increase since this series started in 1999. The last time the CPI recorded an annual increase of 9.6 per cent was in 1986”:

Clearly, working Australians have born the brunt of the RBA’s war on inflation, since they are the ones carrying most of the mortgage debt.

Their living costs have risen at a much faster pace that CPI inflation.

Older cohorts, by contrast, have fared much better as they have been more insulated from the RBA’s rate hikes and the surge in rental costs.